備忘錄讀者:橡樹客戶

作者:霍華德.馬克斯

(Howard Marks,《投資最重要的事》作者、 橡樹資本董事長)

主題:帶投資者去看心理醫生

12 月12 日,星期六,我很早就醒了,前一天股市、債市和原油都出現了大跌,我思慮萬千,睡也睡不著了。於是,我走到桌邊,開始寫備忘錄,把這些思緒整理出來。我知 道從動筆開始寫到最後發出去會用很長時間。我在表達一個想法的時候,新的想法總是接二連三的湧進腦海。最後,寫了一個月才寫完。

芝加哥大學的理查德.塞勒(Richard Thaler) 教授是行為經濟學和決策理論方面的權威(他在業內舉足輕重,甚至在電影《The Big Short》中客串了一個配角)。塞勒教授在他的新書《Misbehaving》中引用了維弗雷多.帕累托(Vilfredo Pareto) 的話:「政治經濟學,乃至所有社會科學,顯然都以心理學為基礎。」

投資雖然不完全是科學,但我認為投資同樣以心理學為基礎。

這話我已經不知說過多少遍了,早在1994年1月的備忘錄《關於尋找投資機會的隨想》(Random Thoughts on the Identification of Investment Opportunities)中,我就說過:

「投資者要取得成功,不但要掌握金融學、會計學和經濟學,還要了解心理學。要弄清市場處於週期的哪個階段、為什麼、該怎麼做,這都必須洞悉投資者的心理。」我從市場最近的行為,不只是12月11日,還包括2015年的其他時間裡,更深刻地認識到這一點的重要性。

在這篇備忘錄中,我希望帶市場去看看心理醫生,看看我們能不能學到點什麼。

2012-2014:不確定的世界

2012年9月,我寫了一篇備忘錄「充滿不確定性」(On Uncertain Ground)。在開頭,我寫道:「當今世界的高度不確定性,是我生平僅見。」接著,我把我的憂慮逐條列了出來。今天,我的這些憂慮沒有一個有所緩解。顯 然,危機後的複甦之路並不平坦。在危機後的復甦方面,2012年,我有以下憂慮:

- 宏觀成長 –人們似乎普遍認為,未來的經濟增長率會比20世紀後半葉放緩。是否因為出生率較低、生產效率增速緩慢,我們注定要承受較低的宏觀成長?這個現實還會產生什麼別的影響?具體而言,如果經濟成長始終低迷,是否會導致通膨減緩,甚至出現通縮?

- 成熟國家的趨勢 –成熟國家能在全球化經濟中保持競爭優勢嗎?發展中國家生產的商品越來越便宜,品質也越來越好,成熟國家能維持住現有的收入水準嗎?隨著我們日益步入知識 經濟(knowledge-based economy)時代,我們還會像過去那樣需要那麼多教育程度較低的工人階層嗎?如果不需要的話,如何解決失業、收入差距乃至整個社會的公平問題?

- 消費者行為 –消費者能重拾信心,恢復過去那種大手大腳的消費行為嗎?消費者還能像過去那樣靠信用支撐消費,保證消費的持續成長嗎?

- 歐洲 –在凝聚力、協同性、生產力方面,歐洲能取得進展嗎?如果做不到,會怎樣?歐洲央行有能力主導經濟復甦 嗎?希臘退出歐盟的風波是否會重演?是否還會有別的國家要退出歐盟?(即將舉行的公投是否會讓英國退出歐盟?蘇格蘭是否會舉行公投決定是否留在英國?加泰 隆尼亞是否會投票決定脫離西班牙,脫離西班牙後它還能留在歐盟嗎?)

- 國家領袖 –許多年來,我一直用PPT做演講,在其中列舉不確定性的幻燈片中,有一條本來應該是「領袖缺乏能力」(dearth of leadership),但打字時錯誤拼寫成了「領袖毫無能力」(death of leadership)……但是竟然沒人挑這個毛病。縱觀全球,與歷史上最傑出的領袖相比,當今各國政壇領袖的水準幾乎都相去甚遠,在美國尤其如此。你可 能認為這樣很好,也可能覺得這樣不好,但是華盛頓顯然因莫衷一是而無所作為。正如我在「充滿不確定性」中所寫的:「……美國的政治家們更看重的是’意識形 態純粹性’(即遵循政黨路線)和重新當選,而不是真正努力的解決問題。黨派偏見和政治陣營之間的鬥爭已經日趨白熱化。」

- 福利 –社會保障制度如同一輛轟鳴的蒸汽機車,緩慢駛向滅亡。藥品越來越貴,美國人壽命越來越長,醫保制度的成本迅速上升。政府為公務員提供了固定收益的養老金 計劃,但養老金計劃卻存在資金缺口。聯邦政府、州政府和市政府將如何履行它們的義務?沒人知道,政府裡的人(特別是華盛頓的人)似乎也不關心。

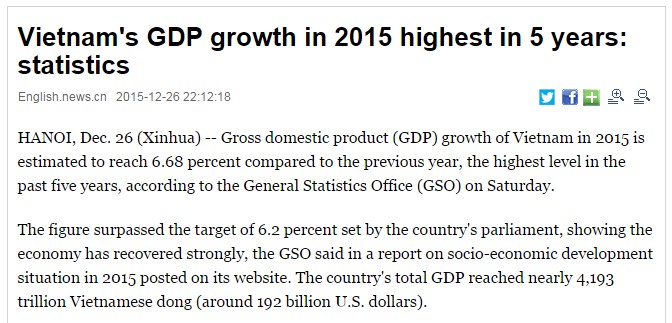

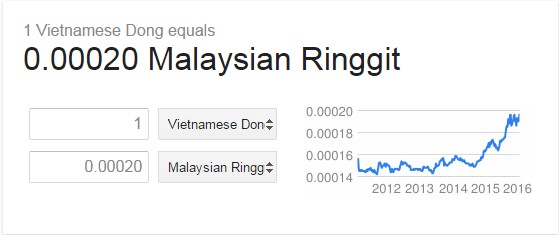

- 中國 –作為世界第二大經濟體,中國對全球經濟成長發揮著舉足輕重的作用。過去20多年裡,中國的GDP始終保持著兩位數的成長速度,從沒出現過衰退。中國高速 發展的基礎有三點:(1)數千萬人從農村遷移到城市(同時為製造業貢獻更高的生產力);(2)中國製造業以低成本大量出口商品;(3)中國擁有大量資本並 投入巨資進行基礎建設。今後上述因素對中國經濟成長的推動作用將減弱,中國必須進行轉型,靠拉動國內產品和服務的消費促進經濟成長,中國的經濟成長將放 緩……或許也會像世界其他國家一樣經歷經濟的起起落落。這是否會導致中國短期內出現硬著陸?這對向中國出售大宗商品和製成品的國家有何影響?

- 地緣政治熱點 –從1991年末蘇聯解體到2001年911襲擊,這段時間裡世界保持和平,這是刺激投資者樂觀情緒的因素之一。但是近年來,我們看到了世界並不太平,包 括伊朗、以色列和中東地區的其他國家;俄羅斯和烏克蘭;中國和朝鮮;以及許多國家面臨的恐怖主義威脅。局勢惡化不可避免,萬一發生,市場將作何反應?

從2012 年到2014 年,上述憂慮始終困擾著投資者。在過去幾個月中,我們看到原油價格腰斬;中國經濟成長繼續放緩;中東局勢惡化的新聞不斷;聯準會利率政策仍不明朗。

既然市場厭惡不確定性,在正常情況下,這些問題應該導致資產價格較低和負收益。但是在2012-2014 年,儘管負面因素眾多,標普500 的累計報酬率達到了74%,房地產價格強勁上漲,曾經是收購對象的公司價格也步步高升。此外,美國高收益債券的平均殖利率與美國國債的殖利率差額從 2011 年年末的706 個基點(7.06%)減小到2014 年末的522 個基點(5.22%),到了2014 年年末,預計最差殖利率(yield to worst)已經降到了6.67%,這進一步反映了投資者的信心。因此,在2014 年年末,我們發現情況是這樣的:

- 客觀上存在一系列重大宏觀風險(如上所述),

- 為了在低報酬的世界追求足夠的報酬,

- 投資者做出樂於承擔風險的行為,

- 因此,資產價格一點也不便宜,

- 獲得的報酬率根本不可能彌補所承擔的風險。

總之,考慮到基本面的情況,人們的心理太興奮了,價格太高了。這幾年的特點是預期報酬率低,棘手的問題多,這兩方面疊加起來很令人頭疼。

2014 年9 月,我在「再談風險」(Risk Revisited) 中寫下了下面的文字:

儘管投資者的行為還沒墮落到危機爆發前的程度(我認為,正是投資者的行為導致了危機),但是從很多方面來看,投資者的行為已經進入了不理智的區域……

在進攻和防守之間,在擔心虧錢和擔心錯過機會賺錢之間,投資者應該追求適度的平衡。我認為,在當前的情況下,與追求報酬相比,投資者更應該注意避免虧損。在過去三年裡,橡樹的原則是「 謹慎前行 」。現在重提這個原則,我更強調其中的「謹慎」二字……

我不知道將來會發生什麼,不知道算總賬的日子是近是遠,但是我認為,當下的市場無憂無慮,現在對這樣的市場保持謹慎並非為時過早。有一點我是知道的:在當前的市場狀況下,其中的風險並沒有對應足夠的風險溢價。

負面因素發酵

鑑於存在市場擔憂的眾多因素,2015 年上半年的表現充其量只能說是停滯遲緩。大多數市場勉強給出正報酬,但是報酬來的很勉強,投資者的日子都不好過。接著,在夏季,擔憂越積越多,越來越嚴重,最終變得難以承受:

- 美國、歐洲和日本的經濟成長持續低迷或放緩。

- 中國經濟繼續減緩。

- 聯準會的利率政策仍然猶豫不決。升息會引發憂慮,聯準會似乎也認為經濟成長疲軟,還不能升息。

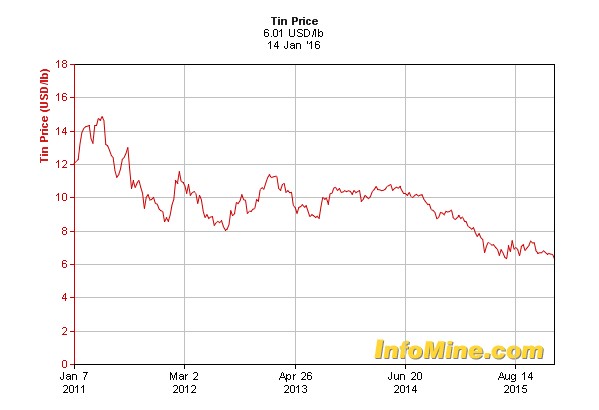

- 原油價格重拾跌勢,其他貴金屬和大宗商品跟著下跌,導致相關的股票和債券價格走弱。

- 地緣政治局勢每況愈下:

敘利亞是個兩難的困境:一條路是讓暴君留下來,另一條路是把暴君推翻,但又將有一個國家陷入動亂和內戰。

俄羅斯出手干涉了,它頻繁秀肌肉,向我們表明它不會讓步。

ISIS 與歐洲難民潮似乎是無解的難題;巴黎和聖貝納迪諾發生的襲擊事件表明恐怖主義仍然嚴重威脅著我們。

各方就限制伊朗核計劃達成了一項協議,但專家們對此褒貶不一。

伊拉克、阿富汗、以色列和巴勒斯坦還是一團亂麻。

南中國海區域不時擦出火花。

- 美國政局也不見起色。黨派偏見和僵持局面仍然沒有改變。兩年膠著的選戰在媒體中愈演愈烈,牽扯了我們太多的精力,大多數候選人都不存在積極的共識。

- 最後,市場內部出現的大量問題動搖了投資者的信心,其中包括市場流動性的降低、報價故障以及高風險信用基金的清算。

不知道為什麼,市場參與者竟然能承受這樣的不確定性,竟然能保持鎮定,有時候還能堅持很長時間。

他們也許是信念堅定,也許是一無所知,也許是拒絕接受。前一段時間市場的情況就是這樣,正如Doug Kass 在2014 年中期所說的,我們正在經歷「一場自我感覺良好的牛市」。

但是最終還是出事了——也許是紙牌屋搭得太高了——投資者平靜祥和的感覺被打破了。事情發展到了一定程度,人們再也無法保持鎮定了,2015 年下半年美國信貸市場出現了大幅度下跌。

引爆點

投資者有一個最明顯的行為特徵:他們總是在一段時間裡忽視負面因素或低估負面因素的影響,最後在下跌的時候認錯服輸,承認負面因素並反應過度。我認為,這種現象的主要原因是心理上的弱點,也是因為缺乏能力,理解不了事件到底有何影響。

隨著負面因素累積——無論是剛剛露出苗頭的,還是人們總算意識到有重大影響的——最後終於到了人們再也無法忽略這些負面因素的時候,這時候,負面因素在人們眼裡就變得無比重要了。距離現在最近的引爆點發生在去年八月份。

在此之前,投資者基本是抵制負面因素,2015 年前七個月,標普500 指數上漲了3.3%。(媒體可能會說投資者「克服了」負面因素,其實他們根本不是成功應對了負面因素,只是把它們忽略了。)

接著,八月份,中國出現了一系列負面因素:報告顯示經濟成長進一步放緩;從7 月份到8 月份,A 股下跌幅度達到了45%;人民幣出乎意料地貶值;有人認為之後的一系列救市措施不夠力、不得法。

多年以來,中國經濟受到了壓低融資成本的過度刺激,導致固定資產投資過剩,這已是人盡皆知。受此影響,GDP 成長表現優異,但是也留下了大批空置的建築和基礎設施。所有人也都知道,有一種可能的結果是,承受經濟成長放緩的陣痛,甚至出現衰退。

但是到了8 月份,外國投資者看到A 股大跌,他們才考慮到中國經濟成長放緩可能對世界其他地區產生負面影響,而且他們還把這種擔憂傳導到自己的市場中。因此,從8 月17 日到8 月25 日,標普500 下跌了11%。為什麼人們會把中國的大跌傳導到其他市場,例如,我們的市場?9 月份,在中國股市大跌後,我寫了一篇備忘錄「投資不易」(It’s Not Easy),在這篇備忘錄中,我是這麼解釋這種現象的:

市場下跌得越猛烈,許多投資者越是要讓市場替他們思考,越是要讓市場告訴他們發生什麼了,該怎麼辦。這是 投資者最嚴重的錯誤之一。正如班傑明.葛拉漢(Benjamin Graham)所說,每天報價的市場先生不是基本面分析師,市場是衡量投資者情緒的溫度計。你就不能太把市場當回事。對於基本面到底發 生了什麼,市場參與者知之甚少,他們買入和賣出背後哪有什麼理智,不過是被情緒控製而已。你要是把最近的全球市場下跌解讀為市場「知道」將來會怎樣,那你 就錯了。其實就是這麼回事:中國傳出了一些負面消息,人們就恐慌了,特別是那些上了槓桿買股票的中國投資者,這可能是他們第一次經歷嚴重的市場調整。看到 中國投資者拋售,美國和其他國家的投資者也跟著拋售,他們覺得中國的市場下跌是一個信號,預示著中國經濟和世界經濟都會出大問題。

無論到底是為什麼,重要的是,我認為儘管7 月份之前佔據主導地位的是容忍風險,8 月份,人們又開始厭惡風險了。我想投資者大概是這樣的:前幾個月他們沒察覺到風險,這回突然說:「唉呀,有這麼多利空啊。」

引爆點終於到來,人們被從睡夢中喚醒,意識到風險的存在性和重要性。

不是一半滿,就是一半空?

將近25 年前,在我寫的第二份備忘錄中(1991 年4 月,「第一季度業績」),我提出了投資鐘擺的概念:

鐘擺擺動弧度的中央正是鍾擺的「平均」位置,實際上鐘擺很少停留在這個位置。它總是從擺動弧線的一個極端走向另一個極端。但是當鐘擺接近任何一個極端時,或早或晚,總是不可避免地要回歸中點。

投資者為什麼不能做出正確的判斷?最重要的一個原因就是,他們在看待世界時缺乏客觀理智,總是訴諸情緒。他們的弱點主要有兩個表現形式:選擇感知和偏頗解讀。換句話說,他們有時候只看到有利因素,看不到不利因素;有時候只看到不利因素,看不到有利因素。他們有時候從正面角度看問題,有時候從負面角度看問題。他們的感知和解讀幾乎從來都不是冷靜理智,不偏不倚的。

自從8 月份中國發生的一系列事件以來,我總是回憶起我收集的一張經典的漫畫,它還是那麼經典:

2015 年,老問題更加難解,新問題頻頻出現,人們整體感覺沒有一點值得高興的。ISIS 和難民潮失控等問題讓人們完全看不到希望,投資者應對這些問題的表現根本不及格。8 月份,中國發生的一系列事件成為了導火線,人們重新產生了風險厭惡和恐懼,對整個世界的震動持續數週。恐懼的解讀宣洩而出,盲目樂觀的風險容忍消失 了,取而代之的是四處蔓延的負面情緒。

總之,投資者的心理是極少均衡考慮有利因素和不利因素。此外,眼前發生的事情會影響投資者的情緒,而投資者對事件的解讀總是因為受情緒影響而有失偏頗。大多數事情都既有好的方面,也有壞的方面,但是投資者普遍只盯著好的或壞的不放,做不到均衡考慮。這讓我想起了另一幅經典的漫畫:

明眼人一眼就能看出來:投資者從來都不是客觀、理智、不偏不倚、平和穩重的。

他們一開始的表現是很樂觀、很貪婪、很能容忍風險、很輕信,他們的行為導致資產價格上漲、潛在收益降低、風險增加。接著,由於某種原因——或許是引爆點的出現——他們轉變為很悲觀、很恐懼、很厭惡風險、很懷疑,這導致資產價格下降、預期收益降低、風險減少。

我們可以明顯看到,在這兩種截然不同的態度中,它們各自的種種表現往往都是同時發生的。從一種態度向另一種態度的轉變,往往根本無法用常理解釋。

這不簡直是精神失常嗎?在現實世界,事物一般在「非常好」和「不太好」之間波動。但是在投資領域,人們的感知是從「完美無瑕」到「不可救藥」之間波動。鐘擺從一個極端猛衝到另一個極端,幾乎完全不守「中庸之道」,哪有片刻理智可言?開始是拒不承認,後來就認錯服輸。

錯誤的根源

為了解釋這種狂躁抑鬱症的病因,下面我要分析一下影響投資者心理的因素。在這些因素中,有很多是很明顯、很好剖析的,一點也不神秘。我在「投資不易」中談到過一些因素:

情緒是投資者的大敵之一。出於恐懼,人們很難在持股價格暴跌時保持樂觀;出於妒忌,人們很難在所有人都賺錢時拒絕買入價格 上漲的資產。自信也是影響很大的一種情緒,我認為,市場最近的波動主要就是因為自信這種情緒的變化。不久之前,人們的自信還是膨脹的,最近一段時間,突然 就萎縮了。這種劇烈變化可能是因為幻想破滅:投資者之前以為世界局勢盡在自己的掌握,有一天,他們發現自己知道的根本沒那麼多,這種感覺很痛苦。投資者的自信要保持適度,但是在現實中,自信和其他情緒一樣,經常劇烈波動。

儘管中國的情況出現後,近期的劇烈波動就發生了,但是還有其他因素也起了作用,上個月就是這樣。面對這種情況,我經常想到的一個詞是「合力」。當出現一個負面因素時,投資者一般能挺住。但是當多個負面因素同時出現時,他們經常就沉不住氣了。上 個月的另一個負面因素是紐約梅隆銀行(Bank of New York Mellon) 的SunGard 軟體出現故障,導致這家銀行無法為它管理的1,200 檔基金和ETF 產品報價。這對投資者也是一記打擊,日常必須的市場機制竟然靠不住,誰都不願意聽到這樣的消息。

還有一種錯誤是,我們經常發現投資者不知道事情的後果和深層次影響,這可能是因為他們的認識存在缺陷,也可能是因為洞察力和分析力不足。舉 個例子,2007年初,次級抵押證券盛行,此後次貸大量違約,2008年中後期引發動盪,在此期間,人們普遍沒考慮到次級抵押證券風險蔓延的情況。大多人 忽略了風險蔓延的可能性,因此,到2008年5月,標普500指數與2007年第一季相比還沒有變化。然而,此後受次貸危機影響,有的銀行陷入癱瘓,有的 銀行需要救贖,雷曼兄弟申請破產,2008年年末出現了恐慌,人們擔心整個金融系統崩盤。從2008年5月到2009年3月,標普指數下跌了52%。

2008年末和2009年初的一系列事件給人們帶來了極大痛苦,但是短短幾個月前,人們還根本沒預料到、沒想像到會發生這些事情……儘管這些事情露出端倪已有一年之久。

人們不客觀、不理智的種種怪癖對行為的影響不勝枚舉。在2015 年5 月15 日的《華爾街日報》中,Carol Tavris 發表了對塞勒教授新書的評論,她寫道:

我是研究社會心理學的,我總是覺得經濟學家很好笑,他們還假設出「理性人」(rational man) 這麼個奇怪的概念。理性?誰能告訴我理性人在哪呢?早在50 年前,實驗研究就表明:人們明知決定是錯的,就是不改;明知敗局已定,還一意孤行;預測失敗了就找各種理由,就是不承認自己錯了;要是有什麼和自己相信的 東西不一致,就一味反對、歪曲或堅決排斥。

投資者之所以難以理解事件、它們的重要性和潛在影響,主要就是因為他們的心理存在各種怪癖。投資者的心理決定了投資者的行為,投資者的行為反過來又影響投資者的心理。投 資者冷靜理智、客觀穩重的時候少,只看正面因素或只看負面因素的時候多。當好消息得到正面解讀,拉動價格上漲時,人們就很樂觀,迫不及待地要買入,反之亦 然。上面說的這些都是顯而易見的(特別是從事後看),所以說,同樣顯而易見的是,投資者如果能正確理解和應對心理,就有可能提高投資收益。

效率市場的概念認為大多數資產的定價是「合理的」,它的理論基礎是相信投資者是理智的、客觀的。在現實生活中,理智客觀的投資者少之又少。「無 效性」說白了就是「標價錯了」,它的根源是人們的偏見,人們可能喜歡一項資產,討厭另一項資產。這種偏見可能是法律上的、文化上的、訊息上的,最主要的是 行為上和情緒上的。在這幾種偏見中,與三四十年前相比,前三種的影響沒那麼大了,但是後兩種仍然時常表現出來。我相信它們會永遠存在。

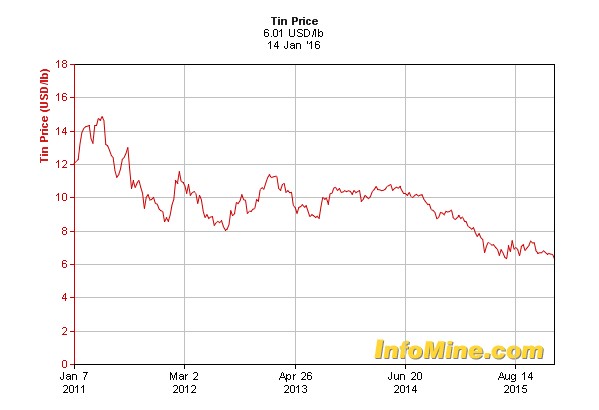

病例分析– 原油

12 月12 日,在我開始寫這篇備忘錄的時候,我從《金融時報》(Financial Times) 中看到了幾個負面思維的例子。下面是從一篇評論市場近期情況的文章中選取的片段:

原油價格暴跌到七年新低,在波濤洶湧的一周行將結束之時,股市感到了恐懼。……作為全球原油價格基準的北海布倫特原油下跌5.6%,跌至37.49 美元……一周之前,石油輸出國組織未能就減產達成協議,在全球石油供過於求的情況下,油價只能下跌。

「油價將持續低位運行。」

芝加哥期權交易所原油波動率指數(CBOE Oil Vix) 保持在54 以上的水平……因為預計原油價格將繼續大幅波動,大量投資者買入該指數避險或進行投機。

聽起來好像很嚴重。真的嗎?有道理嗎?油價下跌到底意味著什麼?

在我看來,如果不是石油公司或石油淨出口國,低油價未必是壞事。

對於美國、歐洲、日本和中國這些石油淨進口國來說,我們看到的油價下跌類似於幾千億美元的稅收減免,可以增加消費者的可支配收入。油價下跌還可以增加出口國家的成本競爭優勢。

美國既是石油生產國,也是石油進口國。這意味美國的宏觀經濟會得到成本降低和收入提高的好處,但是對於美國國內的石油公司以及為其提供產品和服務的 下游公司來說,它們獲得的收入會低於預期,而有些州和地方政府將遭到沉重打擊。(我必須補充一點,迄今為止,各項指標並沒表明低油價對美國宏觀經濟產生了 有利影響。)18 個月前,我認為用水力壓裂法(fracking) 以每桶40-60 美元的成本開採石油,美國的製造業會獲得成本優勢。至少現在看來,這不可能了。

但有一點是毫無疑問的:油價下跌的影響絕對不是一點好處都沒有。其實,我認為,從整體上權衡利弊,油價下跌對美 國有好處,對英國、歐洲和東亞有大大的好處。那麼,為什麼《金融時報》將市場疲軟歸咎於油價下跌?首先,媒體也沒辦法,它們迫不得已,每天都要為我們給市 場上漲或下跌找理由,油價下跌是個很好的理由……至於到底是怎麼樣,你要自己好好想想,才能明白。其次,正如《金融時報》在這篇文章中繼續寫的,油價下跌 讓人產生了一些聯想,或許確實應該憂慮:

大宗商品價格的下跌引起了市場的憂慮,因為投資者擔憂這表明全球需求下降,就算消費者和企業可以獲得更低的成本,但是能源行業的投資會削減、就業崗位會減少,整體下來,經濟還是得不到好處。

換句話說,他們的邏輯是這樣的:油價下跌是因為需求減少了,石油需求減少表明經濟疲軟。但是,經濟成長和這些沒關係,我們不能讓油價告訴我們經濟是否疲軟。在過去幾個月裡,石油價格又跌去三分之一,但全球GDP 還不是繼續成長。

油價下跌能告訴我們今天發生什麼了嗎?這個不重要。重要的是,現在油價跌了,明天會怎樣。在我看來,其他一切不變的情況下,今天的能源價格下跌有利於明天的經濟成長。(受供求關係影響,今天的低價也可能意味著將來價格上漲。)我只是想說,現在所有人看什麼都那麼負面。

病例分析– 利率

《金融時報》還說投資者是對聯準會可能升息做出了反應,儘管升息早已確定無疑:

下週,聯準會將升息。至少現在看來非常可能。在這一年裡,市場和金融監管部門都顧慮重重,要是聯準會不宣布升息,那可就是今年最令人震驚的事件了。我們現在假設聯準會升息了。

這一次的貨幣政策轉向緊縮,可以說是有史以來人們等待最久、預期最久的。

如果說一件事人們普遍已經期待了很多年,人們很長時間之前就知道這件事已成定局,這樣的事變成現實時還能嚴重影響市場,那肯定是有問題。人們對資產的定價應當包含了他們的預期。如果人們對盡人皆知的升息做出負面反應,只能這麼解釋:(a) 投資者太蠢,升息前沒把這個因素包含在價格中;(b) 升息幅度超於人們預期;或者( c) 市場不理智。

12 月15 日,道瓊旗下的報紙引用了這樣一段話:

巴克萊銀行的分析師肯尼斯.希爾(Kenneth Hill) 說:「現在人們的態度是先做再說。人們擔心隨著利率逐步走高,報酬率會越來越低,有些資金會從固定收益資產流出。人們比較擔憂這種情況逐步變成現實。」

在希爾先生說這番話的時候,早在兩年半之前,2013 年5 月,伯南克(Ben Bernanke) 就預示購買債券的資金會逐漸減少,可能會升息。投資者怎麼可能沒有足夠的時間對升息的可能性做出調整,把這個因素包含在價格中?的確,幾天之後的升息根本 就不是什麼事,要說升息導致了12 月11 日的大跌,太牽強了。

自從2013 年伯南克做出了預示以後,我被問的最多的問題就是:「聯準會會從幾月份開始升息?」我的回答始終是:「我不知道,你管這個幹什麼?」要是有人告訴我,如果聯準會三月份升息,他會這樣做,一月份升息,他就會那樣做,這說明他根本不明白資產價格如何包含預期。

時機的差別應當毫不影響行動路線的選擇。升息問題的關鍵是升到多少?升得多快?這屆聯準會是小心謹慎的鴿派,我認為他們不會大幅度升息,也不會迅速升息……除非經濟出乎意料地好轉。

要是經濟真能出乎意料地好轉,這不是好消息嗎,你說呢?

既然說到了利率這個話題,我想說一下在利率問題上,我近期最反感的一個現象。有些人在利率保持不變時是一種做法(儘管所有人都知道利率不會總是保持 不變),現在看到升息0.25 個百分點,他們的做法就完全不一樣了。他們說,這是因為「我們現在處於升息的大環境中。」但是凡事都不能不知變通,看待利率也一樣……不能非黑即白……不 能說利率要麼平穩,要麼上升。

關鍵的問題是:「升息會升多少?」「這波升息會升到什麼時候?利率會上升到什麼程度,是否會真正改變人們的行為?」這才是關鍵。

昨天,《華爾街日報》的文章中說:「最近汽車類股比大盤跌更多,分析師和投資者認為,這是因為人們擔憂美國升息將抑制貸款購車的需求,是因為人們擔 憂汽車銷量已經見頂。」升息前景真的意味著汽車銷量將大減嗎?……油價可是很低的,消費者的成本下降了,駕車開銷也減少了。我覺得人們可能是受負面情 緒影響,突然蹦出了一個毫無根據的結論。

病例分析– 第三大道(Third Avenue)

第三大道資產管理公司(Third Avenue) 宣布旗下的高收益債基金Focused Credit Fund 將清算,我覺得在近期的所有事件中,投資者對這件事的反應是最有意思的。根據《金融時報》的報導:

這是2008 年以來美國發生的規模最大的基金清算,由此引發了人們對美國公司債券市場的深深憂慮。

有些人指出要區分兩種不同的情況:一種是系統性風險,一檔基金出了問題,引發其他基金爆發贖回潮;另一種是個別現象,只是一檔基金存在問題。

在Focused Credit Fund 宣布清算後,昨天,公司債又遭到拋售,許多投資者紛紛為垃圾債購買違約保險合同。

Focused Credit Fund 崩盤的原因很清楚,顯然就是它這一檔基金自己的問題。2014 年,作為一檔管理著35 億美元的基金,它重倉持有風險極高、流動性極差的債券。後來,在市場流動性越來越差的時候,它遭遇了滾雪球一樣的資金贖回。在這種情況下,基金經理一般會 通過將持倉中最容易賣出的債券變現來籌集資金,這就導致餘下的投資組合在品質和流動性上都大打折扣。2015 年12 月,受持續贖回影響,它管理的資產下降到8 億美元,我聽說它的持倉債券下降到不足20 個,都是品質極差的。再有贖回,基金經理別無選擇,只能把這些債券賣出,賣的價格只能是極低的,最後根本就毫無流動性了,那些還沒贖回的投資者只能背黑鍋 了。

毫無疑問,這是基金經理的過錯。

封閉式基金的資本是安全的,它們或許可以進行風險高、流動性差的投資,但是開放式基金則不同,投資者每天都可以贖回,它們或許就不該進行這樣的投資。資 產管理規模(AUM) 減少80%,與此同時,流動性還驟然吃緊,哪隻基金能應付得了這種情況?正如我在「流動性」(2015 年3 月)這篇備忘錄中所寫的:「不管是誰,都必須考慮投資品種的現實,不能讓它承擔更多的流動性」,具體來說,「不管是什麼投資工具,都無法增加流動性,它所 投資的品種流動性如何,這個工具的流動性就如何。」

流動性不足的資產碰上可能出逃的資本,還有什麼能比這兩個因素走到一起更容易導致投資慘敗?

情緒不穩定,也沒分析能力的投資者可能一下子就慌了,他們可能以為Focused Credit Fund 的問題表明或預示著,高收益債券和其他高風險債券全都靠不住。有些投資者沒那麼驚慌,他們可能知道高收益債券整體上或許是安全的,但他們還是害怕流動性不 足與大量資金贖回疊加,導致基金贖回潮、被迫平倉、債券價格暴跌的連鎖反應。那些能控制住情緒,有分析能力的人就不一樣,他們會認識到,Focused Credit Fund 的問題是它自身的問題,是個案,不代表債券市場整體存在問題,充足的信用可以為債券持有者提供最大的保護,他們不會受到市場混亂的影響。

最近的發展

行為經濟學和由此衍生出的行為投資學,都不是純理論。它們都研究實際問題,研究人類的弱點,研究這些弱點如何導致人們的實際行為與理論預期行為相背離。

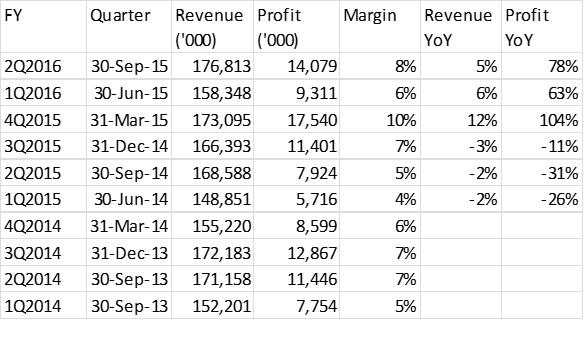

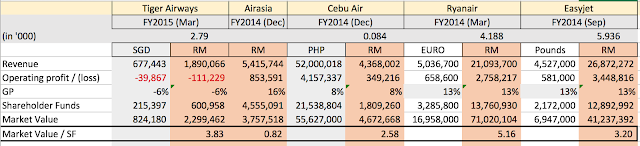

從最近幾個月的情況,我們就可以看出情緒波動是怎樣改變投資環境的。下面,我分析一下困境債券市場的情況。

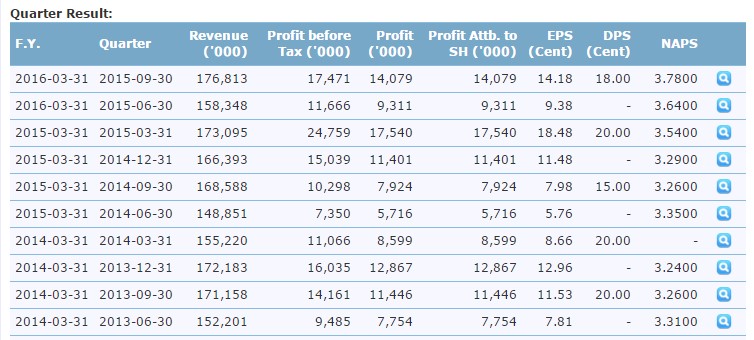

從2010 年到2014 年,美國的大趨勢是經濟逐步好轉,公司盈利上升,信貸市場迅速轉換到寬鬆環境,受這些因素影響,在此期間,低評級債券的違約率接近歷史最低水平。因此,不 良債券很稀有,而且數量有限的不良債券只集中在少數領域,例如,歐洲不良貸款、房地產、船舶製造和能源公司。綜合考慮這些因素,我們橡樹發現沒辦法創建大 規模的或高度分散的不良債券投資組合。自從我們創紀錄的在2007-2008 年籌集了109 億美元的基金後(幾乎都用於在雷曼兄弟申請破產後的那季投資),2010 年,我們籌集了一隻55 億美元的基金, 2011 年,我們籌集了一隻27 億美元的基金。也就是說,我們將可投資的資本規模減為一半,然後又減了一半。

中國的經濟成長放緩(除了在中國有業務的公司)與油價下跌對高收益債券的整體信用和品質沒有直接聯繫。然而,在過去幾個月裡,不良債券市場發生了顯著變化:

- 在此前的一段時間裡,債券價格非常穩定,甚至具有不確定性的債券也是如此。然而,在過去幾個月裡,一些證券的價格出現了「跳空下跌」,它們不是逐漸下跌,而是一跌就跌幾個點。投資者的變化很明顯,他們現在對公司的負面消息非常不耐煩。

- 能源和礦產行業以外的一些公司的債券價格從90 跌到60,有些從50 跌到20, 這還是2008-2009 年以來首次出現這種情況。

- 我的同事們都認為投資者的行為變了:他們以前是樂觀地看待公司基本面,根據收益率高低來評估證券,現在是悲觀地看待公司基本面,根據經過重組後是否可能復甦來評估證券。

- 資本市場的環境從寬鬆擺動到緊縮,這是資本市場一貫的作風。以前,公司很容易就能籌措到償還債務的資金,很容易就能延長債務期限或獲得「紓困融資」。現在,公司很難獲得資金,特別是那些陷入不同程度困境的公司。

12 月7 日,橡樹在紐約舉辦了晚宴,招待追蹤我們上市公司的分析師。鮑勃.歐萊瑞(Bob O’Leary) 是我們的不良債券基金的經理人,他本來打算出席晚宴。但是12 月3 日,他給我打了個電話,他說「您看我不參加晚宴行不行?現在忙不過來了,走不開。」我很長時間沒聽到管理不良債券的同事這麼說了。在某些情況中,投資者態 度的變化遠大於基本面的變化。現在他們的態度變化給我們帶來了投資機會,就在幾個月前,還不存在這樣的機會。

這種情況變化表明人們的悲觀情緒、懷疑態度和恐懼心理在上升。我們橡樹就期待這種情況,因為在其他情況保持不變時,這種變化會帶來更好的買入機會。但是,請注意,現在可能只是公司業績和信貸市場行為進入下行週期的初始階段。

因此,儘管現在是買入的時機,我絕對不是說,就該現在買。

對症下藥

為了幫助投資者克服「人類的弱點」,我這個精神病醫生要開個處方,幫助投資者緩解病情:

- 要戰勝市場先生的非理性,第一條就是要理解。投資者必須認識到心理因素的重要性及其對市場的影響,並積極應對。

- 第二條是要控制自己的情緒。投資者要是像大眾一樣犯情緒錯誤,他也不可避免地會像別人一樣受市場波動的危害。因此,投資者務必要在樂觀和恐懼之間保持適度平衡。

- 控制自己的情緒還不夠,投資者還要掌控自己的環境。對於職業投資者來說,這一條的意思主要是要把自己的環境安排好,不要讓別人的情緒波動對自己產生影響。例如,資金從基金的流入和流出、市場流動性的波動、短期業績的壓力。橡樹能拒絕「熱錢」,也能限制我們管理的基金的贖回條款,我們始終很看重我們由此獲得的優勢。

- 最後一條是逆向思維。有了逆向思維,投資者可以把別人的情緒波動從威脅轉變為武器。有了逆向思維,投資者就不僅僅是克制情緒波動了,他們在別人更恐懼的時候,更樂觀,反之亦然,這才是投資者應有的行為。

我很走運,我在剛入行的時候,就獲得了很多關於投資的真知灼見。40 多年前,在紐約,我們有一項「第三個星期四午餐會」(Third Thursday Group)。當年在這個聚會上,我學到了一個見解,它或許是對我最有幫助的。這個見解講的是牛市三階段:

- 第一階段:只有少數有遠見的人開始相信市場即將上漲。

第二階段,大多數投資者接受市場已經上漲的事實。

第三階段,所有人都斷言市場一定會不停地上漲。

從第一階段到第三階段,基本面可能沒發生任何變化。變化的是投資者的態度,他們的態度變了,決策也就變了。顯然,在第一階段買入最好不過了,在第三階段一定不能買入。

我們知道投資者會搖擺,開始是打死也不信,後來卻無腦地什麼都信。我們橡樹的買入時機是別人悲觀的時候,不是別人你爭我搶的時候。

給我一項投資,讓我研究,我最想知道的就是在這項投資中,價格裡包含了多少樂觀的因素。在牛市第一階段,沒有樂觀因素,這才能有便宜貨。在牛市最後的階段,樂觀情緒爆棚,與基本面相比,買入價格也高高在上。要是大眾的神經症對我有利,我就買;要是我也會像別人一樣被大眾的神經症懲罰,我就不買。

我在上文中說了,到2011 年中期時,人們都追求報酬,債券一點也不便宜,資本市場過於慷慨,投資者俱有偏好風險的行為。當時,橡樹的原則是「謹慎前行」。我們當時覺得我們可以在自 己的細分市場裡做投資,但是我們在投資時必須保持適度的謹慎。除了偶爾出現幾次驟跌,去年之前,投資者沒遭受什麼重大損失。這樣看來,我們又和往常一樣, 謹慎得太早了。但是2011 年中期以來,信貸領域的機會(和報酬)乏善可陳,我們雖然謹慎,也沒錯過什麼。

如上所述,現在投資者的樂觀情緒有些洩氣了,消極情緒流露出來了,價格下跌了。我們覺得現在向前走可以把警惕放鬆一些,當然了,具體肯定要看是哪個市場及其近期表現情況。

* * *

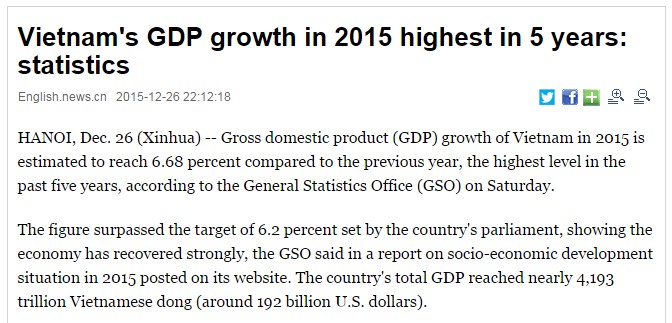

最後,我想順便說一下我最近經常被問到的兩個問題:中國的經濟放緩對美國和世界其他地區會產生什麼影響?會不會出現2008年那種大規模的經濟危機?

既然當前的大環境裡存在這麼多問題,我們一定要弄清哪些問題可能帶來重大影響。油價下跌:對於不生產石油的公司和國家,最不利的影響也就是好壞參 半。恐怖襲擊:很恐怖,但是對於任何一個人或一個地區,我認為它屬於「不可能發生的災難」。政治局勢:無論誰當選,可能都還是得過且過。

我認為,綜合考慮規模、潛在影響和發生的概率,在所有問題當中,中國經濟可能硬著陸是影響最大的。因此,我們有必要客觀地分析一下這會對美國產生什麼影響。

首先,我們要知道,除了向美國出口製成品,中國並非是美國經濟的中流砥柱。據估算,在標普500 指數包含的公司的總盈利中,中國的貢獻只佔1%。對中國的出口占美國GDP 的13%。在2015 年前11 個月,美國出口總量中只有8% 是出口到中國(1060 億美元的商品,而美國的GDP 總量是18 萬億美元,對中國出口商品總額佔比同樣遠低於1%)。

下面,我將分享保羅.克魯曼(Paul Krugman) 於1 月8 日撰文進行的分析。(我基本上不認同克魯格曼的政治立場,但是這裡說的與政治無關):

確實,中國是一個很大的經濟體,佔全球製造業的四分之一,中國的情況對全球都會產生影響。中國每年從全球其他國家和地區進口2 兆美元的商品和服務。

但是,世界很大,不算中國,全球的GDP 也有60 兆以上。就算中國進口嚴重下滑,也不會對全球消費造成嚴重影響。

可是金融市場是連動的,不會有影響嗎?2008 年美國的次貸危機最後演變成一場全球危機,原因之一就是美國股市對外國造成了重大損失,尤其是歐洲的銀行。但是中國實行資本管制,中國對外國投資者不是完全開放的,中國的股市大跌和債券違約直接產生的溢出效應很小。

總的來說,即使中國出現大的問題,對全球的影響也是可控的。但是,我必須承認,分析是這麼分析,我還是不放心。我認為不必在意,但沒這個膽量。為什麼?

部分原因在於各國的商業周期的同步性看起來沒那麼強,其實很強。例如,歐洲和美國之間的出口都只佔它們各自生產產品的一小部分,但是它們經常同時出 現衰退和復甦。這可能是受到了金融市場連動的影響,但是心理因素的傳染也起了作用:一個主要經濟體中的好消息或壞消息會激發其他經濟體的動物本能。

因此,我的擔心是,雖說粗略計算表明中國不會造成太大影響,但中國的問題可能傳染到其他國家……

我特別想強調一下克魯曼提到的「心理因素的傳染」。心理因素的傳染很有意思,上週,全球股市出現了這樣的下跌:標普500 指數– 6.0%、富時指數100 – 5.3%、法蘭克福指數– 8.3%、日經指數– 7.0%。

能出現這樣的同步下跌,投資者真的獨立客觀地分析了事件對每個國家和公司的影響嗎?我看不是這樣。我認為,這恰恰表明各個市場是密切相關的,因為投資者共同的心理而密切相關。

那麼2008 年那樣的危機可能再次發生嗎?

我認為全球金融危機不可能重演:

- 我們沒經歷繁榮(無論是經濟,還是股市),所以我認為我們也不會注定要衰退。因為大多數企業都沒有擴張的意願,如果營業收入持平或下降,我認為企業也不會遭到沉重打擊。

- 私營部門的槓桿已經降低了。特別是銀行,它們的槓桿從危機前淨資產的30 多倍下降到今天的10 多倍。再說現在政策也不允許銀行激進地用自有資金投資了。

- 最後,2008 年危機中的罪魁禍首是次級抵押貸款證券。當年,抵押貸款本身就不可靠,很多都是欺詐性質的。結構化的抵押貸款工具槓桿極高,評級也高到離譜。風險最大的部 分從銀行的投資組合中爆發出來,所以銀行被迫接受救贖。重要的是,現在看來,從脆弱性和數量級考慮,我沒發現與當年的次級抵押貸款和住房抵押貸款支持證券 類似的情況。

我不是說就沒有可擔心的:央行膨脹的資產負債表,沒人知道如何破解,也不知道利率會升到多高;經濟增長乏力、通膨率疲軟,還有上面提到的其他諸多負面因素。作為全球第二大經濟體,中國的硬著陸和大幅度貶值肯定會產生深遠的影響。

無論是經濟學家,還是投資者,最好都不要用「永遠」、「絕不」、「將會」、「將不會」、「肯定會」、「不可能」這樣的字眼,我上面的分析就很注意這 一點。在我看來,當年的全球金融危機及其先決條件是極為不尋常的,我不認為它會重演。但是,請注意,我不是預言家。無論是誰說的,是別人,還是我,橡 樹和我從來不根據對未來的預言下重注。

* * *

結束本篇備忘錄之前,有個問題,我一定要說清楚。2006-2007 年,我說要小心;2008 年末期,我說要積極買入;2012 年,我說要重新保持謹慎;

現在,2016 年年初,我說可以大膽一些。我說這些話的時候,都是非常不確定的。我的結論來自我的思考和經驗(以及與橡樹同事的合作),但是我從來都不覺得這些結論的正確性有100%,甚至是80%。

我當然覺得我的結論是對的,但是我每次說出來的時候,都誠惶誠恐。

我和所有人讀同樣的報紙,看同樣的經濟數據。我經受同樣的市場波動。影響別人情緒的因素,也影響著我的情緒。或許我對自己的思考更有自信,當然我也比大多數人更有經驗。但最重要的是,不管為什麼會這樣,我就是能面對自己的情緒並遵循自己的結論。

情緒這東西無法記錄,也無法證實。否則,大多數聰明人都會得出相同的結論,都會同樣的自信。我和你說這些,只是想告訴你我的感受,我覺得誰都不要因為對自己的結論不確定,就害怕自己不行。

哪有什麼是有確定性的?