From:-http://yy-mylifediary.blogspot.com/2014/08/131000top-glove-13rm55294.html#.VHa9JXlxm1u

说今天的成交值破新高

呵~歪歪依然是记不住billion多少个0,买股收息几年,也没有去注意成交量或成交值。

今天在面书看到股友们热烈讨论,就请教怎么看成交值。

原来就是图标写着vol: 7.669b :)

那么,遇到那么高的成交值要怎么办?

看看股票组合的几家公司,Tune Ins股价见红,情有可原,因为EPS不美嘛~

而OSK股价见红,也是能接受,毕竟OSK不停破新高那么多天了。

现在这一分钟,歪歪比较在乎的是OSK与Sunway会在月尾宣布的业绩。

在今天马股一片红海,Sunway还能稍微上涨RM0.03。:)

因为Sunway是股票组合的老二,加上DIGI和OSKP的给力,所以,组合总数字还是稍微上涨一点。

记得这个道理,一日不套利,这一切都还只不过是纸张上的盈利。

只有等到公司宣布的业绩漂亮,股息不错,或是突然宣布派红股。

那么,所谓的纸上盈利才能看到实际的回报。:)

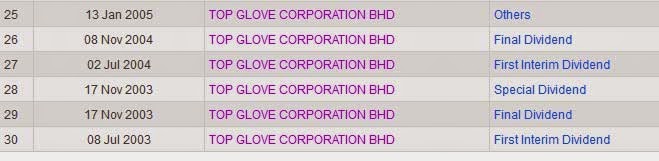

13年前持有1000股Top Glove, 13年后滚成RM55,294

Forest Chew在面子书给歪歪看了一张图表,并建议歪歪可以用来写成文章:)

那张图表是他出席讲座时,Top Glove板分享投资在Top Glove 13年的回报率。

就是2001年3月27日用RM2.70 IPO价格,买入1000股Top Glove。

随后,把1000股Top Glove放在保险箱里,不小心忘记了。

在这13年里,马股有经历过牛市,熊市,再从熊市到牛市。

公司的业务一直在成长,不管牛市或是熊市,都继续营业。

2014年7月,当年的1000股RM2.70的Top Glove,已经得到2048%的资本回筹。

1000股Top Glove 在13年的红股效应下,变成10,192股。

图表显示25072014,Top Glove股价RM4.70。

那么,10,192 x RM4.70= RM47,902, 这个还是没有包括股息计算。

如果包股息,就相等于RM55,294。

13年前,RM2700投资在1000股Top Glove。

13年后,该RM2700增值到RM55,294。

看看股友们都开始讨论沸点,歪歪也有点忐忑不安。

可是,要自己卖掉没有问题的公司股份,内心有一把声音诉自己,不能卖。免得以后再也买不回,当初的买入价。

看看Top Glove的例子,再看看前辈们早前在文章写过的,某某年持有多少张大众银行,等于现在的100万等等。

这一切,不都是告诉我们,买了好公司股份,当个傻子把股份忘记了。

然后,一个10年,或是20年过去了,只要公司业务在成长,我们就能收到一年,比一年多的股息。

当初的1000股还会股生股,变成好几张,甚至是十多张回来。:)

嗯。。。当与股市靠得越近,就会忘记了初心,会随众人情绪牵动,而忘记了股票就是股份,等于投资一门生意。

该买,该卖,该减持,或是该保持不变,都必须靠自己去判断,因为每个人所站在的点都不同。:)

在此,歪歪要谢谢Forest Chew的资讯提供:)

Bursa Malaysia和HLebroking系统找到记录

就来一起见证,马股创高交易量的不久后,是否真的会出现市崩:)

如果你开始为此不能安心,就随你的心来调配。

歪歪也开始节制自己,要减少把即将到手的闲钱投入股市,转增持现金。

投资为了美好的生活,也就是今天买入,能够晚晚睡得安心。

当心不安,就是有问题了,该检讨。:)

注:歪歪并没有持有Top Glove,拜托不要跑来问歪歪,Top Glove可以买吗?

Wednesday, November 26, 2014

网赚也能有春天!

歪歪的部落也我自己的差不多时间开始,自己的目前还是很差。。。看到歪歪的网赚很让人鼓舞。如果能达到USD300算不错的了。另外2个也不错的是第一天和Harry.

看看他们的成绩吧。

10月份部落格所得广告费收入为$211.19,随着马币兑美元率下跌,来到11月份则能换取RM691.95。

$211.19 x 3.2764339=RM691.95。

歪歪还在使用Western Union提取Google Adsense广告费收入,自己就是喜欢拿着真钞票感觉^0^

虽然,拿了钱后还是要去bank in, 有点多此一举^_^

温馨提醒;

要提取Google Adsense广告费收入,除了Western Union, 或领取支票(不建议此方法),还有另一个提款方法就是Wire Transfer 。

部落格额外收入分配

RM691.95足够支付不久前透过Rakuten购买的Pineng PN-999 20000mAh Power Bank, 连同邮费RM71。《Rakuten Pineng PN-999 20000mAh Power Bank RM64》

用了Pineng PN-999 power bank好几次,除了稍微重了一点,其实蛮好用的。

一次满电可以为Sony xPeria Z充电大概4次,这power bank充满电大概要等10个小时。

如果带出去旅行,就能不用再担心smart phone电源不足,可以多拍几张照片^_^

这个月领取的广告费收入,足够支付10月份生效的Great Eastern Investment Link每月RM200保费。

剩下的钱,一部分存起来作为买股后备资金,一部分则成为投资考察车马费。

下一个要出席的股东大会在Shah Alam, 还要10点早上,除了不熟悉路线,还担心堵车,希望赶得到。

要出席该公司股东大会,因为有打算把该公司股份成为累积目标之一。

额外收入

如果你喜欢写blog,不妨考虑加入Google Adsense在部落格内,让自己多赚一点额外收入,把增加的收入作为买股收息闲钱,逐渐提升自己的经济能力。

可以参考旧文章《部落格网赚从Google Adsense 开始》,《中文博客要如何提高Google Adsense美元广告费?》

歪歪理财记事本 2014年的累积美元广告费收入

Feb payment received $151.34 (两个月的累积)

April payment received $145.27(两个月的累积)

May payment received $101.98 ( 第一次单月美元广告费突破$100)

July payment received $216.06 (两个月的累积)

Aug payment received $172.69

Sept payment received $207

Oct payment received $231.52

Nov payment received $211.19

2014年,歪歪累积所收的美元广告费收入$1437.05。

------------------------------------------------------------------------------

看看他们的成绩吧。

10月份部落格所得广告费收入为$211.19,随着马币兑美元率下跌,来到11月份则能换取RM691.95。

$211.19 x 3.2764339=RM691.95。

歪歪还在使用Western Union提取Google Adsense广告费收入,自己就是喜欢拿着真钞票感觉^0^

虽然,拿了钱后还是要去bank in, 有点多此一举^_^

温馨提醒;

要提取Google Adsense广告费收入,除了Western Union, 或领取支票(不建议此方法),还有另一个提款方法就是Wire Transfer 。

部落格额外收入分配

RM691.95足够支付不久前透过Rakuten购买的Pineng PN-999 20000mAh Power Bank, 连同邮费RM71。《Rakuten Pineng PN-999 20000mAh Power Bank RM64》

用了Pineng PN-999 power bank好几次,除了稍微重了一点,其实蛮好用的。

一次满电可以为Sony xPeria Z充电大概4次,这power bank充满电大概要等10个小时。

如果带出去旅行,就能不用再担心smart phone电源不足,可以多拍几张照片^_^

这个月领取的广告费收入,足够支付10月份生效的Great Eastern Investment Link每月RM200保费。

剩下的钱,一部分存起来作为买股后备资金,一部分则成为投资考察车马费。

下一个要出席的股东大会在Shah Alam, 还要10点早上,除了不熟悉路线,还担心堵车,希望赶得到。

要出席该公司股东大会,因为有打算把该公司股份成为累积目标之一。

额外收入

如果你喜欢写blog,不妨考虑加入Google Adsense在部落格内,让自己多赚一点额外收入,把增加的收入作为买股收息闲钱,逐渐提升自己的经济能力。

可以参考旧文章《部落格网赚从Google Adsense 开始》,《中文博客要如何提高Google Adsense美元广告费?》

歪歪理财记事本 2014年的累积美元广告费收入

Feb payment received $151.34 (两个月的累积)

April payment received $145.27(两个月的累积)

May payment received $101.98 ( 第一次单月美元广告费突破$100)

July payment received $216.06 (两个月的累积)

Aug payment received $172.69

Sept payment received $207

Oct payment received $231.52

Nov payment received $211.19

2014年,歪歪累积所收的美元广告费收入$1437.05。

------------------------------------------------------------------------------

Labels:

我的网赚

18年前1000股Dialog, 18年后滚成213, 106股或总值RM406,575

From: http://yy-mylifediary.blogspot.com/2014/11/181000dialog-18213-106rm406575.html#.VHa26Xlxm1u

今年8月Forest Chew提供一张关于长期投资Top Glove图表资讯给歪歪,建议歪歪写一篇相关文章。

于是,歪歪就写了《13年前持有1000股Top Glove, 13年后滚成RM55,294 》。

《13年前持有1000股Top Glove, 13年后滚成RM55,294 》文章是在接近深夜,才完成post上部落格,并在面子书专业做推广。。。

没有想到该文章马上竟然吸引大量读者的兴趣,该文章还成为部落格一个月内最高阅读量的文章。

前几天,Forest Chew再提供一张关于长期投资好公司回报图标给歪歪看。

这一次主角公司从Top Glove换成了Dialog Group Berhad - 戴乐集团,其长年累积的投资回报率更为具大:)

看在即将收到部落格广告费收入份上(好现实的我^0^) ,为此, 就花时间看图表数字,翻查Bursa Malaysia文告,写一篇相关文章送给读者。:)

在忐忑不安的股市,与其把注意力放在股价波动,何不花多一点时间,学习研究公司业务与分析其前景。

以便在大减价出现,可以为自己在危机发生时,捉住当中的机会,这才是明智的举动,不是吗?

由于该图表不是自己做的,就不方便放上部落格,只能自己看图表数字,再用文字做一个简报。:)

18年前1000股Dialog, 18年后滚成213,106股或RM406,575

Dialog在1996年上市,当时IPO-Iniatial Public Offer 价格RM2.75,最初投入资本RM2750持有1000股。

1999年,只要当初的1000股Dialog还被持有着,投资者就能以4股配5红股下,获得800股红股,总累积了1800股Dialog。

2000年,Dialog宣布2配3红股,也代表投资者手上的1800股可以获得1200股红股,总累积了3000股Dialog。

2001年,Dialog宣布2配5红股,只要投资者手上继续持有3000股Dialog,就能获得1200股,总累积了4200股Dialog.

2002年,Dialog宣布1配5红股, 手上只有4200股Dialog投资者可分得840股,总累计5040股Dialog.

2004年,Dialog宣布1配5红股,5040股可以1008股,总累积6048股。

同年,Dialog宣布拆细1变10,6048股变成60,480股。

2006年,Dialog宣布special share dividend 1 for 50, 60,480股可以获得1209股,总累积61,689股。

以此类推,来到2010年再获得2配5红股下,连同之前的红股和Special share dividend,已经累积了88,890股。

2012年,Dialog宣布2配10 right issue - RM1.20,持有88,890可以认购17,618股,并支付RM21,142。

那么,在1996年投入RM2750再加认购股份的RM21,142,总投入资金为RM23,892。

随后,投资者可以获得8809股凭单。

只要投资者继续持有所有累积的Dialog股份,一直到2014年都没有减持~

来到了2014年9月份,在股生股,加认购股份下,1996的1000股Diaglo滚成213,106股Dialog,总价值为RM406.575。

其实,实际回报应该更多,因为数字还没有包括多年来的股息收入。 :)

Bursa Malaysia和HLebroking系统找到记录

歪言歪语

如果股息是王道,那么红股的威力算是霸道吗?_?

2013年,当Sunway, Sunreit, IGBreit股价下跌,歪歪有陆续加码。

2014年,股价回升,纸上亏损变成盈利,而且还有股息。

2015年,歪歪还会得到Sunway的免费Sun Con股份和特别股息。另外,估计Sunreit和IGBreit的股息都会有所增长,带给歪歪更多的passive income。

当自己写完这一篇文章,歪歪想着为自己的2015年订下目标,就是找另外新两家公司成为要累积的目标,而且最好是未来有高机会可以获得红股。

AEON, Karex或Tune Insurance。

来到2014年11月,自己累积了AEON 600股,Karex 2600股,Tune Insurance 1300股。

三家公司中,那一个的业绩会先带来突破?

三家公司中,目前以Tune Insurance 业绩表现有点让歪歪失望,希望新CEO能够带给公司新改革吧~

开始在想,如果选保险公司股份做投资,选的是Takaful,而不是Tune Insurance,会否更好?

最近,Etiqa Motor Takaful给歪歪寄上了支票,让歪歪对Takaful保险有了好感。

作为投保人之一,开始喜欢Takaful保险概念了。^^(参考:Maybank eTiQa Motor Takaful寄上门的支票)

又或者,让自己两者兼得,有机会就两家公司都买入:)

注:歪歪并没有持有Dialog,拜托不要跑来问歪歪,Dialog可以买吗?

今年8月Forest Chew提供一张关于长期投资Top Glove图表资讯给歪歪,建议歪歪写一篇相关文章。

于是,歪歪就写了《13年前持有1000股Top Glove, 13年后滚成RM55,294 》。

《13年前持有1000股Top Glove, 13年后滚成RM55,294 》文章是在接近深夜,才完成post上部落格,并在面子书专业做推广。。。

没有想到该文章马上竟然吸引大量读者的兴趣,该文章还成为部落格一个月内最高阅读量的文章。

前几天,Forest Chew再提供一张关于长期投资好公司回报图标给歪歪看。

这一次主角公司从Top Glove换成了Dialog Group Berhad - 戴乐集团,其长年累积的投资回报率更为具大:)

看在即将收到部落格广告费收入份上(好现实的我^0^) ,为此, 就花时间看图表数字,翻查Bursa Malaysia文告,写一篇相关文章送给读者。:)

在忐忑不安的股市,与其把注意力放在股价波动,何不花多一点时间,学习研究公司业务与分析其前景。

以便在大减价出现,可以为自己在危机发生时,捉住当中的机会,这才是明智的举动,不是吗?

由于该图表不是自己做的,就不方便放上部落格,只能自己看图表数字,再用文字做一个简报。:)

18年前1000股Dialog, 18年后滚成213,106股或RM406,575

Dialog在1996年上市,当时IPO-Iniatial Public Offer 价格RM2.75,最初投入资本RM2750持有1000股。

1999年,只要当初的1000股Dialog还被持有着,投资者就能以4股配5红股下,获得800股红股,总累积了1800股Dialog。

2000年,Dialog宣布2配3红股,也代表投资者手上的1800股可以获得1200股红股,总累积了3000股Dialog。

2001年,Dialog宣布2配5红股,只要投资者手上继续持有3000股Dialog,就能获得1200股,总累积了4200股Dialog.

2002年,Dialog宣布1配5红股, 手上只有4200股Dialog投资者可分得840股,总累计5040股Dialog.

2004年,Dialog宣布1配5红股,5040股可以1008股,总累积6048股。

同年,Dialog宣布拆细1变10,6048股变成60,480股。

2006年,Dialog宣布special share dividend 1 for 50, 60,480股可以获得1209股,总累积61,689股。

以此类推,来到2010年再获得2配5红股下,连同之前的红股和Special share dividend,已经累积了88,890股。

2012年,Dialog宣布2配10 right issue - RM1.20,持有88,890可以认购17,618股,并支付RM21,142。

那么,在1996年投入RM2750再加认购股份的RM21,142,总投入资金为RM23,892。

随后,投资者可以获得8809股凭单。

只要投资者继续持有所有累积的Dialog股份,一直到2014年都没有减持~

来到了2014年9月份,在股生股,加认购股份下,1996的1000股Diaglo滚成213,106股Dialog,总价值为RM406.575。

其实,实际回报应该更多,因为数字还没有包括多年来的股息收入。 :)

Bursa Malaysia和HLebroking系统找到记录

歪言歪语

如果股息是王道,那么红股的威力算是霸道吗?_?

2013年,当Sunway, Sunreit, IGBreit股价下跌,歪歪有陆续加码。

2014年,股价回升,纸上亏损变成盈利,而且还有股息。

2015年,歪歪还会得到Sunway的免费Sun Con股份和特别股息。另外,估计Sunreit和IGBreit的股息都会有所增长,带给歪歪更多的passive income。

当自己写完这一篇文章,歪歪想着为自己的2015年订下目标,就是找另外新两家公司成为要累积的目标,而且最好是未来有高机会可以获得红股。

AEON, Karex或Tune Insurance。

来到2014年11月,自己累积了AEON 600股,Karex 2600股,Tune Insurance 1300股。

三家公司中,那一个的业绩会先带来突破?

三家公司中,目前以Tune Insurance 业绩表现有点让歪歪失望,希望新CEO能够带给公司新改革吧~

开始在想,如果选保险公司股份做投资,选的是Takaful,而不是Tune Insurance,会否更好?

最近,Etiqa Motor Takaful给歪歪寄上了支票,让歪歪对Takaful保险有了好感。

作为投保人之一,开始喜欢Takaful保险概念了。^^(参考:Maybank eTiQa Motor Takaful寄上门的支票)

又或者,让自己两者兼得,有机会就两家公司都买入:)

注:歪歪并没有持有Dialog,拜托不要跑来问歪歪,Dialog可以买吗?

DiGi.com - 17 年 3,819% 的复利威力

DiGi.com - 17 年 3,819% 的复利威力

DiGi 在 18 Dec 1997 上市,那时是公司名称是 DiGi Swisscom Bhd。

在 1999 年,Telenor 收购了 DiGi。同年, DiGi 配发 1:2 的 RM1.25 附加股。

然而,1997 至 2005 DiGi 都没派股息。

一直到了2006 和以后,DiGi 就慷慨派息了。

而且在 2006 年, 股东获得每股 RM1.35 的资本回退; 在 2011年11月,DiGi 被 拆细 1 into 10 。

要是在 DiGi 1997 上市时买进 1000 股 DiGi (假设 IPO 股价 RM2.50),随后分得 500 股 附加股(RM625)。 这 1500 股 的 DiGi 本钱是 RM3,125。

从 1997 年至今(17年),DiGi 股数从 1,000 股增至 15,000 股。

以今天 DiGi 的股价 ~ RM6.40, 现手上的股票价值就是 15,000 X 6.40 = RM96,000, 而这17年得到的股息是 RM26,468.625. 两个的总额是 RM122,468.62。

这意味着17年来, DiGi 股票加股息的总价值从 RM3,125 增加至 RM122,468.62,共增长了 3,819%, 而年复合增长率 (CAGR) 则是 24%。(比较大众银行的 19.5%)

其实要是倒算回 DiGi 的股价,它每股的“原价”该是: RM 6.40 X 10 X 1.5 = RM 96 !

我在 22 Feb 2010 首次买入 RM22.34 的 DiGi, 这批股票 4 年来开翻了一番半。过后我也逐渐增持至今,没什么原因,就是它的股息与股票增值太丰厚了。

DiGi 在 18 Dec 1997 上市,那时是公司名称是 DiGi Swisscom Bhd。

在 1999 年,Telenor 收购了 DiGi。同年, DiGi 配发 1:2 的 RM1.25 附加股。

然而,1997 至 2005 DiGi 都没派股息。

一直到了2006 和以后,DiGi 就慷慨派息了。

而且在 2006 年, 股东获得每股 RM1.35 的资本回退; 在 2011年11月,DiGi 被 拆细 1 into 10 。

要是在 DiGi 1997 上市时买进 1000 股 DiGi (假设 IPO 股价 RM2.50),随后分得 500 股 附加股(RM625)。 这 1500 股 的 DiGi 本钱是 RM3,125。

从 1997 年至今(17年),DiGi 股数从 1,000 股增至 15,000 股。

以今天 DiGi 的股价 ~ RM6.40, 现手上的股票价值就是 15,000 X 6.40 = RM96,000, 而这17年得到的股息是 RM26,468.625. 两个的总额是 RM122,468.62。

这意味着17年来, DiGi 股票加股息的总价值从 RM3,125 增加至 RM122,468.62,共增长了 3,819%, 而年复合增长率 (CAGR) 则是 24%。(比较大众银行的 19.5%)

其实要是倒算回 DiGi 的股价,它每股的“原价”该是: RM 6.40 X 10 X 1.5 = RM 96 !

我在 22 Feb 2010 首次买入 RM22.34 的 DiGi, 这批股票 4 年来开翻了一番半。过后我也逐渐增持至今,没什么原因,就是它的股息与股票增值太丰厚了。

Thursday, November 20, 2014

How to lead a comfortable retirement life through investing in the stock market? Part 3 kcchongnz

What, another “How to lead a comfortable retirement life through investing in the stock market? Yes, I am very happy to write under this title as the two previous articles written by me with the same title have received more than ten thousand reads each. You know any writer would be happy when his articles have good readership. Thanks i3investor again for providing me this opportunity. The first article I wrote described how some well-known super investors in the US and here have accumulate enormous amount of wealth through their long-term investment in the equity markets following the fundamental value investing principles. http://klse.i3investor.com/blogs/kcchongnz/59971.jsp I also presented my own experience in the last few years and provided facts and figures that value investing is the way to go for long-term wealth building. Part 2 of the series I described in detail that the most important thing an investor who aims to build long-term wealth must avoid the lemons. “If one doesn’t invest the right way but by simply listening to rumours and punt on hot stocks, instead of building wealth for retirement, can end up as a pauper.” I used one stock, KNM, as example how you can look at its financial statements and annual reports, and everything was crystal clear and the signs were written everywhere how a lemon is like and must be avoided at all costs. Here is another article of mine for you to check if a stock is a lemon, what to look out for. http://klse.i3investor.com/blogs/kcchongnz/45373.jsp Notice that none of the nine stocks I mentioned in the above article failed me. While KLCI went up about 10% in the past one year, the average and median return of those stocks is -29% and -40% respectively within the same period. That means the hot stocks had a negative alpha of 50%! So can you see why I am so concern about avoiding lemons if you intend to build long-term wealth? In this Part 3 of “How to lead a comfortable retirement life through investing in the stock market?”, I am going to share with some more exciting part of investing, what kind of investing strategy you can utilize to earn extra-ordinary return from the market. Value Investing Strategies Identifying lemons as I have mentioned is very easy. You just need to know the language of business, that is analyzing and interpretation financial statements. This part of making extra-ordinary return I can tell you is not easy. I would rather say you have a higher probability to earn extra-ordinary return from the market in the long run using these value investing strategies. There are numerous academic research especially in the United States showing these value investing strategies had worked well and it is still working well. In our case, I will show some non-academic evidences that these strategies also work well in Bursa. Value Investing Strategy No. 1: Buy Earnings on the Cheap This strategy is described in the following article here: http://klse.i3investor.com/blogs/kcchongnz/62822.jsp The article shows that the total return of a portfolio of 104 low P/E stocks in Bursa held over a period of 5 years since 2009 until to date is an average of 181%, or 3.5 times that of KLCI of 51%. However, there were some bad losers and a number of companies disappeared from the screen. In another words, there is this survival bias. It is still a viable strategy if you can hold a diversified portfolio of low price-to-earnings stocks in Bursa. Value Investing Strategy No. 2: But a Buck for 66 sen Isn’t this strategy of buying stocks with net asset much more than its share price intuitive? Walter Schloss, a not-so-well known disciple of Benjamun Graham is one of the most influential investors based on his 5 decade long performance from 1955, returning 20% per year, almost three times the 7% return of the S&P during the same period, using purely this balance sheet investing strategy as shown in this link below. http://klse.i3investor.com/blogs/kcchongnz/52280.jsp We can actually refine this method by using more stringent criteria, the Graham net net asset value and the negative enterprise value investing strategy as described here: http://klse.i3investor.com/blogs/kcchongnz/45296.jsp Some of my results investing in Bursa stocks using this strategy is described here: http://klse.i3investor.com/blogs/kcchongnz/56472.jsp “The average portfolio return of a portfolio of 10 stocks is 43.1%, close to three times the return of the broad market of 15.1% during the same period. None of them had a return of less than 10%.” This strategy of buying a buck for 66 sen involves very little downside but plenty of upside. Both the above strategies, although as a diversified portfolio yields satisfactory return, they do have some shortcomings. Many of them are cheap for some reasons. It is good to be aware of them and use some metrics to check and ensure one doesn’t buy some of the stocks which would go bankrupt as described in the links. Investing strategy No. 3: Buying good companies Cheap The above strategies involve buying cheap companies. Here, I have introduced the use of Magic Formula by Joel Greenblatt as shown in this link below: http://klse.i3investor.com/blogs/kcchongnz/63417.jsp Here, Greenblatt did away with the manipulative E, and the deceptive P in the P/E ratio, and replaced it with EV/Ebit. Moreover he recommended only good companies, and not any company as in the first strategy above. Buying good companies cheap. How not to make good extra-ordinary return? Yes, Greenblatt has actually shown that the Magic Formula, not only worked, but still works well. http://klse.i3investor.com/blogs/kcchongnz/51631.jsp I have also described my experience investing in Bursa and it has also worked very well. Investing strategy No. 4: High dividend yield strategy Another value investing strategy is the high dividend yield strategy which also worked very well in Bursa for the past 5 years as described in the article here. http://klse.i3investor.com/blogs/kcchongnz/62033.jsp It shows that high dividend yield is a viable strategy for a diversified portfolio but it is not necessary a sure win strategy and one has to separate the chaff from the wheat with some health checks as described. Investing strategy No. 5: Super investor strategy, buying high growth companies What about growth stock investing strategy? Sure it works as shown in this company, Scientex Berhad, below but make sure your projection of its growth is not far off, and you don’t pay a hefty price for a growth expectation. http://klse.i3investor.com/blogs/kcchongnz/56316.jsp And also be aware that not all growth stories are good stories. Many are dreadful as shown in the link below. Avoid them at all costs. http://klse.i3investor.com/blogs/kcchongnz/63777.jsp Investment strategy No. 6: Buying companies with a margin of safety Many value investors chose to invest in good stocks without considering their price. I do admit that many of them were successful. However, I opine that not only good companies, knowing the price-value relationship is also very important. Hence it is my habit to make some estimation on the intrinsic value of stocks using discount cash flow analysis and compare with their prices. We must a sense of what is the margin of safety investing in a stock. http://klse.i3investor.com/blogs/kcchongnz/46864.jsp Conclusions Share prices don't exist in a vacuum. Instead, they represent what it costs, at one point in time, to buy a tiny proportion of a company listed on the stock exchange. It is not difficult to see that the value investing strategies described above; buying earnings on the cheap, buying a buck for 66 sen, buying good companies cheap, buying companies at a large margin of safety etc would logically work, work well I would say. Hence in my opinion, value investing is the most dependable way to build long term wealth.

Labels:

kcchongnz

Tuesday, November 18, 2014

雲頂傷風

中國打噴嚏,全球就感冒。對一些受到中國反腐敗等政策打擊的領域來說,這句話的體會特別深。

雲頂(GENTING,3182,主板貿服組)與其他博彩業者,現在紛紛咳成一片。

該集團屬下雲頂新加坡上週公佈第三季業績,營業額下跌17%至6億4千477萬新元,淨利更猛挫43%至1億2千710萬新元,寫下4年最低水平,原因就在於中國遊客,特別是“豪客”減少。

雖然雲頂新加坡的一般賭客穩定增長,但受中國豪客減少等影響,第三季籌碼兌換率滑落10%,博彩營收跟著下降21.3%。

分析員認為,隨著中國遊客數量存有不確定因素,相信雲頂新加坡必須重點開發東盟遊客,惟這些措施的效果仍有待觀察。

與雲頂新加坡命運相同的,包括世界級賭博王國澳門。

澳門博彩監察協調局的數據顯示,10月博彩收入為280億2千500萬澳門元(約117億令吉),按年下跌23.2%,重要因素之一正是“中國反腐敗等多項政策限制了中國遊客在澳門參與賭博活動”。

過去幾年,全球忙於籌建新賭場,以爭取中國豪客為主的賭客,現在中國政府打貪打到舉世皆知,連奢侈品、豪宅、高級食品等都深受波及,銷量一瀉千里,更加敏感的博彩業自是不會討好,雲頂集團作為全球數一數二的博彩王者,難免受到打擊。

見慣風雨的雲頂集團當然不會坐以待斃。除了繼續開拓紐約、拉斯維加斯、日本、韓國等市場,該集團也加強非博彩收益,以多元化營收來源。雲頂新加坡第三季酒店入住率維持在95%的高水平,平均房價更由390新元提高到408新元,就是最好的證明。

不過,中國豪客無論數量或“質量”都在全球首屈一指,雲頂再怎麼多元化營收來源也好,恐怕也不得不跟著浮浮沉沉。

何況,除了新加坡賭場,雲頂屬下大馬、澳門、澳洲,包括遠至紐約、拉斯維加斯,還有計劃中的日本、韓國等賭場,都必須看這批賭客的臉色,如此一來,雲頂如何避得開中國的影響?

相信在可預見的未來,只要中國打噴嚏,雲頂即使不感冒,至少也會患上重傷風吧。(星洲日報/投資致富‧投資茶室:王寶欽)

Labels:

Genting

Wednesday, November 12, 2014

Oldjim on Malaysia property

新加Bore接鄰馬拉的地方叫新山,英文叫 Johor Bahru,新山是馬來西亞最南端、也是歐亞大陸最南端的城市,與鄰國隔著柔佛海峽相對,就好似香港去深圳咁,通關很方便,這裡將會成為強國另外一座鬼城,而且全部Made by China,新加Bore人現正隔岸觀火,李氏父子又在冷笑。 馬拉年頭黑到年尾,MH370事件令馬拉政府形象跌入谷底,馬拉各個行政機關的辦事效率和透明度,都會一直成為世界熱議話題。在此之前,碧桂園、綠地、富力等冇運行的地產商因為國內投資環境插水,被一班國際級大鱷騙了過來投資,眾房企都沒想到,事情遠沒那麼簡單,除了財務風險,經濟週期、匯率及當地住房需求等因素,落南洋的擴張計畫既沒佔到天時,也沒有地利,更欠人和,借Ge錢全部是外資,是時候等我整份「渾水」報告沽空佢。 這裡有數十幢樓高50層的Condo,通通建於填海地,2014年2月,綠地集團宣佈,集團計畫斥資近200億元人民幣投資柔佛州兩個地產專案,綠地的Billboard早已將這塊區域圍了起來,運沙卡車絡繹不絕。 我地問發展商,填海填幾耐?答:「一年。」「你地香港填海要填六至八年,新加坡10年,我地只需一年。」 我心諗,有冇搞X錯,I wish you Luck。 碧桂園是最早下南洋的開發商之一,從2008年起,順德佬楊國強就有意向海外拓展。2011年,通過同是順德同鄕四叔李兆基介紹識左老虎仔,遠東集團主席邱達昌,後者旗下的私人地產企業Mayland在馬來西亞耕耘多年,根基深厚,兩人很快就達成了合作意向,建立合營公司Wealthy Signet Sdn Bhd開發吉隆玻附近的兩個專案。但由於中馬法律法規的差異,在開發過程中,受制於私人土地權屬問題、政府繁雜的審批程式以及合營公司利益分配問題,兩個項目不久就陷入了僵局。 邱達昌都有名比你叫做「老虎仔」,當然唔係長隆D白老虎咁溫馴,邱達昌九十年代初拿着3000 萬,赤手空拳在馬來西來創立了馬來西亞置地。碧桂園佔合營公司55%的股權,但專案至今還未開盤,開發速度遠低於碧桂園持有100%股權的新山鬼城。 呢D貨,根本係用來協助碧桂園清國內存貨,即係響南番順買一件,就送一套南洋樓比你,買菜搭條葱。 馬來西亞在過去十多年的房地產市場發展並不理想,樓價升幅很小,馬拉總共才3000萬人,其中馬來人占67.4%,華人占24.6%。相對而言,在美國、歐洲、澳大利亞等地投資開發的回報與國內差不多,但風險較低,因為那些地方的市場處於相對低位元,在復蘇狀態,價格向上的趨勢明確,移民因素也不同程度地吸引著全球投資者。但馬拉似乎不具備這些優勢,整個東南亞市場受全球經濟週期影響較大,市場波動及匯率變化,對強國開發商的抗風險能力提出了更高要求。 針對目前進入馬來西亞最大的五個強國開發商,它們在馬拉的投資額與總資產的占比,形成投資沽空風險榜。房企在當地投資佔比越高,說明企業對該地的收入期待越高,也就越不容有失。資料顯示,富力地產以7.4%的占比排名第一,風險最高;緊隨其後的就是碧桂園,占比為6.4%;綠地集團以5.8%排名第三;新華聯不動產和雅居樂排在第四、第五位,占比分別為2.4%、0.33%。 除了已經開始銷售的碧桂園,其餘四家房企均是近幾個月才開始進入馬來西亞市場,其中富力、雅居樂和新華聯均是首次海外置地。他們天真的以為,只為新加Bore三份之一的房價,會吸引到坡佬過來置業。 馬來西亞的房地產投資政策在今年也有所變動。為了防止近年來在馬拉流行的團購房地產投資或炒房,總理納吉布宣佈,買樓三年內出售的,盈利所得應徵稅額從以前的15%提高到30%。購房5年出售的,也要征繳15%的盈利稅。除此以外,為了防止外資進入馬拉炒樓,2014年財政預算案規定外國人只能購置100萬令吉(約193萬人仔)以上的房產,比之前規定的最低金額翻了double,預計後續的政策只會更加嚴厲。 看起來,蝗蟲發展商想不斷複製國內開發的神話。但實際上,它的這種開發模式有其固有問題,就是只能賣一次。要保持一次性高去貨率,碧桂園必須不斷地開拓新的城市,尤其是幾乎沒有知名開發商進入、競爭不太激烈但消費潛力尚可的城市。但這樣的馬拉城市,能否滿足的增長需求很值得懷疑。當然,也有其他的選擇,就是減價。但這樣做,必將極大地損害原本已在下滑的利潤率。消失的飛機會給開發商們帶來什麼?或許是消失的銷售額。 這所謂的「深圳-香港」模式,在此根本唔會Work,這裡其實風水不錯,用來搞陰宅、土葬墓地或者骨灰龕場都應該不錯,反正遲早變成鬼城。 這裡,英文叫 Danga Bay,你自己讀一次。「釘嫁,悲」。

Uchi Technologies Berhad: A high dividend yield investing strategy

Uchi Technologies Berhad: A high dividend yield investing strategy

“The secret to successful investing is to figure out the value of something and then-pay a lot less”

Joel Greenblatt

Uchi paid a dividend of 10 sen last year, its lowest since more than 10 years ago, with the exception of year 2009 when the whole world was affected by the US sublime crisis. Even that year, a 6 sen dividend was paid out. At the price of RM1.33, the dividend yield is 7.3%, easily doubled what you get from fixed deposit. Uchitech seems to fit in to the high dividend investment strategy. The pertinent question is “Will this high dividend payment continue?”

Share price movement

Uchi’s share price was about RM1.20 fourteen years ago. It rose sharply up to about RM3.30 in mid 2007 before the US sublime crisis took its toll. Its share price retreated to about RM1.00 after the crisis. Since then it has been traded between the narrow ranges of RM1.00 to RM1.50 and closed at RM1.33 on 17th October 2014.

The figure below shows the total return of Uchi compared to that of KLCI for the last 5 year.

In the last 5 years, Uchi returned only about 10%, way under-preformed the total return of 50% of the KLCI. For a long term horizon, the strategy in investing in a high dividend stock like Uchi doesn’t seem to provide excess return as envisaged (so do many high dividend paying stocks). But why do I still think it is good to invest in Uchi since its share price has dropped so substantially from its peak of RM3.30 seven years ago to RM1.33?

That is precisely my investment thesis; a great company with a beaten down price, and probable poise for a turnaround story.

Business background

Uchitech via its fully owned subsidiary company, Uchi Electronic (M) Sdn Bhd, involves in original design manufacturing and assembly of electrical components onto printed circuit boards (PCB) and trading of complete electronic module, such as that of coffee machine, and saturated paper for PCB lamination.

Another fully owned subsidiary company, Uchi Optoelectronic (M) Sdn. Bhd is involved in design, research, development and manufacturing of touch screen advance display, high precision light measurement (optoelectronic) equipments, mixed signal control system for centrifuge/laboratory equipments, mixed signal microprocessor based application and system integration products.

The Electronic Control Modules segment, particularly the Art-of-Living products (i.e. high-end consumer electrical appliances), was the highest contributor to the Group’s income at approximately 75%. Meanwhile, Biotechnology products (i.e. laboratory and industrial equipment) which contribution has been negligible in the past, have started increasing its contribution to 24% in the last financial year and set to increase further to 50% in the future. 93% of the total revenue is derived from exports to Europe.

Uchi’s past financial performance

Table 1 below shows the performance of Uchi for the last 9 years.

Table 1: Revenue and profit of Uchitech

| Year |

2013

|

2012

|

2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

2005

|

| Revenue in million |

94.0

|

92.3

|

103.3

|

100.9

|

83.1

|

122.9

|

156.9

|

153.2

|

131.9

|

| Net profit million |

39.1

|

44.8

|

48.9

|

52.6

|

27.0

|

58.7

|

78.2

|

83.9

|

73.6

|

| EPS, sen |

10.3

|

11.9

|

13.0

|

14.0

|

7.2

|

15.7

|

20.9

|

22.4

|

19.8

|

| Dividend , sen |

10.0

|

12.0

|

12.0

|

12.0

|

6.0

|

12.0

|

20.0

|

27.0

|

20.0

|

Uchi’s revenue and net income dropped drastically from its peaks of 156.9m and 78.2m in 2007 to 83.1m and 27m in 2009 respectively due to the US sublime financial crisis. It attempted and succeeded to recover somewhat in 2010 but the recovery was stunted due to the slow recovery of the European economy. However, Uchi’s business remains highly profitable with positive earnings and good cash flow every year, including during the financial crisis. This shows the durability of its business model.

However I must say many do not like this type of performance, especially those who don't see the so called profit growth in the last few years. It is understandable. We are talking about potential in the future though,

The secret weapon

Uchi has been paying more than 90% of its earnings as dividend each year. Its balance sheet remains healthy with more than 100m cash in bank and zero debt all these years. Cash has depleted a little the last 3 years, but it is mainly because it spent a lot of money in capital expenses improving its edge of its core business within its circle of competence, 54m in all the last three years. Where did the money come from?

Yes, the secrets lie in its margins. Uchi’s gross margin has been consistently in the high 60% every year for at least the last 10 years. That itself demonstrate the high quality o fits business.

“In business, I look for economic castles protected by unbreachable ‘moats’.”Warren Buffet (?)

Company which earns a gross margin of above 40% consistently must have an economic moat. Uchi’s net profit margin has also been consistently way above 40%.

The high margin provide it with another secret, the high return on capital. Is it a secret, I thought I have been talking about the importance of high return on capital when we want to invest in a company? Its return on equity (ROE) was 45% in 2007 and dropped to its lowest of 21% last year, not because of the competition driving down its margin, but lower revenue due to the economic crisis in its main market in Europe. Nevertheless, the 21% ROE without any debt is still way above its cost of equity. If the European economy recovers, Uchi would be able to recover to its former glory. Yes, Uchi just need to have more business. So what is the chance that Uchi will recover and is able to continue to pay high dividend?

How does the market value Uchi?

At the close of RM1.33, and a trailing twelve month EPS of 11.5 sen as at 30th June 2014, Uchi is trading at a PE ratio of 11.5, and an enterprise value of 10 times its earnings before interest and tax. These valuations are undemanding considering its highly efficient operations business, stable earnings and cash flows, a healthy balance sheet and high dividend yield.

What the future entails for Uchi?

“Mario Draghi, president of the European Central Bank, has finally announced that the bank plans to engage in a form of quantitative easing” Forbes Magazine

Is Uchi ready for a probability of the recovery of the European economy? Below is an abstract from its 2013 annual report.

“In 2013, we continued our practice of investing substantially in R&D, further cementing our technological leadership position in the marketplace. Our successful bid for pioneer status will see our product mix expand to include touch screen advanced displays, high precision light measurement (optoelectronic) equipment and mix signal control systems for centrifuge/laboratory equipment. According to the incentive scheme, 100% of the statutory income derived from the design & development and manufacture of these products will be exempted from income tax for a period of five years commencing from the day of production.

However, arguably the most significant development, particularly in terms of environmental impact, comes from the Group’s contribution in the design and manufacture of energy-saving modules for household and office equipment which comply with European eco-design requirements… in accordance with a new directive that will take effect from January 1, 2015.

The Group continued to invest heavily in our R&D endeavours in 2013; it therefore gives us great pleasure to announce that we have expanded our R&D product lines that are scheduled to be launched in 2014/2015. In embracing green technology, aside from the new energy-saving compliant projects that will be launched under the Art- of-Living product line, we are also developing inverter technology and its extended application to further improve the energy efficiency and wake-up time of products.

Among others, our formidable R&D team is well equipped with the technology and know-how to offer practical and innovative solutions in the shortest timeframe.”

A technology company consistently spending money for research and development from its internally generated fund and yielding positive results is what is needed to be successful. If Phillip Fisher is still alive, Uchi would have got him drooling.

Second quarter report ended 30th June 2014

Uchi reported its second quarterly report for the financial year 2014 on 19th August 2014. Its revenue still remains subdue but net profit for the two quarters has improved by about 20% to RM20.6m. One interesting thing is its capital expenses has reduced to just 204,000. So with the low capital expenses required for it near future, it would have abundant free cash flow which will continue to sustain its high dividend payout policy.

Uchi also reported a very important development that the application for the pioneer status for their new products namely touch Screen Advance Display, High Precision Light Measurement Equipment and Mix Signal Control System for Centrifuge/laboratory Equipment has been approved by MIDA. The tax saving will enhance the profitability and free cash flow of the company, and hence its divided.

Is Uchi going to reap its fruits in the near future? The future is unknowable and unpredictable. I can only base on the information I can gather and provide a novice opinion.

Conclusion

Uchi has demonstrated that it is a great company with high quality and durable business with an economic moat with its consistent high margins and high return on capital. There also seems to be a good future growth story to tell with its attaining the investment pioneer status from MIDA, and its success in Research and Development meeting stringent client and regulatory requirements, placing it ahead of its competitors. Thanks to the good capital allocation of the management. The most recent quarterly report appears to prove the plausibility of the turnaround story. Most of all, it is selling at a beaten down price and hence good value. In my opinion, investors looking for high dividend stocks may add some Uchi stocks into their portfolio.

Labels:

kcchongnz

Subscribe to:

Posts (Atom)