kcchongnz Good summary of packaging companies.

What screen did you use. It doesn't seem right. For example Scientex D/E > 50%? So are many others which are excluded with D/E are much lower than 0.5.

Enterprise value computations are not right. Were those from the screen? You may refer to this link.

http://klse.i3investor.com/blogs/kcchongnz/49016.jsp" style="text-decoration: none; color: rgb(0, 102, 170);" target="_blank">http://klse.i3investor.com/blogs/kcchongnz/49016.jsp

What screen did you use. It doesn't seem right. For example Scientex D/E > 50%? So are many others which are excluded with D/E are much lower than 0.5.

Enterprise value computations are not right. Were those from the screen? You may refer to this link.

http://klse.i3investor.com/blogs/kcchongnz/49016.jsp" style="text-decoration: none; color: rgb(0, 102, 170);" target="_blank">http://klse.i3investor.com/blogs/kcchongnz/49016.jsp

17/10/2015 07:51

We value precision in our shared information.

I will use Scientx as the subject of our discussion here. It is pointless to have a theoretical discussion without any practical exercise.

After all, I encourage evidence-based investing approach such as those (i.e. deep value investing, net current asset value) branched out from Benjamin Graham's seminal work.

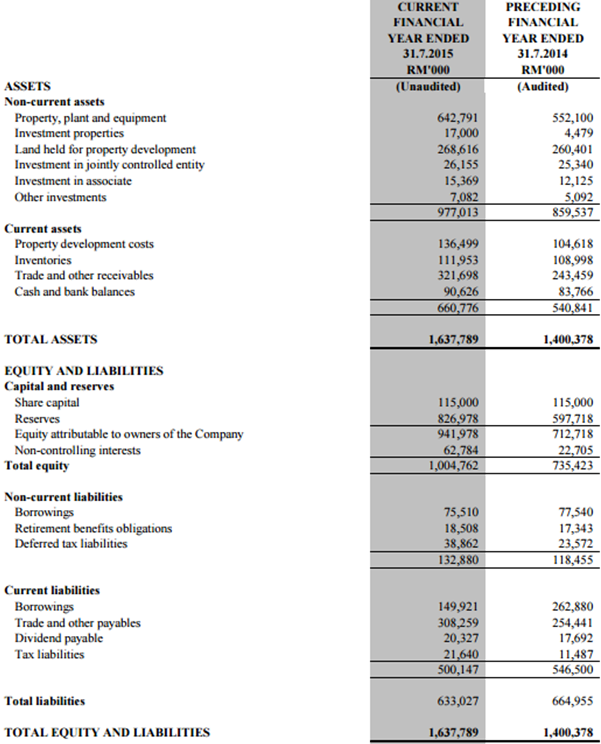

In searching for deep value, I start off with Scientx's latest Annual Balance Sheet (as at 31 July 2015).

Current ratio: Current Assets / Current Liabilities

Current ratio: 660,776 / 500,147 = 1.32

Debt-Equity ratio: Total liabilities / Total equity

Debt-Equity ratio: 633,027 / 1,004,762 = 0.63

Based on Scientx's latest financial position, both its Current (1.32) and D-E (0.63) ratios fail to meet Graham's standard for Current (>2.0) and D-E (<0.50) ratios. Nevertheless, Scientx has shown improvement when compared to its previous financial year.

Enterprise Value as a Key Variable in Valuation

Enterprise Value (EV) is a nominator in measuring Acquirer's Multiple: Enterprise Value / EBIT. A lower Acquirer's Multiple suggests that an investor could acquire the entire company at a cheaper price than other candidates (companies).

EV is a denominator in estimating Earnings Yield: EBIT / Enterprise Value. Earnings Yield tells us the percentage of a company's earnings relative to our entire puchase price of the company in comparison to other candidates (companies).

Their interpretation are essentially similar and their outputs are used to identify stocks trading cheap among their peers.

One needs to get the estimation of EV right or risks to get a skewed output.

Revisiting Enterprise Value (EV)

Your current formula of Enterprise Value is expressed as:

EV = Market Capitalization +Interest Bearing Debts +Preferred Share Capital + Minority Interest - Cash

"Cash" here refers not only to cash and equivalents, but also to short- and long-term investments and bank deposits.Therefore, the calculation of "Cash" should include both liquid and fairly liquid capital.

Theoretically, cash isn't really invested capital in business operation. Invested capital is fixed assets (i.e. property, plant and equipment) and net working capital (Current Assets - Current Liabilities). We should, therefore, substract "Cash" in our calculation of EV.

So, what is wrong with that?

Scientx lists RM7.082 mil in Other Investments (of Non-Current Assets) and RM90.626 mil in Cash (of Current Assets).

One common use of that "Cash" is to meet Current Liabilities.

Scientx lists short-term obligations of RM149.921 mil Borrowings, RM308.259 mil Trade & Other Payables, RM20.327 mil Dividend Payable, and RM21.64 mil Tax Liabilities. In total, the company has to clear its Current Liabilities for RM500.147 mil.

If we subtract Current Liabilities from cash available, Scientx comes up with a massive shortfall of cash (-RM402.439 mil)!

-RM402.439 mil = "Cash" (RM7.082 mil + RM90.626 mil) - Current Liabilities (RM500.147)

This does not make any business sense.

"Cash" is not the only thing used to cover Current Liabilities.

Current Assets, that are expected to be turned into cash within a year, is used to meet Current Liabilities.

In fact, Current Assets need not be fully employed to pay off Current Liabilities.

As indicated by Scientx's Current Ratio (1.32), there is Excess Cash.

Excess Cash is defined as an additional amount of cash beyond what a company normally needs to run its business operation in the short-run (i.e. 1 year).

In Scientx case, a special note must be made here: Current Assets include "Cash".

To get Excess Cash, we need to subtract "Cash" to generate Non-Cash Current Assets first.

Non-Cash Current Assets: (Current Assets - "Cash")

Non-Cash Current Assets= Current Assets RM660.776 mil - "Cash" (RM7.082 mil + RM90.626 mil) = RM563.068 mil

Excess Cash = Shortfall of Cash -RM402.439 mil + Non-Cash Current Assets RM563.068 mil = RM160.629 mil

Scientx has RM160.629 mil in Excess Cash that it does not need to meet its Current Liabilities. The Excess Cash could be conceivably be used for dividends, shares buy back, business acquisitions, etc on top of on-going Free Cash Flow.

From the above, we can therefore express Excess Cash as:

Excess Cash: "Cash" - Current Liabilities + (Current Assets - "Cash")

where "Cash" is the sum of cash and equivalents and short- and long-term investments and bank deposits.

Consequently, our refined formula of Enterprise Value is expressed as:

EV = Market Capitalization +Interest Bearing Debts +Preferred Share Capital + Minority Interest - Excess Cash

Who is using this refined formula of Enterprise Value?

-Joel Greenblatt

-Morningstar

-Tobias Carlisle

-Ernst and Young

-and many others (including ME).

Deep valuation of Scientx

Share price: RM7.68

No. of outstanding shares: 224,615,000 units

Market capitalization: RM1,725.043 mil

Interest bearing debts: LT Borrowings RM75.510 mil + ST Borrowings RM149.921 mil = RM225.431 mil

Minority interest: RM62.784 mil

Excess cash: RM160.629 mil

Enterprise Value: 1,725.043 mil + RM225.431 mil +62.784 mil - RM160.629 mil = RM1,852.629 mil

Annual EBIT: RM224.977 mil

Earnings Yield = EBIT / Enterprise Value

Earnings Yield = RM224.977 mil / RM1,852.629 mil = 0.12 or 12%

Acquirer's Multiple: Enterprise Value / EBIT

Acquirer's Multiple: RM1,852.629 mil / RM224.977 mil = 8.23

Conclusion for Scientx

Its current financial position is fairly weak as it does not meet Graham's Current Ratio and Debt-Equity Ratio standards. I absolutely will not recommend Scientx.

Stongest evidence to that decision is rendered by its Acquirer's Multiple 8.23. It means that, in acquiring the whole company, you are paying 8 times of its annual EBIT (not net profit yet). You need at least 8 years to cover your cost of capital.

In comparison, Cenbond (see my analysis here) is selling cheap, just for Acquirer's Multiple 1.34!

No comments:

Post a Comment