Rising interest rate

Author: Equityengineer | Publish date: Wed, 5 Aug 2015, 09:55 PM

As for today, the highlight would be ADP National Employement Report, private employers hired 185,000 workers in July, which was the smallest increase since April and reduced expectations of a strong jobs reading in the government's payrolls report due Friday. This news would be the curreny mover.

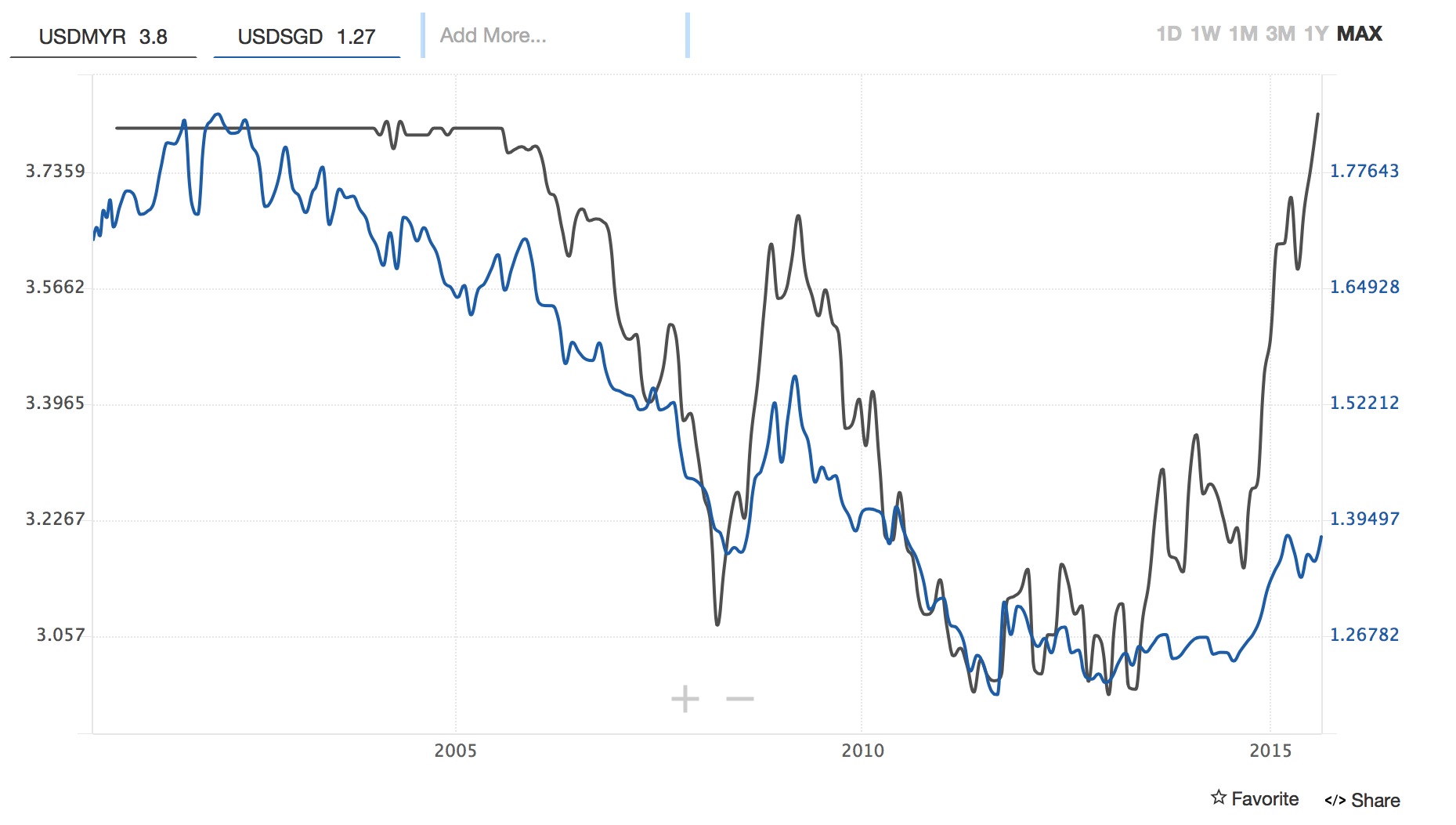

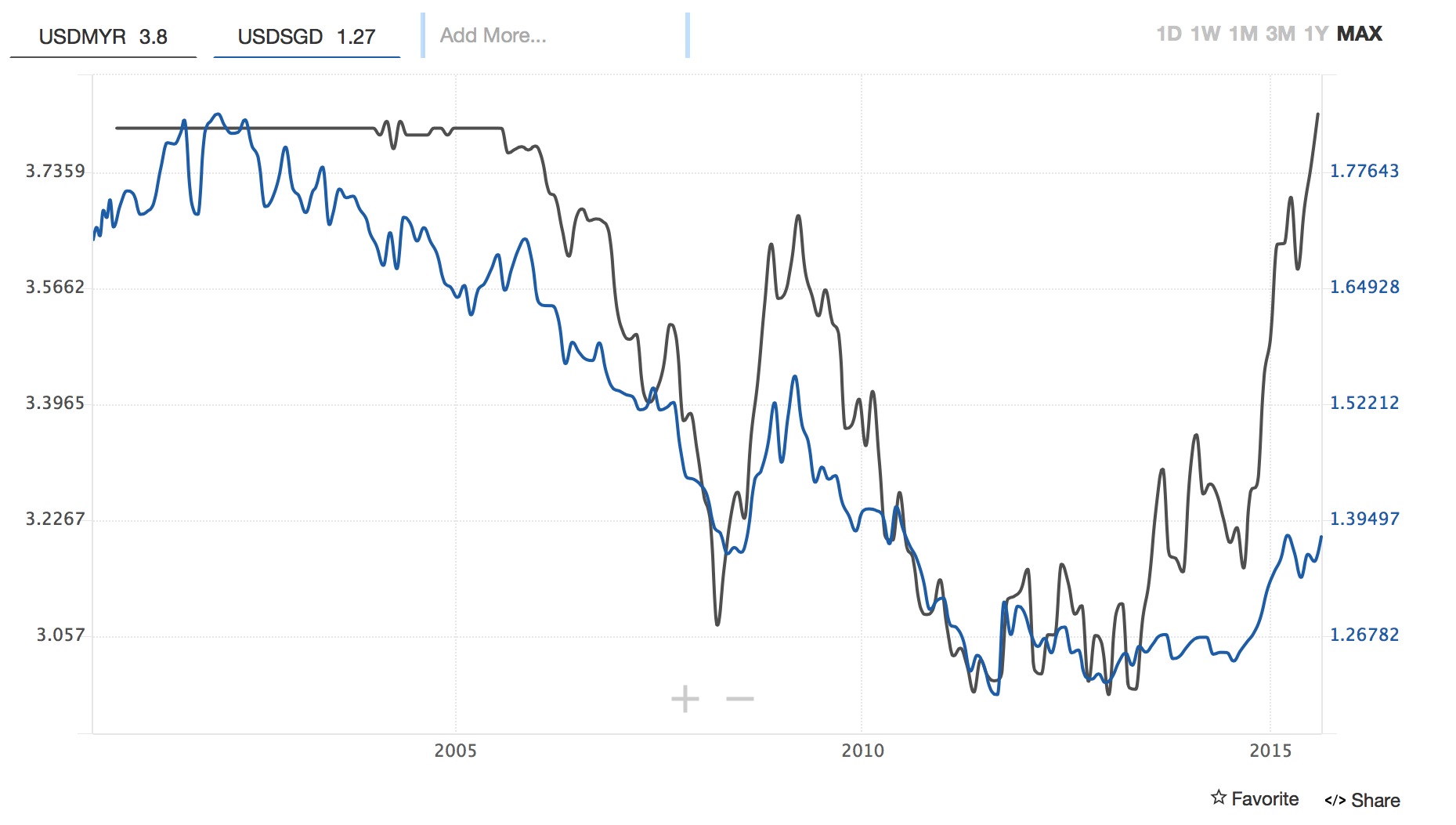

Long term historical USDSGD and USDMYR. The interets rate has fueled USD to ramp up but MYR is at at historical high and SGD is following trend upwards. With QE and zero interst rate had slammed down USD for the past 7-8 years. Raising an interest rate will cause emerging markets currency suffer losses even more plus commodity price pressed down. Oil is a risk. Nothing is certain even the FED giving hawkish sign to increase interest rate.

Together with them BOE is also expected to move interest rate by beginning of next year. Tomorrow, on Thursday the BoE is combining the breakdown of voting on its nine-member Monetary Policy Committee with the minutes from the meeting. It will also concurrently publish its quarterly inflation report. Its - "Super Thursday".

This type of hike has created volatility and turbulences in the market. Export related stocks mainly is good but yet its not always can be the case. Still have to deal with Malaysia political turbulence which widely reported around the world.

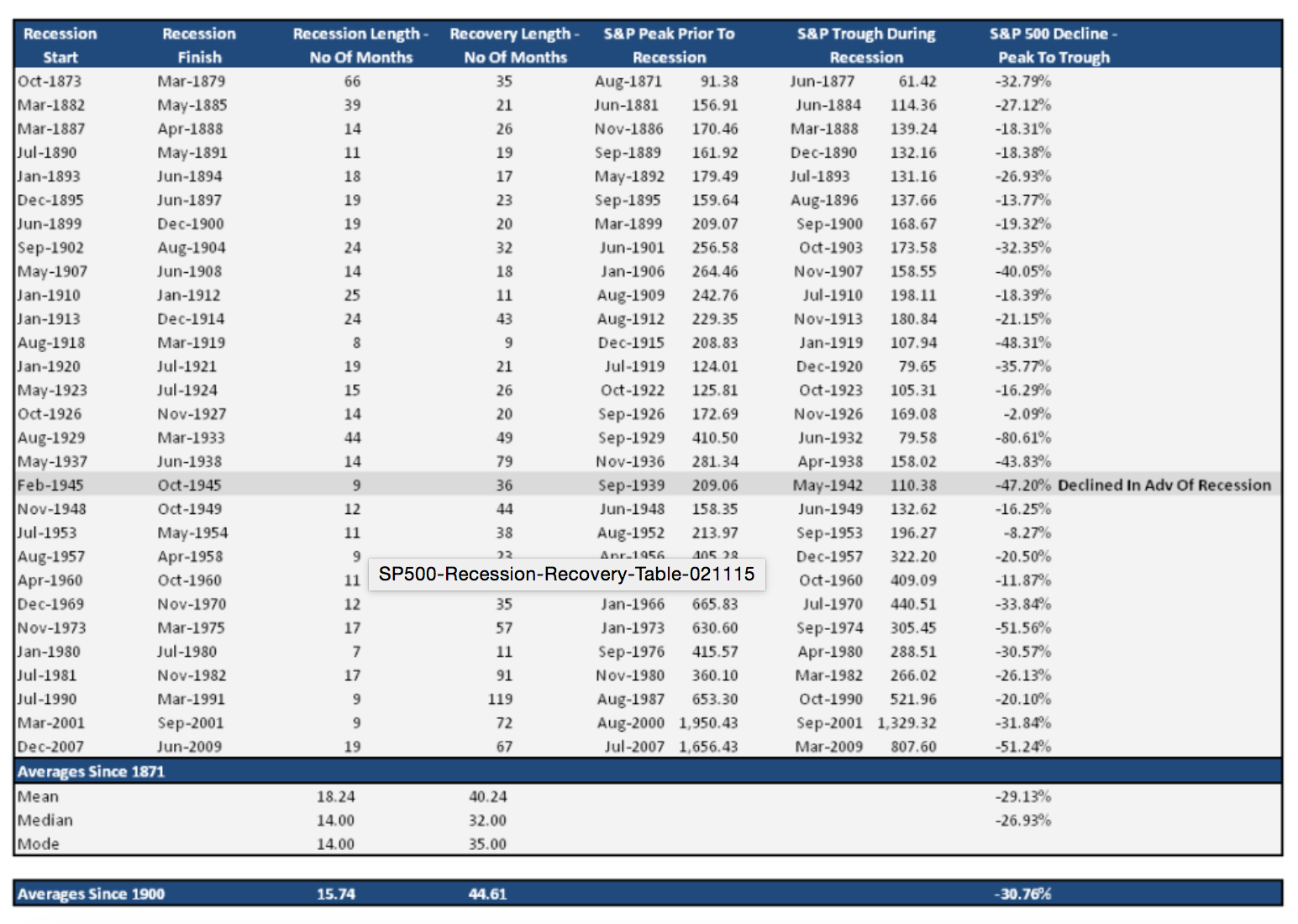

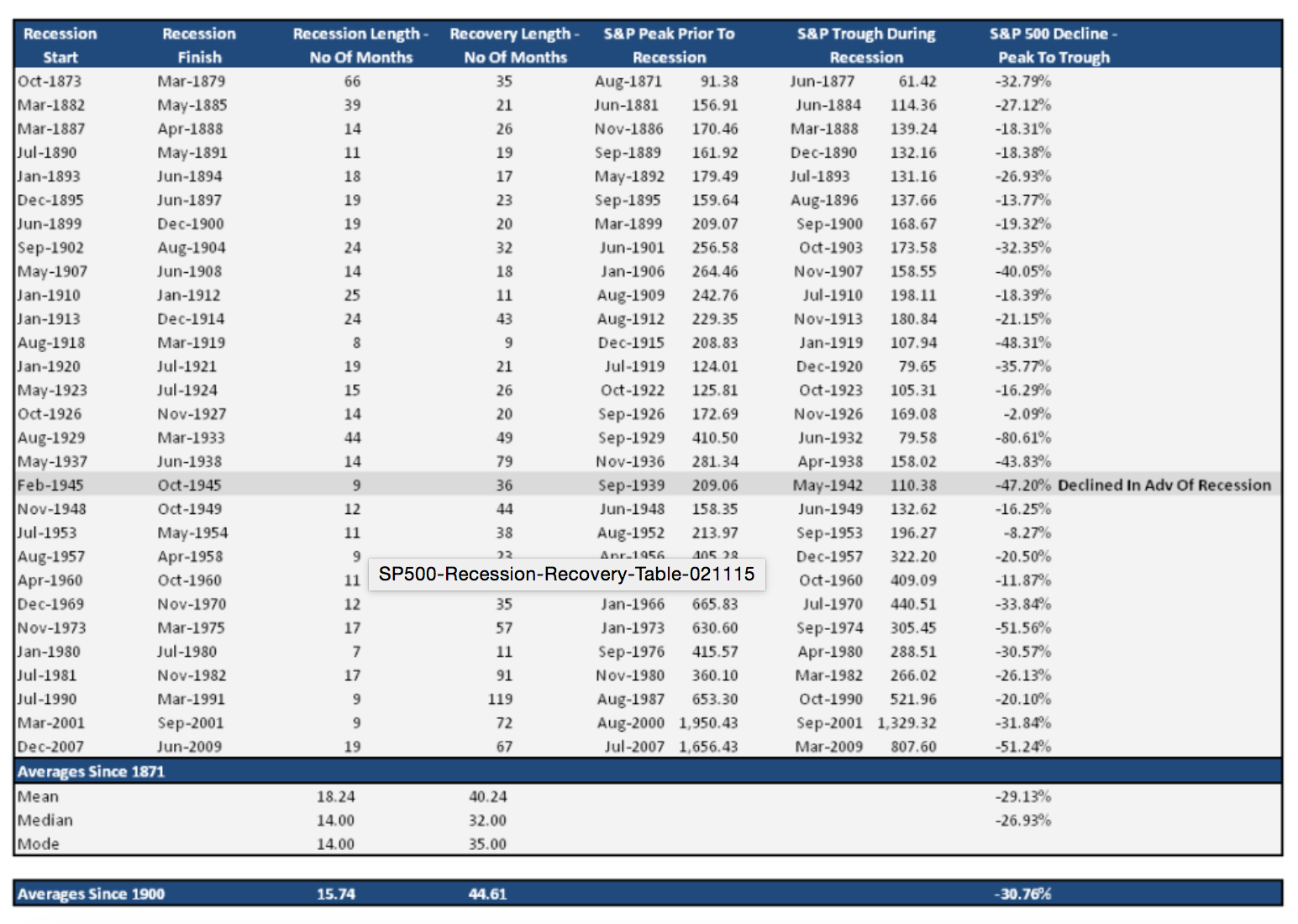

. This table shows the recession in past 100 years and so. Well, the current bull run is about 6 years which is 73 months. With the hope that interest rate does not jeopardize the economy the bull should continue. Even if Malaysia does not seem interesting to invest some US stocks can be an option besides it will be in the US currency.

Nothing much about the recession, definitely the FED won't increase the rate if we are falling into recession.

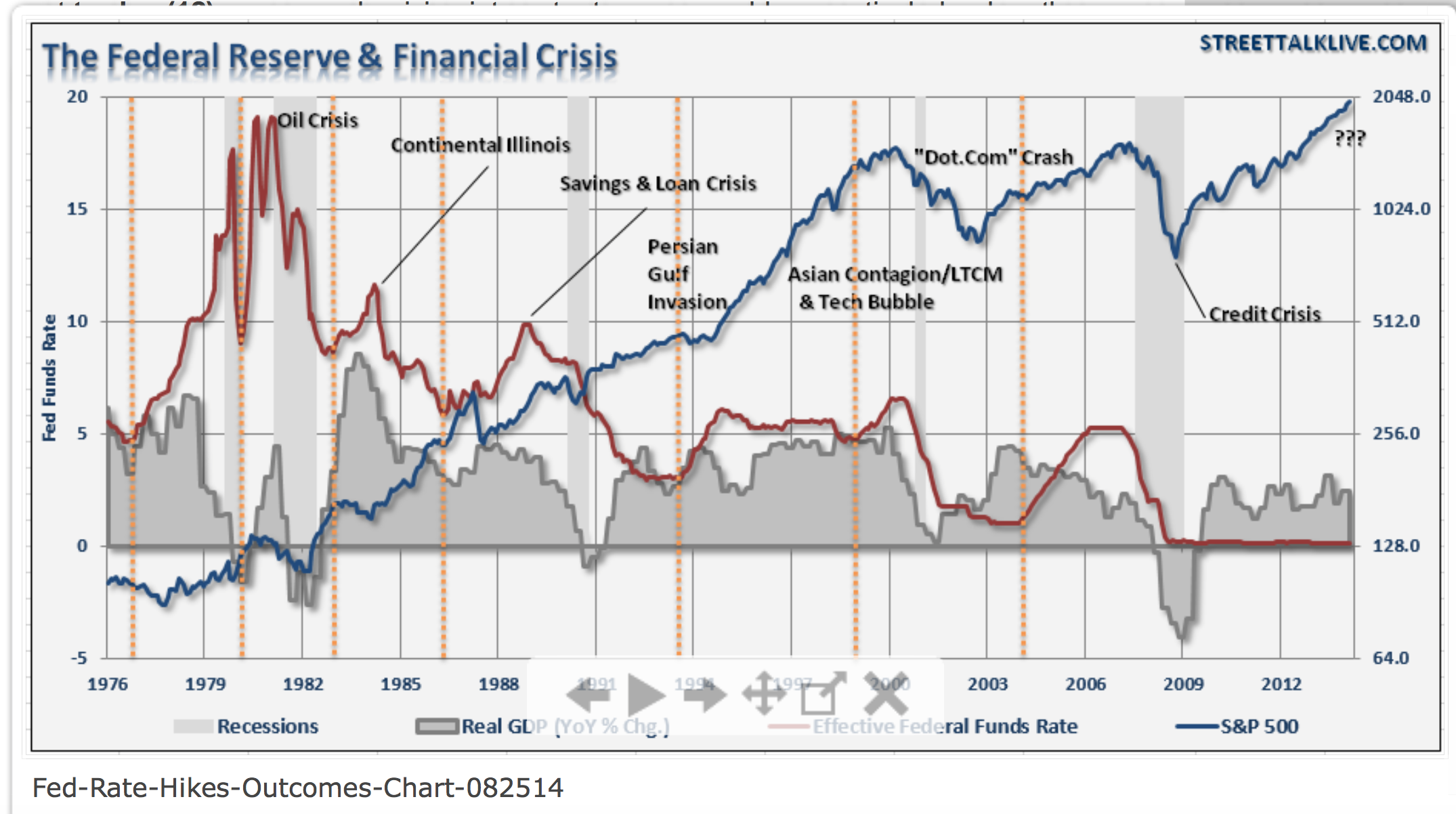

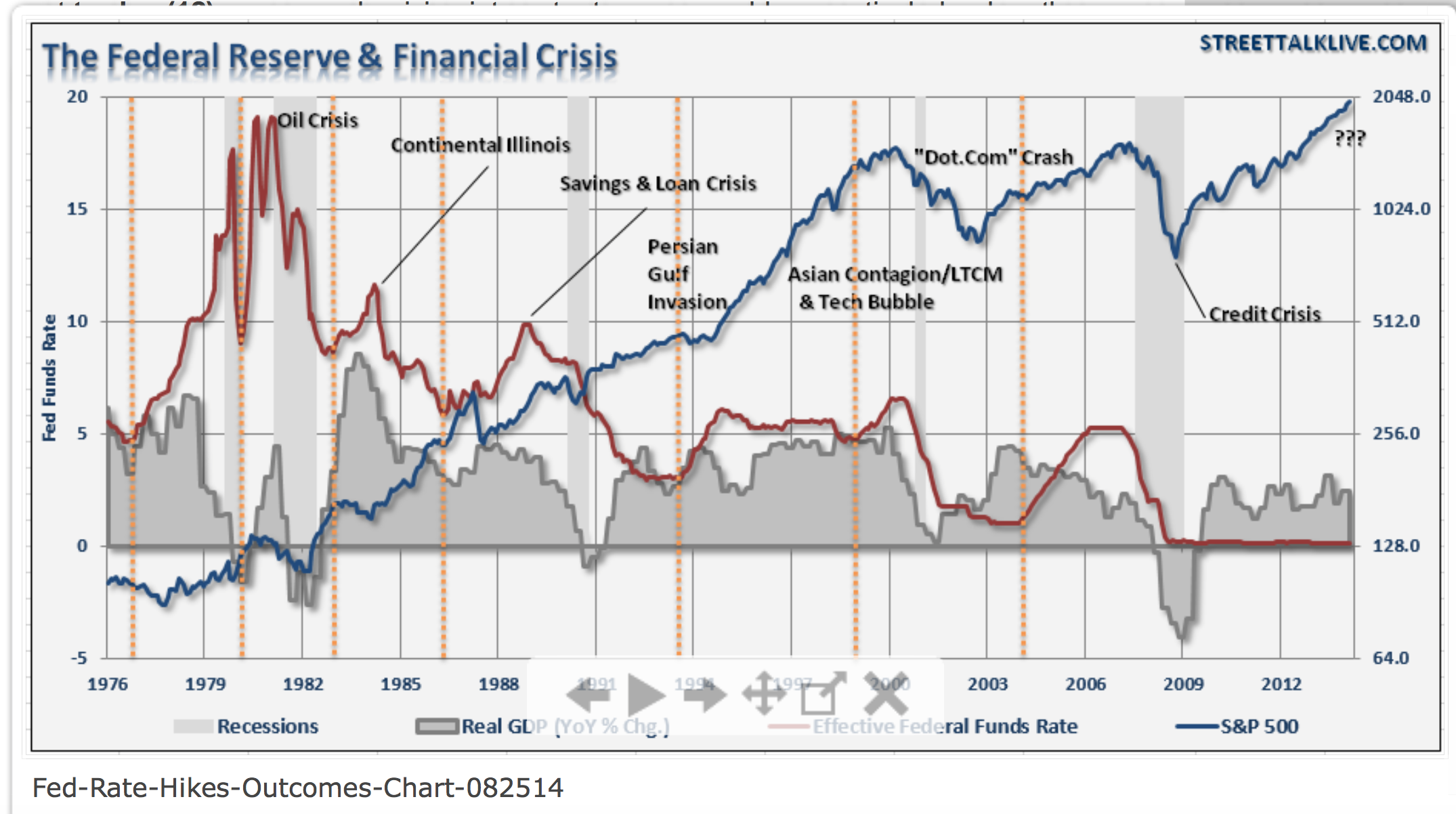

But the chart below worth checking out. You see, when something is done there will be a consequences, good for somehing and bad

for something.

Some quotes worth to be reminded

Long term historical USDSGD and USDMYR. The interets rate has fueled USD to ramp up but MYR is at at historical high and SGD is following trend upwards. With QE and zero interst rate had slammed down USD for the past 7-8 years. Raising an interest rate will cause emerging markets currency suffer losses even more plus commodity price pressed down. Oil is a risk. Nothing is certain even the FED giving hawkish sign to increase interest rate.

Together with them BOE is also expected to move interest rate by beginning of next year. Tomorrow, on Thursday the BoE is combining the breakdown of voting on its nine-member Monetary Policy Committee with the minutes from the meeting. It will also concurrently publish its quarterly inflation report. Its - "Super Thursday".

This type of hike has created volatility and turbulences in the market. Export related stocks mainly is good but yet its not always can be the case. Still have to deal with Malaysia political turbulence which widely reported around the world.

. This table shows the recession in past 100 years and so. Well, the current bull run is about 6 years which is 73 months. With the hope that interest rate does not jeopardize the economy the bull should continue. Even if Malaysia does not seem interesting to invest some US stocks can be an option besides it will be in the US currency.

Nothing much about the recession, definitely the FED won't increase the rate if we are falling into recession.

But the chart below worth checking out. You see, when something is done there will be a consequences, good for somehing and bad

for something.

Some quotes worth to be reminded

1) There have been ZERO times that the Federal Reserve has entered into a rate hiking campaign that did not have a negative consequence.2) Assuming a buy and hold investment, which never really occurs due to panic selling during declines, investors would have still netted a slightly positive return following the crash of 1987. However, having just been in cash during that entire period would have netted a higher overall compounded return.3) The average period of time following an increase in the effective funds rate to either a stock market correction, economic recession or both has been 20.75 months. Therefore, if we assume an initial increase in the Fed funds rate in June of 2015, that would put the next negative event sometime in the first quarter of 2017.4) However, the median number of months following the initial rate hike has been 17 months. This would advance the timeframe into mid-2016. Such a time frame would coincide with both the Decennial and US presenditial election years5) Importantly, there have been only two times in recent history that the Federal Reserve has increased interest rates from such a low level of annualized economic growth. The most relevant period was in 1983 when the economy was recovering from two adjacent recessions. Due to such weak economic growth, the impact of rising interest rates tripped up the stock market just 17 months later.6) Lastly, it is crucially important to recognize that the ENTIRETY of the "bullish" analysis is based around a sustained 34-year period of falling interest rates, inflation and annualized rates of economic growth. With all of these variables near historic lows there is absolutely no way to assume how asset prices, or economic growth, will fair going forward.

No comments:

Post a Comment