Oil and fossil fuel is dying, making way for renewable energy. Unlike previous cycles, oil will not recover. That's because technology for renewables have reached an inflexion point when it's actually cheap and feasible to use renewables. This will be great for airline stocks (you would know if you have been tracking global airline stocks).

Anyway, back to airlines and AirAsia.

1) AirAsia : Most lagging Airline stock in the WORLD

Do you know that global airline stocks are rallied 200-300-400% in the last 2-3 years??

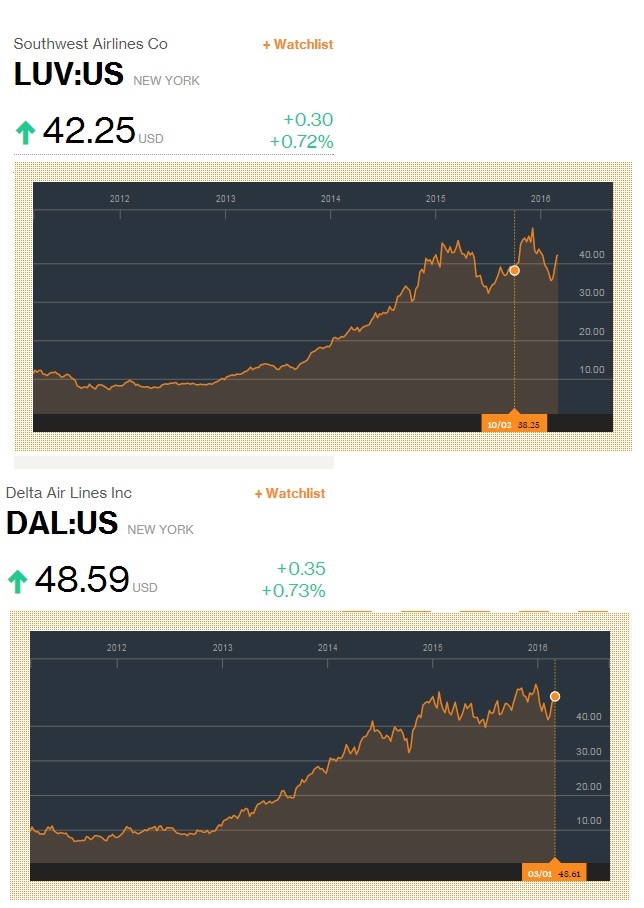

Southwest Air's share price in the US tripled from 10.62 in 2014 to 42.34 now! Delta Air also nearly tripled from 12.65 to 48!

What about AirAsia? AirAsia's share price actually went down 27%! Think it's fair to say that it's time for AirAsia to catch up! A double, or triple maybe. ;)

Anyone who say that Airlines is a not so good business should look at the charts above as proof that airlines is a good business for this cycle. The current economic cycle of low oil prices is a blessing for non-oil logistics as well as tourism travel stocks ie Airlines.

2) AirAsia is super cheap now : only 4.7x PE!

AirAsia is forecasted by HLG Research to make RM822m core profit or 29 sen core EPS for 2016. This means it's only trading at 4.7x 2016 PE. Serious?!

Ryanair and Southwest trades at 13x and 12x PE. This means AirAsia is only 60% cheaper than it's contemporaries. It's ridicilous because AirAsia is a world famous brand and is the strongest proxy to South East Asia. It should trade at least at the SAME valuations as these two stocks ie at least 12-13x. This would mean a potential 150% upside from here.

3) AirAsia profits trending upwards and Higher in 2016-17

Oil and Jet fuel prices have been lower recently, plus AirAsia's hedges will be lower which means much lower fuel costs for coming quarters and higher profits. Plus it has already kitchen sunked it's losses in Indonesia and Philippines, which means a clear financial path for 2016.

All in all, AirAsia's profits will boom higher in 2016 which will make it even cheaper. Pegging a 13x PE fair valuation AirAsia should be trading at above RM3.50 in 1-2 years time.

No comments:

Post a Comment