In lay man term, the retail business is the petrol station that we see and possibly pump petrol. In order to get the oil to the station, they need to refine it first (from the crude oil). So, PETRONM is also involved in refining the crude oil to petrol and other products. If you ever wonder how many stations does PETRONM has, it is 550 from the website.

To fully understand what PETRONM does you can visit their website here

http://www.petron.com.my/web/site/slider/9

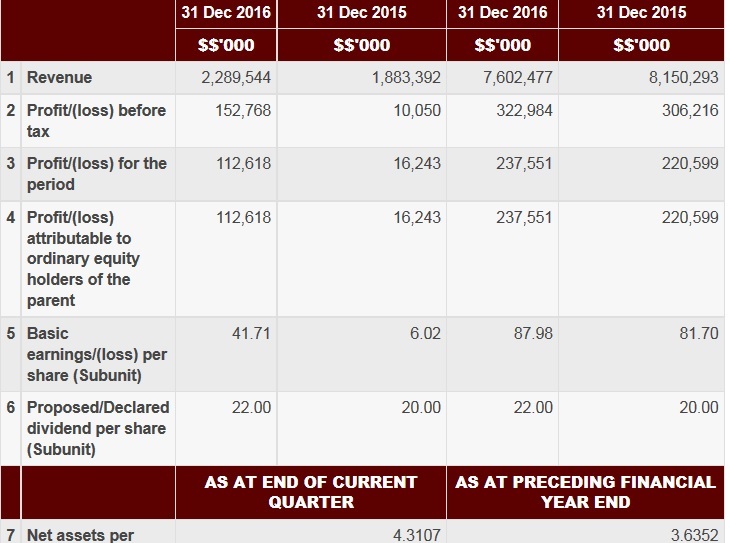

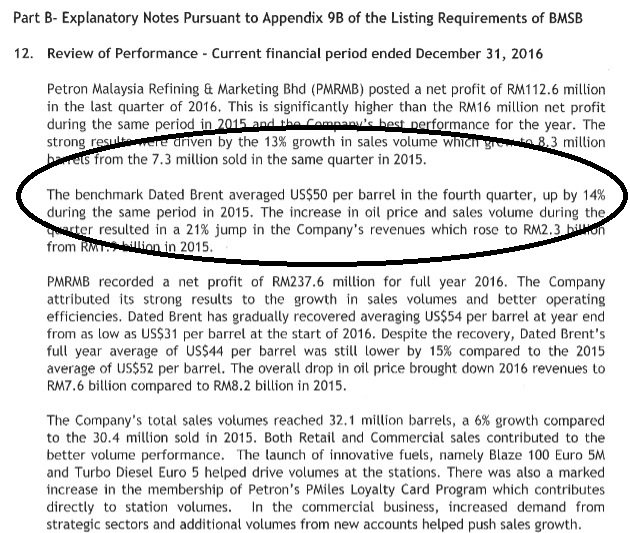

2. Stellar earnings growth in 4QFY16 (+593% to RM112.62m). Accordingly, EPS also jump 593% to 4171sen. Reason for the earnings surge can be seen below. It is mainly due to 13% increase in sales volume (which means this is operation improvement and is sustainable).

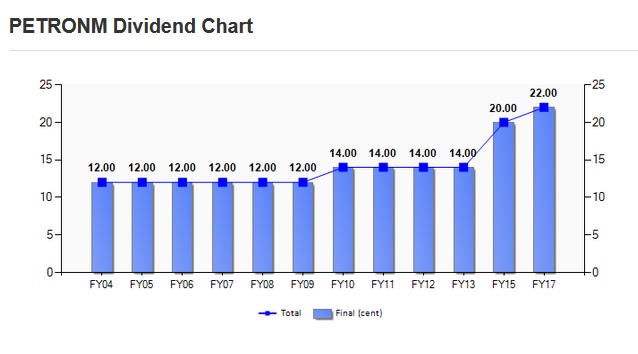

3. Consistent paid dividend (10 out of 11 years) in the past. FY16 dividend has increased by 10% to 22 sen (against 20 sen in FY16). The Company has consistently paid dividend in the past with only one miss in FY14 (but that one is due to loss in that financial year under previous management).

4. SUPER CATALYST = 1QFY17 earnings to triple??? Sometimes, you need to monitor global news as it is increasingly hard to make ALPHA GAIN from the market in Malaysia. Just three days ago, PETRON CORPORATION (parent company of PETRON MALAYSIA made an announcement of its 1Q profit which doubled. BUT the most important thing is it mentioned that

Income from Malaysia operation surged 335% to Peso 1.5 billion (about RM130m). AND Malaysia investors may not fully realize this because it is not annouced yet in the BURSA!!!

You can read the full Media Release from Singapore Exchange here

http://infopub.sgx.com/FileOpen/05%2008%2017%20-%20Media%20Release%20-%20Petron%20Posts%20Record%20Quarter%20Hits%20P5.6%20Billion%20in%20Net%20Income.ashx?App=Announcement&FileID=452503

5. Long term value is between RM12 to RM15 per share. There is more than 50% upside that I am looking at. I think that the Company is worth between 8x to 10x PE. The 8x PE is if you take oil and gas Company PE. While the 10x PE is the minimum for consumer sector PE. I think PETRONM is a mixture of O&G and CONSUMER because its petrol station business is basically similar to 7 ELEVEN. For FY17, the 1Q net profit is assumed at RM130m and I multiply this by 3 to get the full year earnings. I purposely ignore one quarter for conservativeness purpose in my calculation (that's why not multiplying by 4).

That gives me FY17 earnings of around RM390m (or RM1.45 of EPS).

8x PE * RM1.45 FY17 EPS = RM11.60 (round up to RM12)

10x PE * RM1.45 FY17 EPS = RM14.50 (round up to RM15)

For record keeping purpose, I am using last Tuesday closing price of RM7.97

No comments:

Post a Comment