Air Asia plunged to around RM0.80 range during its worst period last year, with perfect storm of Airplane crashing in Indonesia, Indon air control asking for Capital topup, and also the unexpected audit report from HK.

But, crude oil plunge further to current USD28 is a BIG positive to me.

I especially like felicity articles on Asia's budget flight and the prospects. I expected it to be one of the booming sector next 10 years and Air Asia stand a good position to become largest here.

My TP set was RM2 level, then longer term around RM3.50-4.00 if expansion in India, Japan, China, HK were to be successful.

WEAKNESS-the only weakness I think will be the many unexpected events such as crash, sudden spike in crude oil fuel price, and also their HIGH debts denominated in USD, thought they are longterm bonds. (Good thing they had launch USD1Bil funding).

Read research as below:

Aviation - Year 2016 – Recovery in Air Travel

Highlights

- We expect a gradual demand recovery for air travel in 2016 benefitting MAHB and AirAsia:- 1) Foreigner: Government is stepping up efforts in promoting Malaysia tourists destinations with a huge allocated budget of RM1.2bn for 2016 (vs. RM316m in 2015). Malaysia targets for 30.5m tourist arrivals (vs. 27.4m in 2014). 2) Malaysian: Gradually adjusting to the increasing cost of living and RM depreciation since 2015, increasing number of Malaysian will resume their travelling passion with adjusted budget in 2016.

- In 2016, better structured capacity addition is expected to match the gradual recovery in ai r travel demand. Post capacity rationalization exercise in 2015, MAS will be more focused in expanding its domestic and regional networks, integrating with long-hauls (code-sharing), while AirAsia is also working towards equitable supply-demand growth.

- With the drastic capacity cut in the system (by MAS) in 2015 and reasonable planned supply-demand structure in 2016, we expect continued yields improvement in 2016, benefitting airlines (i.e. – AirAsia, AirAsia X and MAS).

- Jet fuel price has slumped further in 2015 to US$45/bbl and expected to stay low in 2016. The low jet fuel price will improve ai rlines profitability. AirAsia is expected to be the major beneficiary (jet fuel contributed 40-60% to airlines cost structure) of low oil price environment. AirAsia only hedged 41% of 2016 jet fuel requirement at US$63/bbl.

- The depreciation of RM impact:- 1) MAHB: Positive impact from the higher translated earnings contribution of wholly owned ISGA in EU€. 2) AirAsia: Negative impact from higher translated cost structure (jet fuel, maintenance and debts) denominated in US$ (+18% YTD). However, the negative impact only partially offset the benefits from the slump in jet fuel costs (-35% YTD).

Risks

- World crisis (i.e. war, tourism and epidemic outbreak), delay in KLIA2 completion, high jet fuel price and the development of high speed train between Singapore and Pulau Pinang.

Forecasts

- Unchanged.

Rating

- OVERWEIGHT

- Low Jet fuel price.

- Liberalization of ASEAN open sky policy.

- Increased government budget to RM1.2bn for tourism.

- Ringgit depreciated against US$.

- Negatives consumer sentiments – Air Incidents and GST.

Valuation

- Maintained BUY on MAHB with unchanged target price of RM6.30 based on DCFE.

- Maintained BUY on AirAsia with unchanged target price of RM2.00 based on SOP.

Also, felicity studies on Budget Airline was master piece.

I am wary of the fear in investing into an airline given the past experiences of many collapses - and Malaysia Airlines has been our closest example. Thai Airways did not fare well either. The list goes on and on. But those are the traditional airlines and their possible collapse could be due to the proliferation of low costs model. Airasia's drop however warrant me to look deeper into the company as I feel that it is managed by people who are capable.

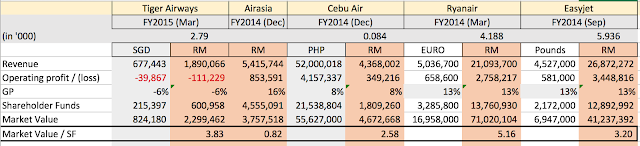

Let's look at comparison of Airasia's successful peers (except for Tiger) than look at the non-performing ones. I have taken some examples of Ryanair, Easyjet, Cebu Air (Airasia's top furious competitor in Philippines) and Tiger Airways. Why did I chose those?

Ryanair - model low costs airline operating only in Europe

Easyjet - second to Ryanair and hugely successful as well

Cebu Air - as mentioned, Airasia's top competitor in Philippines. It is dominant there and Airasia is having a tough competitor. But it is predominantly a Philippines airline.

Tiger - well, nearest financially available competitor to Airasia. Not very successful and it needed injection of capital last year.

The significant names that are not here - Southwest (largest low costs in the world and operating only in US) and Lion Air (not listed). I did not pick up Southwest because over the last year, non-US airlines have suffered from the appreciation of US Dollar but benefited from the huge drop in oil price. US Dollar of course appreciated against many currencies and Malaysian Ringgit suffered the most. However, if one is to believe that USD could not appreciate much further, this forex losses will stop. No single currency will appreciate the way USD appreciated in the last few months and continue to appreciate. Think of what the consequences would be to US economy if that happens.

Anyway on the numbers, I have picked up revenue operating gain / loss, GP and shareholders funds. Why I did not use Net Profit is due to the forex loss that some of the companies experienced including Airasia which I do not think will be a long term thing. Fundamentally it is how well the company manages the gross margin as well as the fuel hedges.

The accounting policy for foreign exchange for Airasia is as below.

Comparison

As below are the important numbers for the list of companies.

Airasia's of course is the Malaysian operation only where it can consolidate the numbers. Others are based on equity accounting.

While one can understand that Airasia's balance sheet is not that strong as compared to its stronger peers like RyanAir and Easyjet, I do not think that it is cashflow starved. One should note that Airasia's business model is to collect cash upfront and pay later. There is a period where it is benefiting from customer financing and that business model is great especially if applied to one's advantage. Airasia, to some extent have managed to use that to its advantage.

And based on its market value to its book value, would it be a reason to buy? Personally, I would say yes, especially for an airline which is still growing. There should be continuous competition but gone are the days where "everyone wants to own a low costs airline" as the barriers of entry is getting much much tougher.

Remember, the stock market in the short run is a voting machine, but in the long term is a weighing machine. What's substance is more important. Think of Airasia's substance.

No comments:

Post a Comment