- Cash Conversion Cycle (CCC)

- CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

- It measure of management effectiveness on cash management. How efficiently the business turn cash over. The lower the better.

- CCC is a relative number. It need to compare with historical average and competitor's figure to determine whether it’s good or not.

- CCC with decreasing trend is peferable.

- Need to be cautious with bing increase - possible cash shortage and inventory issues.

- Cash Return on Invested Capital (CROIC)

- CROIC = FCF / Invested Capital

- Invested Capital = Shareholders Equity + Interest Bearing Debt + Short Term Debt + Long Term Debt

- The numerator can interchange with owner earnings - depending on the company and situation.

- CROIC is a lumpy figure and it is not going to be flat line. We need to look for some levels of consistency.

- CROIC > 13% consistently is a sign of moat - mean FCF is +ve and the business is a strong performer in the industry.

- EV/EBIT

- EV/EBIT = Enterprise Value / Earning before Interest and Tax

- Buffett’s rule of thumb is to pay 10x pretax when acquiring businesses.

- FCF to Sales

- FCF to Sales = FCF / Sales

- What percentage of sales is converted directly to FCF. - The higher the better

- Any company hash FCF to Sales > 10% is a FCF generating machine.

- FCF to Short Term Debt

- Whether the company can cover it’s short term debt with FCF. Not by borrowing or diluting, but with internally generated funds.

- < 1, the company doesn't generate enough FCF to cover its debt. If the ratio consistently < 1, there is a high change of trouble.

- > 1, the debt can be covered without borrow more.

- Inventory Turnover

- Inventory Turnover = COGS / Average Inventory

- Measure how quickly company sell it inventory

- The goal is to quickly turn inventory into cash, then reinvest the cash back into inventory, and then turn it to cash again for even more profits.

- Compare inventory turn over with similiar companies.

- High inventory turnover can be achieved via

- Tight inventory management (excellent)

- Reducing price to quicky sell (bad)

- Magic Formula Yield

- Magic Formula Yield = EBIT/EV

- It can be used to compare against earnings of another stock, sector or the whole market and even bond yields.

- A relative valuation to use it with reference.

- Look for EY >= 10%

- Piotroski Score

- It is a quality score that leads to an easier valuation.

- The first four criteria of the Piotroski Score count towards profitability.

- Points 5-7 of the Piotroski Score, looks at the health of the balance sheet in terms of debt and the number of shares outstanding.

- The last two factors of the Piotroski Score looks at operating efficiency.

- Positive net income compared to last year

- Positive operating cash flow in the current year

- Higher return on assets (ROA) in the current period compared to the ROA in the previous year

- Cash flow from operations greater than Net Income

- Lower ratio of long term debt to in the current period compared value in the previous year

- Higher current ratio this year compared to the previous year

- No new shares were issued in the last year

- A higher gross margin compared to the previous year

- A higher asset turnover ratio compared to the previous year

- How to use?

- Look for trends. Increasing? or Decreasing?

- Price to Intrinsic Value

- This one is tricky. How to get intrinsic value?

- Intrinsic value can be caculated via DCF, Graham Net Net, Graham Growth Value, Katsenelson's Absolute P/E, EV/EBIT, etc...

- The idea behind using a price to intrinsic value ratio is to invest in the most undervalued stock. If you have 10 stocks - how do you know which one to buy? Go for the one with lowest ratio

- DuPont model for ROE

- 3 step formula or 5 step formula

- ROE is a way to measure the effectiveness of management. Now you can see in which area management is exceeding or lacking.

- To find which element to blame if ROE not perform well.

山下圣人投资理财日记

投资理财日记

Wednesday, August 15, 2018

Top 10 stock valuation ratios

http://intelligentinvestor8.blogspot.com/2014/05/jae-juns-top-10-stock-valuation-ratios.html

Labels:

自我增值

Altman Z score case studies

What You Will Learn

I’m a boring guy so when I try to come up with ideas, I prefer to look at things that are proven.

I’ll let Mark Zuckerberg or Elon Musk change the world.

My tendency is to simply mash two good or OK ideas that work.

Since 2014, it’s been the Altman Z screener that I track and value investing.

The Altman Z formula is already proven and papers and tests prove the effectiveness if used correctly.

Same with value investing.

Value investing works and it’s been proven. I’m not saying that value investing works all the time. There are ups and downs.

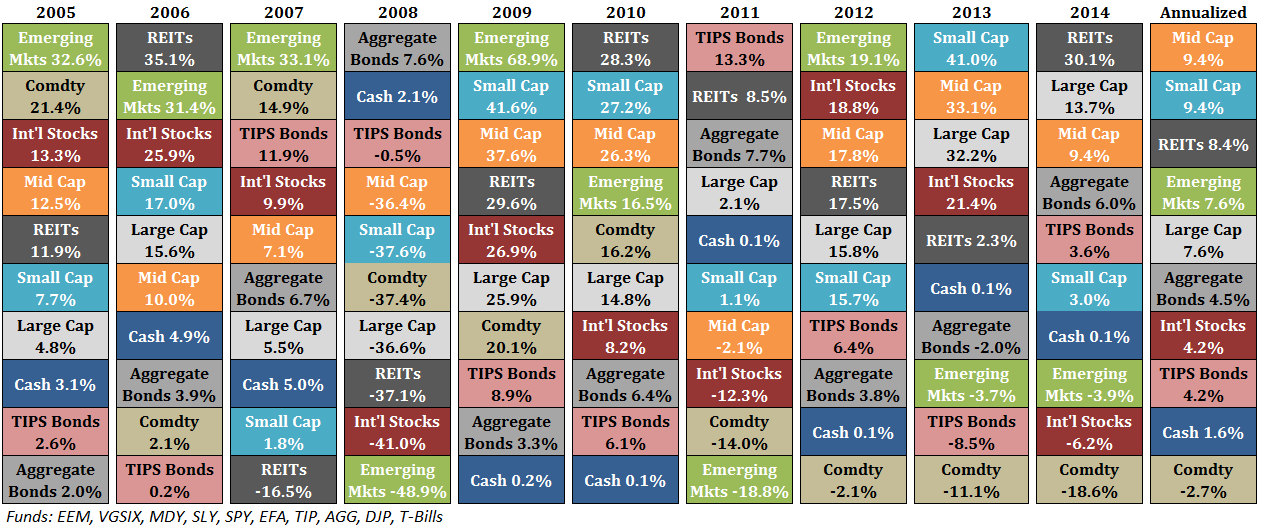

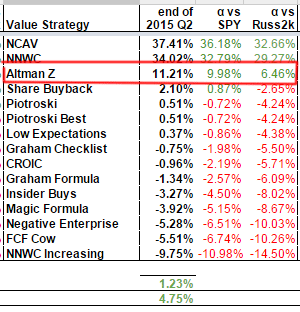

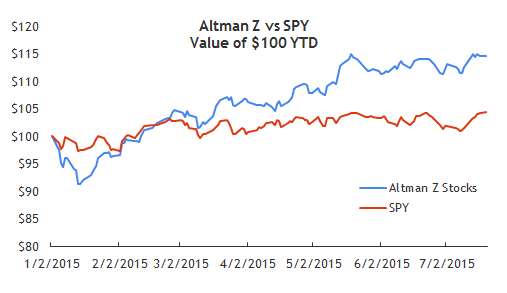

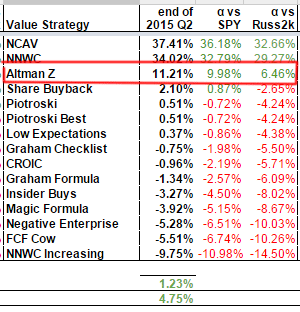

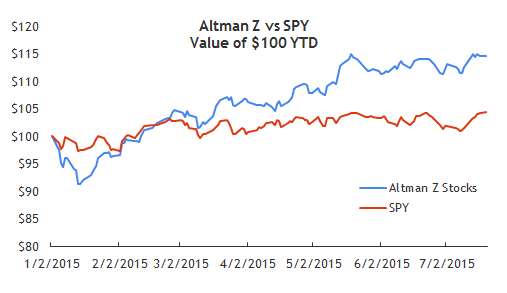

See this chart below to get a real grasp of how different asset classes performed.

What does this show?

There’s more than one way to build wealth or do well in the markets.

So when you combine two good ideas, they can be great.

The score predicts whether a company will go bankrupt within 2 years. Back when the test was performed in 1968, the Altman score had an accuracy rate of 72%.

Further tests performed by Altman in 1999 and 2000 showed the accuracy to be in the 80-90% range.

It’s widely adopted by auditors but less so by investors.

So in a way, you’ve already been using parts of the Altman Z without knowing it.

X1 = Working Capital / Total Assets

The more working capital there is compared to the total assets, the better the liquidity situation.

X2 = Retained Earnings / Total Assets

The lower the ratio, the company is funding assets by borrowing instead of through retained earnings.

X3 = EBITDA / Total Assets

EBITDA / Total Assets is a variation of ROA. Instead of net income, EBIT is used for the numerator.

This ratio looks at the company’s ability to generate profits from its assets before deducting interest and taxes.

X4 = Market Value of Equity / Total Liabilities

This ratio is supposed to show you how much of the company’s market value could decline before liabilities exceed assets.

If the stock price is high, then this ratio also goes up.

X5 = Net Sales / Total Assets

Simply asset turnover.

The more money you can generate from assets, the better.

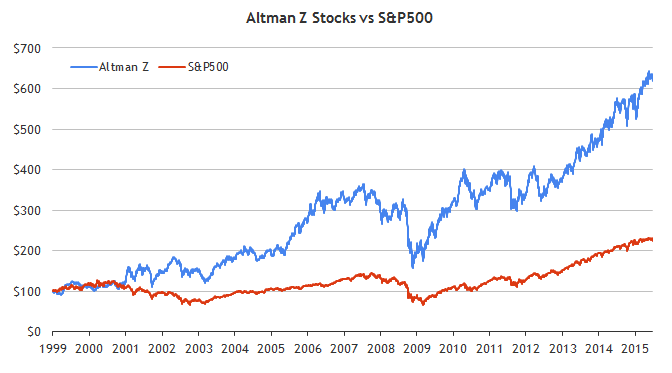

And here’s another reason why you should take second notice based on the 2015 Q2 results of the Altman Z screen

Earlier, I noted down the list of Altman Z stocks outperforming the market by just under 10%.

When I re-ran the results to today’s date, the performance is 14.6% despite the market volatility compared to the S&P’s total return of 4%.

So how do you use the Altman Z score to your advantage?

The common method is to use the Z score to identify potential issues with stocks.

The better way is to break down and look at each component. That way, you can choose financially sound stocks.

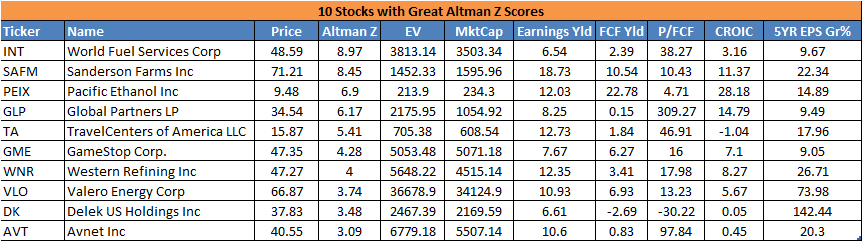

The 10 stocks are:

Also 5 of the 10 stocks are also energy related. Not my favorite sector but when the entire sector is being trampled on, that’s the best place to start.

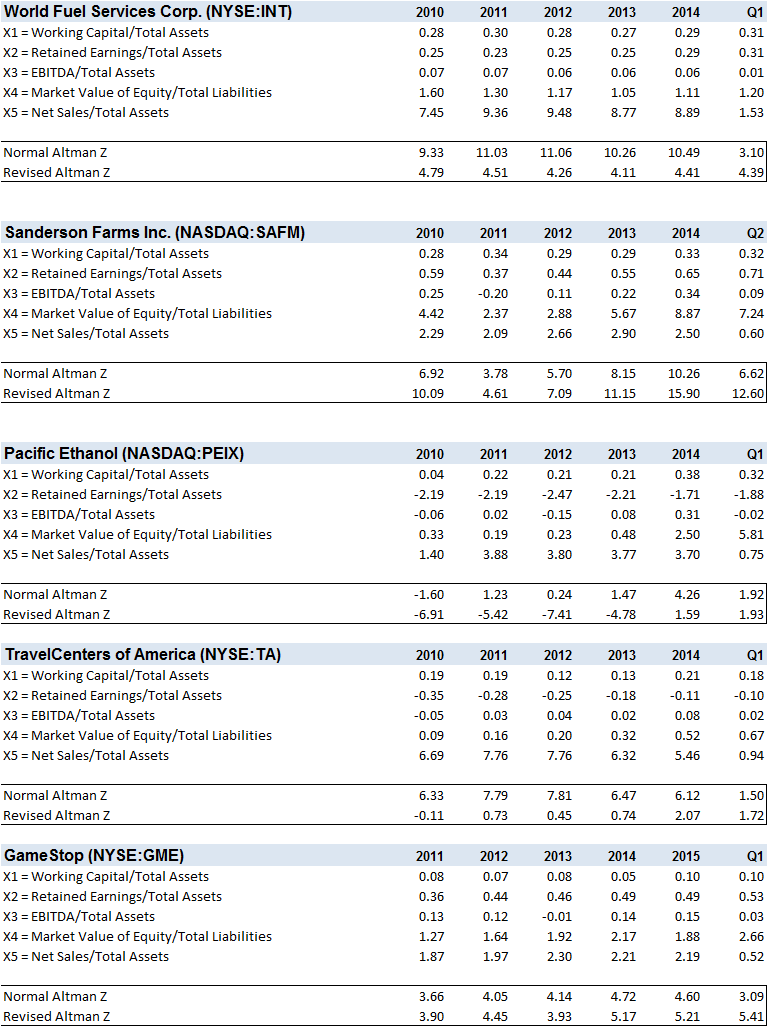

Going back to the pointers about each Altman Z component above, here’s the data for 5 of the stocks (click the image to enlarge) or download this spreadsheet with the data to see it better..

I’ve used the Old School Value analyzer here to pull in all this data automatically and cleaned up the formatting to make it easier to analyze.

But you can download the free version of the Altman Z calculator via email as part of the mini valuation course if you subscribe to this blog.

X1 = Working Capital / Total Assets

I see that World Fuel Services and Sanderson Farms are the most liquid.

X2 = Retained Earnings / Total Assets

Pacific Ethanol is the worst of the bunch needing funding by borrowing. Without digging in, I can tell it has a bad balance sheet.

X3 = EBITDA / Total Assets

Sanderson Farms has the highest ratio which means that of the 5 stocks, it’s able to generate the highest profit from its assets.

X4 = Market Value of Equity / Total Liabilities

Sanderson Farms has the highest ratio which means that it’s stock price is very high or it doesn’t have much liabilities compared to its market cap.

X5 = Net Sales / Total Assets

World Fuel Services wins this one with the highest asset turnover ratio, meaning it generates more dollars from its assets.

Instead of comparing stock prices, volume or other useless metrics side by side, try this method out.

The Altman Z score is much more versatile than a single score.

Some people may claim that it’s outdated, but you’ve seen how useful it is.

And with the way it’s been performing, it will be a shame if you ignore it.

Don’t forget to download your spreadsheet.

- How Altman Z stocks work

- An updated performance chart of the Altman Z screener

- 5 stocks reviewed using the components from the Altman Z formula

I’m a boring guy so when I try to come up with ideas, I prefer to look at things that are proven.

I’ll let Mark Zuckerberg or Elon Musk change the world.

My tendency is to simply mash two good or OK ideas that work.

Since 2014, it’s been the Altman Z screener that I track and value investing.

The Altman Z formula is already proven and papers and tests prove the effectiveness if used correctly.

Same with value investing.

Value investing works and it’s been proven. I’m not saying that value investing works all the time. There are ups and downs.

See this chart below to get a real grasp of how different asset classes performed.

What does this show?

There’s more than one way to build wealth or do well in the markets.

So when you combine two good ideas, they can be great.

- French fries and ketchup

- Music and chores

- Electrons and protons

- Sleep and a comfy bed

- You get the point

Quick Recap of Altman Z

The Altman Z score is a bankruptcy check score created by NYU Professor Altman back in 1968.The score predicts whether a company will go bankrupt within 2 years. Back when the test was performed in 1968, the Altman score had an accuracy rate of 72%.

Further tests performed by Altman in 1999 and 2000 showed the accuracy to be in the 80-90% range.

It’s widely adopted by auditors but less so by investors.

The Altman Z Score

First the formula.

Z = 1.2 X1 + 1.4 X2 + 3.3 X3 + 0.6 X4 +1 X5 where

X1 = Working Capital/Total Assets

X2 = Retained Earnings/Total Assets

X3 = EBITDA/Total Assets

X4 = Market Value of Equity/Total Liabilities

X5 = Net Sales/Total Assets

Here are the rules for interpreting the Altman Z score.X1 = Working Capital/Total Assets

X2 = Retained Earnings/Total Assets

X3 = EBITDA/Total Assets

X4 = Market Value of Equity/Total Liabilities

X5 = Net Sales/Total Assets

- When Z is >= 3.0, the firm is most likely safe based on the financial data.

- When Z is 2.7 to 3.0, the company is probably safe from bankruptcy, but this is in the grey area and caution should be taken.

- When Z is 1.8 to 2.7, the company is likely to be bankrupt within 2 years.

- When Z is <= 1.8, the company is highly likely to be bankrupt.

So in a way, you’ve already been using parts of the Altman Z without knowing it.

General Points to Understand About Each Component

These are general pointers. Be sure to read the full discussion to see the pros and cons of each.X1 = Working Capital / Total Assets

The more working capital there is compared to the total assets, the better the liquidity situation.

X2 = Retained Earnings / Total Assets

The lower the ratio, the company is funding assets by borrowing instead of through retained earnings.

X3 = EBITDA / Total Assets

EBITDA / Total Assets is a variation of ROA. Instead of net income, EBIT is used for the numerator.

This ratio looks at the company’s ability to generate profits from its assets before deducting interest and taxes.

X4 = Market Value of Equity / Total Liabilities

This ratio is supposed to show you how much of the company’s market value could decline before liabilities exceed assets.

If the stock price is high, then this ratio also goes up.

X5 = Net Sales / Total Assets

Simply asset turnover.

The more money you can generate from assets, the better.

Now, Why You Should Take Notice

This performance should explain it clearly.And here’s another reason why you should take second notice based on the 2015 Q2 results of the Altman Z screen

Earlier, I noted down the list of Altman Z stocks outperforming the market by just under 10%.

When I re-ran the results to today’s date, the performance is 14.6% despite the market volatility compared to the S&P’s total return of 4%.

So how do you use the Altman Z score to your advantage?

The common method is to use the Z score to identify potential issues with stocks.

The better way is to break down and look at each component. That way, you can choose financially sound stocks.

10 Current Altman Z Stocks to Check Out

Based on the latest Altman Z score, here are 10 stocks that are showing up on my screen with additional value-centric stats I always track.The 10 stocks are:

- World Fuel Services Corp. (NYSE:INT): fuel logistics, transaction management and payment processing company

- Sanderson Farms Inc. (NASDAQ:SAFM): poultry processing company

- Pacific Ethanol (NASDAQ:PEIX): ethanol based company

- Global Partners LP (NYSE:GLP): midstream logistics and marketing company for petroleum

- TravelCenters of America (NYSE:TA): operates and franchises travel centers and gasoline station/convenience store locations.

- GameStop (NYSE:GME): video game retailer

- Western Refining (NYSE:WNR): crude oil refiner

- Valero Energy Corp. (NYSE:VLO): oil refiner

- Delek US Holdings (NYSE:DK): oil refiner

- Avnet (NYSE:AVT): distributes electronic components, semiconductors, and IT solutions

Also 5 of the 10 stocks are also energy related. Not my favorite sector but when the entire sector is being trampled on, that’s the best place to start.

Going back to the pointers about each Altman Z component above, here’s the data for 5 of the stocks (click the image to enlarge) or download this spreadsheet with the data to see it better..

I’ve used the Old School Value analyzer here to pull in all this data automatically and cleaned up the formatting to make it easier to analyze.

But you can download the free version of the Altman Z calculator via email as part of the mini valuation course if you subscribe to this blog.

What Do I See?

From these 5 stocks and based on the generalized explanations, what do I see?X1 = Working Capital / Total Assets

I see that World Fuel Services and Sanderson Farms are the most liquid.

X2 = Retained Earnings / Total Assets

Pacific Ethanol is the worst of the bunch needing funding by borrowing. Without digging in, I can tell it has a bad balance sheet.

X3 = EBITDA / Total Assets

Sanderson Farms has the highest ratio which means that of the 5 stocks, it’s able to generate the highest profit from its assets.

X4 = Market Value of Equity / Total Liabilities

Sanderson Farms has the highest ratio which means that it’s stock price is very high or it doesn’t have much liabilities compared to its market cap.

X5 = Net Sales / Total Assets

World Fuel Services wins this one with the highest asset turnover ratio, meaning it generates more dollars from its assets.

Summary

Although I compared 5 totally different companies, can you see how useful it is when you compare competitors side by side?Instead of comparing stock prices, volume or other useless metrics side by side, try this method out.

The Altman Z score is much more versatile than a single score.

Some people may claim that it’s outdated, but you’ve seen how useful it is.

And with the way it’s been performing, it will be a shame if you ignore it.

Don’t forget to download your spreadsheet.

WSOP: World Series Of Poker

WSOP, the poker game has always been a nice game to watch. It tested ones strategy and psychology. The game is pretty much like Investment field.,and many good money managers, fund hedge managers are good if not great poker cards player.

About WSOP

https://en.m.wikipedia.org/wiki/World_Series_of_Poker_Circuit

About WSOP

https://en.m.wikipedia.org/wiki/World_Series_of_Poker_Circuit

The World Series of Poker Circuit is a series of poker tournaments held annually at a variety of casinos since 2005 as a build-up to the World Series of Poker (WSOP).

All Championship events are competed in no limit Texas hold 'em; preliminary events may be different poker variants.

Starting with the 2011 WSOP Circuit, the WSOP Circuit National Championship was held as a closed event for participants of various circuit events.

In 2015, the WSOP International Circuit was launched, with rounds in Canada, Latin America, the Caribbean, Europe, Asia-Pacific and Africa. The WSOP Circuit National Championship was replaced by the WSOP Global Casino Championship, featuring the winners from both WSOP Circuit and WSOP International Circuit.[1] The International Circuit has expanded to 13 tournaments for the 2017/18 season.

WSOP famous players

http://www.wsop.com/players/WSOP Players

| SORT BY BRACELETS | SORT BY RINGS | SORT BY CASHES | SORT BY EARNINGS |

|  |  |  |

| Phil Hellmuth 15 | Valentin Vornicu 12 | Douglas Carli 192 | Antonio Esfandiari $22.2mm |

Labels:

WSOP

Subscribe to:

Posts (Atom)