GEORGE TOWN: Electronic gaming machine and equipment maker RGB International Bhd is eyeing new businesses in Europe and South America, as the company seeks to expand its market reach.

RGB derives 95% of its sales from the Asia-Pacific region.

“We want to move away from our traditional markets to broaden the revenue base for the group,” said group managing director Datuk Chuah Kim Seah (pic).

The company, he said had secured orders for 700 units of gaming machines valued at RM80mil for the first half 2016.

About 500 units had been delivered to customers.

“The remaining 200 will be delivered in the third quarter. With the delivery of the 700 units, we are projecting double-digit percentage growth over last year’s net profit,” he told StarBiz.

The sales of gaming machines made up about 70% of the group’s revenue, while the remainder was contributed by the RGB’s gaming concession programme, which included the leasing of machines and equipment.

Chuah said the group was targeting to sell more machines than last year’s 1,300 units, which generated RM145mil in revenue.

For the second half, the group had 400 more gaming machines with an estimated market value RM45mil to deliver before the end of the year.

“The total undelivered units to date is 600, which includes the 200 yet to be delivered units secured in the first half.

“To surpass last year’s goal, we need to secure sales for 300 more units,” he said.

On RGB’s concession business, the leasing of the machines in the Asia region is expected to generate RM7.6mil per month for 2016, compared with RM7mil in 2015.

RGB leases its gaming machines to customers in Indochina, the Philippines, Timor Leste and Nepal.

“The Philippines is one of the largest markets for us,” he said.

Chuah said the group would be leasing machines soon under its concession programme to Kathmandu, which is a new market for the group.

“The machines are ready to be shipped out and should be operational by the fourth quarter,” he said.

RGB reported a 37% increase in net profit to RM5.9mil in the first quarter ended March 31, as revenue improved 45% to RM56mil.

Meanwhile, the group has settled the remaining RM27mil debts owed under the Commercial Papers Medium Term Notes (CPMTN) programme ahead of the scheduled final payment due in 2019.

“The group has more than RM60mil cash in hand, after settling the CPMTN debts,” Chuah said.

This cashpile will come in handy as the group explores opportunities in new markets.

Sunday, July 31, 2016

RGB eyeing new business in Europe, South America

Labels:

RGB

获20亿Dyson合约普遍看好‧星光资源依赖单一大客户

获20亿Dyson合约普遍看好‧星光资源依赖单一大客户

(吉隆坡18日讯)星光资源(SKPRES,7155,主板工业产品组)获英国Dyson颁发电子消费产品制造合约,总值高达20亿令吉,合约期限为期4年,每年价值5亿令吉,主要替代之前取消的合约。

(吉隆坡18日讯)星光资源(SKPRES,7155,主板工业产品组)获英国Dyson颁发电子消费产品制造合约,总值高达20亿令吉,合约期限为期4年,每年价值5亿令吉,主要替代之前取消的合约。

由于大马雇用外劳政策改变,去年5月获Dyson公司颁发每年4亿令吉吸尘机合约将不再继续;另外,每年生产价值6亿令吉的无线吸尘机合约(为期5年)则保持不变。

分析

星光资源虽获新合约,但也失去一些合约,惟新合约的价值让分析员普遍看好,唯隐忧是过于依赖单一大客户。

肯纳格研究相当看好上述合约,星光资源拥有Dyson旗下吹风机(Supersonic)的独家制造商,Dyson未来可能会颁发更多合约予星光资源,因Dyson打算继续进行扩展。

安联星展研究认为过于依赖单一客户是隐忧,星光资源2016财政年,55%的营业额由Dyson贡献,并预期2017财政年比例将走高至72%。若Dyson终止合约,届时星光资源净利将受到影响。有鉴于此,星光资源期望来自非Dyson贡献的营业额可取得成长,并设下8%成长的目标。

安联星展补充,星光资源在柔佛士乃的工厂空间使用率为25%,余下75%为空置地段,相信星光资源将会提升使用率,以攫取更多合约。

净现金公司

尽管星光资源过去不断进行扩展计划,但该公司仍保持净现金地位,安联星展认为,2017至2019财政年,星光资源仍可以保持净现金地位。

达证券认为,星光资源虽然可从上述合约受惠,但外劳冻结,可能会导致盈利受损,因此下调2017至2019财政年的净利预测。

大众研究则表示,一旦所有产品生产线全面使用,星光资源未来净利仍有成长空间,本益比介于10至12倍,加上强劲资产负债表,是该公司值得看好的优势。

Labels:

SKPRES

Holistic View of SKP Resources with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

Background and Core Business

SKP Resources Bhd was listed on Bursa Malaysia in 2000 and is categorised under the Miscellaneous Manufacturing industry. It belongs to the Industrial Product, FBM Small Cap and FBM Emas Indices. SKP Resources Bhd is an integrated plastic manufacturer, with 3 wholly owned subsidiaries: SKP (Syarikat Sin Kwang Plastic Industries Sdn Bhd), GHI (Goodhart Industries Sdn Bhd) and GHL (Goodhart Land Sdn Bhd). They also own 63% of another subsidiary known as GHT (Goodhart Technology Sdn Bhd). They are based in Batu Pahat, Johor.

Essentially, all the subsidiaries work synergistically from design and fabrication of high precision plastic molds to the manufacturing of plastic parts and components, sub-assembly and other secondary processes. Each subsidiary specialises in the manufacturing of distinct products for different clients. These parts are finally used as casings of media players, printers/scanners, video game console peripherals and also TV cabinets.

SKP Resources proudly lists their clients (both direct and indirect) from MNCs such as Apple, Fujitsu, Sharp, Pioneer, Dyson, HP, Flextronics, Microsoft and Sony.

The FY ended on 31st March 2016 and they are in their 1st quarter for FY 2017. The next quarterly results should be due sometime in August 2016. Market capitalisation stands at around RM1.4 billion.

Financial Brief and Ratios (Historical)

SKP Resources had seen stellar growth in their revenue for the past 5 years, with the highest turnover recorded in FY 2016. This translated into a profit of RM 82 million for its shareholders last year, while profit margin increased only slightly from 6.8% to 7.8% y-o-y. This is due to the increase in cost of revenue, reported at a figure of RM 902 million.

Although the PE ratio is not low, it has reduced over the years from the 40s to less than 20 today. ROE is relatively on the low end. No dividends were declared for FY2016. It is worth mentioning that the company had managed to reduce their current liabilities by nearly half from RM 410 million to RM 200 million during FY 2016.

In terms of cash flow, it has recorded its highest operating cash flow in 2015 at around RM 221 million, at the same time using up to RM 149 million for investing activities in the same year. In line with the increase in cost of revenue during FY2016, do take cautionary note that operating cash flow has turned negative to -RM 37 million from RM 221 million just a year ago. Similarly, Free Cash Flow has turned negative to -RM 70 million for FY 2016.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – SKP Resources

Interested to learn more?

- Join our Investment & Market Outlook Conference on 28th Aug 2016. Find out more via: https://www.ivsachart.com/investconference2016.php

- Website: https://www.ivsachart.com/events.php

- Email: sales@ivsachart.com

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Follow & Like us on Facebook: https://www.facebook.com/priceandvolumeinklse/

This article only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

SKP Resources Bhd was listed on Bursa Malaysia in 2000 and is categorised under the Miscellaneous Manufacturing industry. It belongs to the Industrial Product, FBM Small Cap and FBM Emas Indices. SKP Resources Bhd is an integrated plastic manufacturer, with 3 wholly owned subsidiaries: SKP (Syarikat Sin Kwang Plastic Industries Sdn Bhd), GHI (Goodhart Industries Sdn Bhd) and GHL (Goodhart Land Sdn Bhd). They also own 63% of another subsidiary known as GHT (Goodhart Technology Sdn Bhd). They are based in Batu Pahat, Johor.

Essentially, all the subsidiaries work synergistically from design and fabrication of high precision plastic molds to the manufacturing of plastic parts and components, sub-assembly and other secondary processes. Each subsidiary specialises in the manufacturing of distinct products for different clients. These parts are finally used as casings of media players, printers/scanners, video game console peripherals and also TV cabinets.

SKP Resources proudly lists their clients (both direct and indirect) from MNCs such as Apple, Fujitsu, Sharp, Pioneer, Dyson, HP, Flextronics, Microsoft and Sony.

The FY ended on 31st March 2016 and they are in their 1st quarter for FY 2017. The next quarterly results should be due sometime in August 2016. Market capitalisation stands at around RM1.4 billion.

Financial Brief and Ratios (Historical)

SKP Resources (7155.KL)

|

FY 2016

|

| Revenue (RM’000) |

1,051,027

|

| Net Earnings (RM’000) |

82,145

|

| Net Profit Margin (%) |

7.82

|

| EPS (RM) |

0.070

|

| PE Ratio (PER) |

17.52

|

| Dividend Yield (%) |

1.58

|

| ROE (%) |

23.40

|

| Cash Ratio |

0.216

|

| Current Ratio |

1.834

|

| Total Debt to Equity Ratio |

0.158

|

SKP Resources had seen stellar growth in their revenue for the past 5 years, with the highest turnover recorded in FY 2016. This translated into a profit of RM 82 million for its shareholders last year, while profit margin increased only slightly from 6.8% to 7.8% y-o-y. This is due to the increase in cost of revenue, reported at a figure of RM 902 million.

Although the PE ratio is not low, it has reduced over the years from the 40s to less than 20 today. ROE is relatively on the low end. No dividends were declared for FY2016. It is worth mentioning that the company had managed to reduce their current liabilities by nearly half from RM 410 million to RM 200 million during FY 2016.

In terms of cash flow, it has recorded its highest operating cash flow in 2015 at around RM 221 million, at the same time using up to RM 149 million for investing activities in the same year. In line with the increase in cost of revenue during FY2016, do take cautionary note that operating cash flow has turned negative to -RM 37 million from RM 221 million just a year ago. Similarly, Free Cash Flow has turned negative to -RM 70 million for FY 2016.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – SKP Resources

· Above is SKP Resources weekly chart showing price & volume action for the last 6 months

· Prices were ranging sideways with some Signs of Strength (green arrows) seen around pivot lows

· Although the bulls had their chance, there were unsuccessful attempts to break beyond RM 1.40 level

· Instead its’ prices drifted lower after the Sign of Weakness (red arrow) appeared in May 2016 culminating in breaking of support level around RM 1.23 in June 2016

· Strong hands emerged when prices hit around the level RM 1.14 to RM 1.12 and the down move has temporarily ceased

· For a sustainable new uptrend, not only do we need to see prices reacting favorably to the Signs of Strength (green arrow) that have appeared in July 2016 but also bullish attempts to rally and break above the RM 1.40 level

Interested to learn more?

- Join our Investment & Market Outlook Conference on 28th Aug 2016. Find out more via: https://www.ivsachart.com/investconference2016.php

- Website: https://www.ivsachart.com/events.php

- Email: sales@ivsachart.com

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Follow & Like us on Facebook: https://www.facebook.com/priceandvolumeinklse/

This article only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

Labels:

SKPRES

Dear Investor Quarterly report on investment: kcchongnz

Dear Investor,

From the beginning of this year, the US stock market have proven to be exceptionally resilient in the face of market volatility, despite being on many measures the most expensive. The broad S&P500 Index has risen by 6.4% from 2044 points from the beginning of the year to close at all-time high of 2174 at the end of July 2016. The S&P 500 Index has gone above a PE ratio of 20.

Most bourses in the matured markets follow the trend of Wall Street. However, Bursa bucked the trend with the KLCI Index dropped by 2.4% year to date to 1653 at the close on 30th July 2016.

As at 30th July 2016, I have purchased a diversified portfolio of 15 stocks for you as shown in the attached Excel file. Focus Lumber was cut loss and sold off after a drop of 18.5%. I am afraid there is something I do not know as a major shareholder has been selling the stocks relentlessly. Furthermore, if the share price drops further, I am afraid heavy margin calls for some traders will come into play, which can be quite scary. Otherwise, I still think at this price now at RM1.70, the downside is limited, considering its good fundamentals; consistent earnings and cash flows and healthy balance sheet.

The proceeds of the sales were used to purchase KESM and Stock O, which proved to be a very good move as their share prices have moved up by about 20% since purchased.

Your net gain for this quarter is +7.37% against the loss of the broad market of 3.9% during the same period, or for a positive alpha of 11.27%. This includes ex-dated dividend you have received, or to be received for some stocks as shown in the spreadsheet attached.

The good performers are SAM (+27.4%), Thong Guan Holding (+23.3%), Stock H (+22.5%), and Stock O (+21.4%), KESM (+19.2%), Stock G (+14.4%) and Padini (+13.1%). Not too bad relatively for this short-term period of just three months, when the broad market has actually declined by 3.9%.

Note that except for Focus Lumber which incurred substantial loss, the loss of those few underperforming stocks are generally very minimal, all with low single digit losses, whereas the gains are generally outsized as shown above. This fits my investing philosophy below perfectly,

“Take care of the downside, and the upside will take care of itself.”

It is still too early to conclude anything as the return is only for a short-term of just three months’ period as investing is a long-term endeavour. I am sure there are many others out there who have done better, or much better. However, I believe if we follow the “correct” philosophy, “right” methodologies, “well-proven” strategies, and a “well-thought of” process in investing, I believe one should be able to earn reasonable and satisfactory return over a long period of time. And most of all, with lower risks.

Before I stop, I would like to address some issues raised by one of your course mates.

Quote [Hi Kc,

Good day to you.

Good day to you.

Would like to ask you about the current economic climate.

I have been very cautious lately about stocks in general as US S&P index is at an all time high, fueled mainly by cheap money. Therefore I am just buying REITs and also some property developers stocks at the moment.

Am I right in my assessment to say if the US market crash, it will bring the world down with it? Including Bursa, SGX and HKEX? Or would it depend, if we buy the right company, which are not too richly valued now, a crash will not affect these companies much?

Also, would it not better to preserve cash now?

BUT, I do know no one can forecast this and how severe it will crash, but my concern is - would all countries be affected similarly?

Also I am thinking if it is a good idea to be holding ringgit now? On one hand I see it is undervalued, but on the other hand, our economy do not look healthy.

Would you recommend that we keep some other currencies (If so, what currencies? SGD?) or even gold/silver as a way to diversify our wealth?] Unquote

Robert Shiller, in his book “Irrational Exuberance” shows that the average historical PE ratio of S&P is 15.6. At S&P PE ratio above 20 now, the US market is not cheap any more. But is it expensive?

In today’s Business headlines in Yahoo Finance, “Sell everything”, said DoubleLine’s Gundlach, when S&P 500 touched an all-time high of 2177. He advises investors to hold gold instead. We have also constantly heard from one well-known fund manager singing the same tune, over and over again every year, and already for many years.

I personally really have no ability to predict what the US stock market will crash or not, and if but if it does, it will definitely affect the other markets in the world, including Bursa, SGX and HKX. I do not think anyone else can confidently predict that. But if you are really that scared about it, maybe it is advisable for you to preserve cash, but maybe not purely in Ringgit which I will elaborate later. Note when market crashes, Reits and property stocks will also not be exempted from the fall.

What is the use of holding gold or silver when there is no convenient yield from them? You may even have to pay for their storage if it is physical gold or silver. Historically, the real return of gold is insignificantly different from zero.

What are you going to do with the cash when the real return after inflation is negative? With the low interest environment and many countries pumping liquidity into the financial system, where will those cash end up to, into the bonds where yields are so low or even negative, or likely into the equity market where the earnings yield is 5% (inverse of PE of 20)?

I have no concrete answer, nor any prediction to the above as there are many factors affecting the capital markets and investment. Hence although I take heed about all these macro news, I try not to let them rule on my investment decisions.

I will continue to focus on scouting for good companies at cheap prices to invest in, with good investment principles, following the principle that investing in a stock is investing in part of a business. And never forget about risk; the risk of paying too much for a business which may turn out to be wrong in our decision.

I will also never forget about diversification, asset allocation and including geographical diversification, and hence diversification into SGX and HKEX, for example. Remember, diversification is the only free lunch in investing.

There are some clear problems in our beloved country, with some rampant corrupt practices, political risk, currency depreciation risk etc. Hence it pays to diversify into other currencies if you have substantial wealth, and those who have the intention to send their children to study overseas later. Investing in overseas bourses such as SGX and HKEX present a better option as diversification than putting there in cash which produces very low yield.

More importantly, the stock markets in Singapore and Hong Kong are much more attractive valuation wise, with PE ratio of 12+ and 10+ respectively, compared to the 18+ in Bursa. I can find many more companies fitting very well with the Joel Greenblatt Magic Formula, Dr Neoh Soon Kean’s dividend yield, and Graham net net investing strategies which I have been propagating to you in your online course in these countries. Besides, the corporate governance in those countries seem to be better and they are more transparent.

Anyway, the above is just my personal view. You have been taught to be independently thinking.

Please do not hesitate to contact me at the following email address if there if you need any help.

ckc14training@gmail.com

Happy investing. Investing is a long-term endeavour.

KC Chong

Labels:

kcchongnz

Wednesday, July 27, 2016

MQ Research: AirAsia’s air traffic beats estimates

AirAsia reported its operating numbers for the second quarter of 2016, reflecting the performance of its Malaysian, Thai, Indonesian, Indian, and Philippine entities. In terms of air traffic, AirAsia unveiled a better-than-expected performance, beating Macquarie Equities Research’s (MQ Research) estimates by 7.8%, which translated to a better than expected load factor. In its report, MQ Research reiterated an ‘Outperform’ rating on AirAsia, with a 12-month target price of RM3.50.

Event

Impact

Action and recommendation

Event

- AirAsia (AIRA MK) released a good set of 2Q16 operating statistics on late Tuesday.

- In terms of air traffic (RPK), its Malaysian entity, the major contributor to MQ Research’s sum-of-parts target price, is tracking 8% ahead of MQ Research’s estimates and its India entity is tracking marginally above expectations (4%), while its Thai and Indonesia entities are tracking in line with MQ Research’s estimates. However, its Philippine entity is tracking marginally below MQ Research’s estimates due to an unexpected capacity reduction.

Impact

- Load factor improvements across its five entities in Malaysia, Thailand, Indonesia, Philippines and India.

- Malaysia AirAsia improved load factors by 6.7% to 87% and delivered a 10% passenger growth in an industry that had zero growth in 2Q16. Traffic beat MQ Research’s expectations by 7.8% and capacity was in line with MQ Research’s expectations, leading to the positive surprise in load factors

- Thai AirAsia delivered double-digit passenger growth in 2Q16, carrying 18% more passengers in 2Q16. Its three-year compound annual growth rate (CAGR) stands at 20%, a commendable performance, in MQ Research’s view. Capacity and traffic figures for Thai AirAsia were in line with MQ Research’s expectations.

- Indonesia AirAsia, in line with its restructuring plans, carried 2% more passengers. Load factors were 83%, an increase from 73% in 2Q15. Capacity and traffic figures for Indonesia AirAsia were in line with MQ Research’s expectations.

- Philippines AirAsia surprisingly reduced 7% year-on-year (YoY) capacity in 2Q16, thus leading to traffic figures marginally below MQ Research’s expectations. Load factor received a boost, at 91% for 2Q16 vs MQ Research’s expectations of 85%.

Action and recommendation

- Reiterate Outperform with a target price of RM3.50 (+25.8% TSR).

Labels:

AirAsia

Monday, July 25, 2016

在过去十年里,乐高 (LEGO) 都做了什么使得净利润增长 32 倍,每年营收也长时间保持两位数增长?

FROM: https://www.zhihu.com/question/28383329

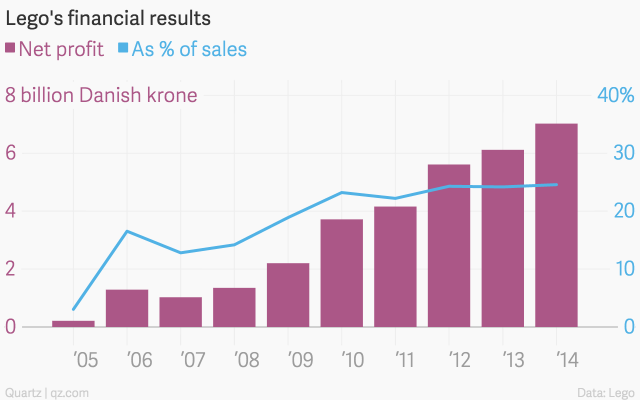

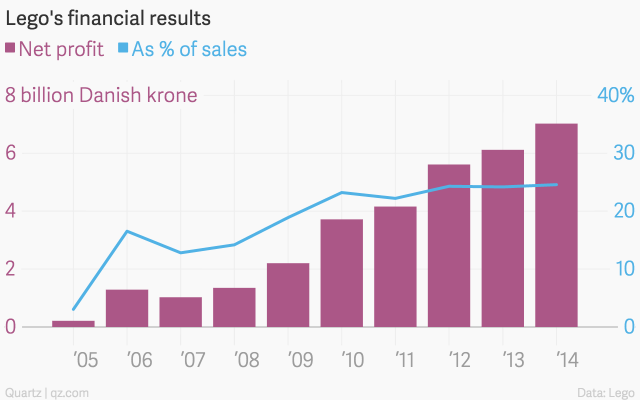

看到 2005 年财报的 net profit 是 2.14 亿丹麦克朗,而 2014 年这个数字是 70 亿克朗。

看到 2005 年财报的 net profit 是 2.14 亿丹麦克朗,而 2014 年这个数字是 70 亿克朗。

现在乐高在玩具市场上也把芭比娃娃和孩之宝甩在了身后1、重整产品线,留下真正赚钱的产业,砍掉头脑发热的产物,恢复创新的正常节奏从产品到周边产业都一样。在70到90年代有过创意井喷期,啥都能上市,丢弃拼砌的传统优势,天马行空,不少产品还蛮奇葩。不信看下图,芭比系列,你信这是乐高么?

婴儿玩具PRIMO、塑料玩具ZNAP、针对于女孩的类似于芭比娃娃的SCALA系列、网络大师机器人套装、防卫者系列、试图取代传统乐高人仔的杰克斯通系列,这些耗费成本且销量不佳的产品后来全部停售。

除了产品以外,乐高鼎盛时期对周边产业的扩展也有点丧失理智,除了乐高主题公园一直运营到现在,其他很多3D乐高数据库、拼砌指令这些周边的东东也都砍掉了,不是说这些项目毫无成就,只是节奏太激进。停止了揠苗助长之后,乐高的颓势已经有所好转。而在之后,乐高扩展周边产业的步子慢了很多也谨慎了很多。

2、削减成本,从制造到人力

在产品方面,在疯狂扩张期,乐高积木有将近1.29万个零件,在发生危机之后减少到7000个。塑料开模是不小的成本,数量少了,但是其实更能发挥想象力。在人力方面,一个比隆工厂就砍掉了1000+号员工。乐高掌权者的变更、管理层换血、股权变化这些就更复杂一些,暂且不谈(其实是因为这个我也不太懂哈哈哈哈)。

3、2013年的乐高大电影

上面也有人提到了乐高大电影,确实牛逼啊,这动画电影不光是拍给熊孩子看的!能把品牌嵌入电影还不惹人讨厌,也就乐高能干得出来,这简直就是个巨大的品牌广告片!段子够逗逼,乐高人仔的渲染非常细腻,关键是结尾确实完美植入了品牌理念。一部电影,转化成了实实在在的巨额销量,攒新粉丝的效果惊人,14年上半年因为电影提振,销量直涨11%。乐高大电影还会有2,就是不知道大陆会不会引进。

上面也有人提到了乐高大电影,确实牛逼啊,这动画电影不光是拍给熊孩子看的!能把品牌嵌入电影还不惹人讨厌,也就乐高能干得出来,这简直就是个巨大的品牌广告片!段子够逗逼,乐高人仔的渲染非常细腻,关键是结尾确实完美植入了品牌理念。一部电影,转化成了实实在在的巨额销量,攒新粉丝的效果惊人,14年上半年因为电影提振,销量直涨11%。乐高大电影还会有2,就是不知道大陆会不会引进。

4、教徒式的忠诚粉丝

这点太重要了,除了苹果之外,还没有哪个品牌能够像乐高那样拥有那么多的忠实粉丝。爸妈玩,带着孩子玩,一代接一代,乐高情况最不好的时候,全球粉丝有过各种自发的支持活动。乐高自己也知道粉丝、粉丝的体验对自己有多重要,一直坚守玩具的品质,这几年开了ideas平台,投票过万的粉丝作品经过评审就可以投产发售,对粉丝是很好的鼓励和振兴。

5、其实还有挺多其他的,NXT机器人神马的,持续主推电影合作产品神马的,断断续续的零零散散的回头想到再补充,大致以上足够大家随便看看~

备注:以上资料很多来自《乐高:创新者的世界》一书和《透过乐高创新兴衰史看文化产业的未来》的论文,简略的提炼了一些主要观点,感兴趣的小伙伴可以看看!

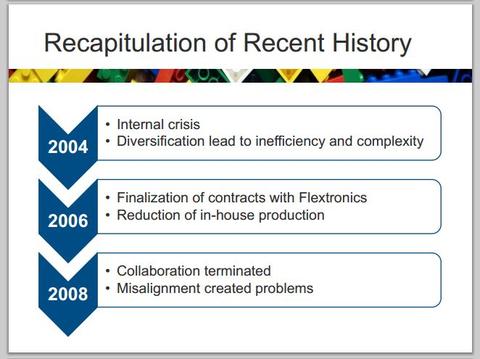

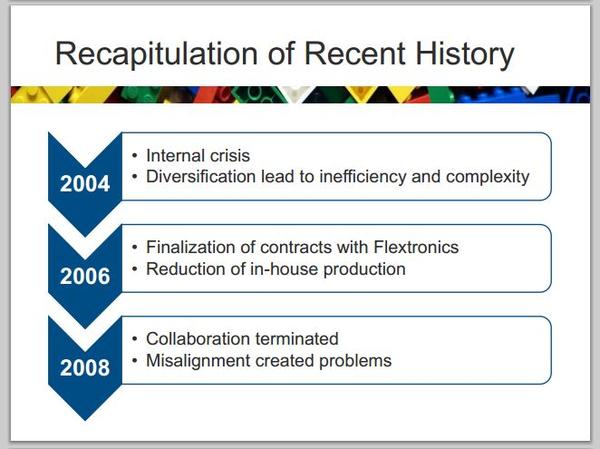

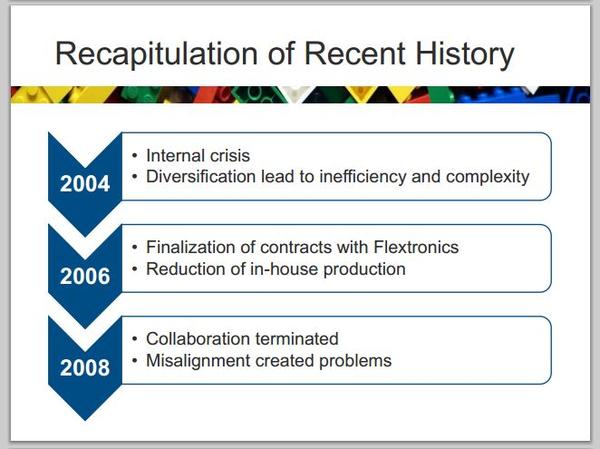

我来试着回答一下05~09年那波动的净利润......那几年Lego的大动作如下:04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低… 显示全部

我来试着回答一下05~09年那波动的净利润......那几年Lego的大动作如下:04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低… 显示全部

看到 2005 年财报的 net profit 是 2.14 亿丹麦克朗,而 2014 年这个数字是 70 亿克朗。

看到 2005 年财报的 net profit 是 2.14 亿丹麦克朗,而 2014 年这个数字是 70 亿克朗。现在乐高在玩具市场上也把芭比娃娃和孩之宝甩在了身后1、重整产品线,留下真正赚钱的产业,砍掉头脑发热的产物,恢复创新的正常节奏从产品到周边产业都一样。在70到90年代有过创意井喷期,啥都能上市,丢弃拼砌的传统优势,天马行空,不少产品还蛮奇葩。不信看下图,芭比系列,你信这是乐高么?

婴儿玩具PRIMO、塑料玩具ZNAP、针对于女孩的类似于芭比娃娃的SCALA系列、网络大师机器人套装、防卫者系列、试图取代传统乐高人仔的杰克斯通系列,这些耗费成本且销量不佳的产品后来全部停售。

除了产品以外,乐高鼎盛时期对周边产业的扩展也有点丧失理智,除了乐高主题公园一直运营到现在,其他很多3D乐高数据库、拼砌指令这些周边的东东也都砍掉了,不是说这些项目毫无成就,只是节奏太激进。停止了揠苗助长之后,乐高的颓势已经有所好转。而在之后,乐高扩展周边产业的步子慢了很多也谨慎了很多。

2、削减成本,从制造到人力

在产品方面,在疯狂扩张期,乐高积木有将近1.29万个零件,在发生危机之后减少到7000个。塑料开模是不小的成本,数量少了,但是其实更能发挥想象力。在人力方面,一个比隆工厂就砍掉了1000+号员工。乐高掌权者的变更、管理层换血、股权变化这些就更复杂一些,暂且不谈(其实是因为这个我也不太懂哈哈哈哈)。

3、2013年的乐高大电影

上面也有人提到了乐高大电影,确实牛逼啊,这动画电影不光是拍给熊孩子看的!能把品牌嵌入电影还不惹人讨厌,也就乐高能干得出来,这简直就是个巨大的品牌广告片!段子够逗逼,乐高人仔的渲染非常细腻,关键是结尾确实完美植入了品牌理念。一部电影,转化成了实实在在的巨额销量,攒新粉丝的效果惊人,14年上半年因为电影提振,销量直涨11%。乐高大电影还会有2,就是不知道大陆会不会引进。

上面也有人提到了乐高大电影,确实牛逼啊,这动画电影不光是拍给熊孩子看的!能把品牌嵌入电影还不惹人讨厌,也就乐高能干得出来,这简直就是个巨大的品牌广告片!段子够逗逼,乐高人仔的渲染非常细腻,关键是结尾确实完美植入了品牌理念。一部电影,转化成了实实在在的巨额销量,攒新粉丝的效果惊人,14年上半年因为电影提振,销量直涨11%。乐高大电影还会有2,就是不知道大陆会不会引进。4、教徒式的忠诚粉丝

这点太重要了,除了苹果之外,还没有哪个品牌能够像乐高那样拥有那么多的忠实粉丝。爸妈玩,带着孩子玩,一代接一代,乐高情况最不好的时候,全球粉丝有过各种自发的支持活动。乐高自己也知道粉丝、粉丝的体验对自己有多重要,一直坚守玩具的品质,这几年开了ideas平台,投票过万的粉丝作品经过评审就可以投产发售,对粉丝是很好的鼓励和振兴。

5、其实还有挺多其他的,NXT机器人神马的,持续主推电影合作产品神马的,断断续续的零零散散的回头想到再补充,大致以上足够大家随便看看~

备注:以上资料很多来自《乐高:创新者的世界》一书和《透过乐高创新兴衰史看文化产业的未来》的论文,简略的提炼了一些主要观点,感兴趣的小伙伴可以看看!

匿名用户

我来试着回答一下05~09年那波动的净利润......那几年Lego的大动作如下:04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低… 显示全部

我来试着回答一下05~09年那波动的净利润......那几年Lego的大动作如下:04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低… 显示全部

我来试着回答一下05~09年那波动的净利润......

那几年Lego的大动作如下:

04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低成本提高利润。当时Lego认为外包约80%产品生产和关闭大部分高人力成本国家的生产基地将大幅降低公司生产成本。然而4年后,因为全球供应链管理上的力不从心,Lego终止了协议并重开了在欧洲的生产基地。再1年后,通过管理层重组和优化供应链,标准化生产,公司内部流程更新等,Lego重新走上了稳健发展的道路。

---------------------------------------------------------------------------------------------------------------------------------

纵观外部环境对Lego的影响:

那几年Lego的大动作如下:

04年,全球第五大玩具制造商Lego集团与电子制造服务提供商Flextronics(伟创力)签订长期协议,外包模型、组装、包装和运输(modeling, assembly, packaging and distribution)以期降低成本提高利润。当时Lego认为外包约80%产品生产和关闭大部分高人力成本国家的生产基地将大幅降低公司生产成本。然而4年后,因为全球供应链管理上的力不从心,Lego终止了协议并重开了在欧洲的生产基地。再1年后,通过管理层重组和优化供应链,标准化生产,公司内部流程更新等,Lego重新走上了稳健发展的道路。

---------------------------------------------------------------------------------------------------------------------------------

纵观外部环境对Lego的影响:

- 政治:

- 出口欧盟和美国的税负增加导致售价提高;

- 不同国家对玩具的尺寸、材料不同,增加Lego的设计和生产压力。

- 经济:

- 08年全球经济危机开始,作为主要顾客的中产阶级家庭收入减少,玩具支出自然相应减少;随着经济复苏,中产阶级也逐渐增加了部分支出;

- 发展中国家为了吸引外资,提供了良好的投资条件,使得Lego对在海外设立新生产基地重拾信心。

- 社会文化:

- 信息时代的孩子们对互联网和电子游戏的兴趣更大;家长也乐于尝试使用教育类应用;

- 孩子们很忙:不少孩子在课业之外被家长送去参加各种兴趣班,使得他们也许没空玩或者对自己学得东西更感兴趣而不玩Lego了。

- 技术:

- 随着技术的发展,Lego要求的产品2毫米(micrometer)误差更容易被达到了;Lego的自家生产机器性能也得到了大幅度提升;

- 智能手机和无线网络的普及,为Lego带来了新的创意。

- 生态

- 作为一家优秀的历史悠久的不上市的公司,Lego一直坚持对产品品质和CSR的追求,随着公众对公司csr的注重,对Lego这样一直保有此种发展模式的公司来说是好事;

- 法务

- 由于产品的易模仿性,Lego在世界各地有无数的盗版和仿制品,自然也产生了大量的版权官司。不同国家对版权的保护程度不同。官司影响了Lego的声誉并增加了法务支出。

- 新进入者的竞争:中等

- 通过几代人的努力,现存的几大玩具制造商已经达到了他们的economic of scale.新进入者不太可能从全行业的角度和现有大品牌竞争。

- 在快速变化和竞争激烈的玩具行业,建立品牌相对优势的方法一是建立自己的独特品牌,如Lego的砖块;二是通过取得Star wars, Harry Porter之类拥有大量粉丝群体的品牌的授权。或者这些品牌会自行发展代工工厂。

- 供应商的议价能力:中/低

- Lego的供应商主要来自3个方面:化学品、模具、电影公司(授权)。

- 买方的议价能力:中/高

- 个人买家:中

- 集团买家如Walmart:高

- 替代品竞争:高

- 电子游戏如任天堂;Mega&Mattel的战略合作(2014年Mattel已收购Mega)

- 同行竞争:除了Lego的仿制者以外,Mattel, Hasbro一类同样的玩具行业全行业玩家和Lego在玩具、游戏、主题乐园有全面竞争。

- 2003到2004年之间,正是乐高(Lego)这个创立已70年企业的历史最低点,连续2年销售暴跌,利润亏损,每个人都在想,明天是不是我们就要看到破产通告?——虽然从2015年的现在看过去,那一刻,不过是又一轮辉煌的起点,但在那时,乐高的第三代家族接班人凯尔德·科尔克·克里斯蒂安森是绝望的。

凯尔德接班20多年,他知道这个时代不属于他了。他赶走了前任CEO,那位奋力十载却没能拯救乐高的悲剧人物。同时提拔了两只左膀右臂,一位叫做克努,营销背景,一位叫做奥夫森,财务背景。而正是这次壮士断腕般悲壮的换帅,为乐高开启了新一轮的伟大征程。

改革的序曲,第一步,熔炼心法,大道至简。

公司比以前大太多了,我们需要新的、有效的管理手段。

前文说到,这左膀克努,右臂奥夫森,两人一个擅长营销,一个擅长财务,凑在一起,他们认为:大企业需要品牌,大企业需要财务控制。可是说来容易做来难。什么是品牌?什么是财务控制?

不管是消费者,还是员工。他们都希望事情简单,对员工而言,你的一套管理办法即便有效,但太过于复杂、繁缛,那么他们倾向于抵制,至少不会积极去执行。同样的,你的财务管理,也许每个会计能头头是道,可对于员工来说,是不能承受之负担。

克努和奥尔森,决定,树立一个标杆,去简化他们的管理,激发员工的积极性。于是推出了创造性的13.5的概念。

13.5原则:“乐高从今天起,每一个产品,它的销售利润率必须大于或者等于13.5%这个基准。”对市场负责,否则淘汰——这是乐高企业几十年来第一次树立这么一个清晰而简单的企业行为准则。

这不禁令我们想起了屈臣氏著名的26周原则:“屈臣氏对新进品牌在第十三周进行库存评估,如果库存周转天数超过26周,则下架停售”。在这一条准则之下,乐高有了几个明显的变化。

一方面,设计师受到了约束,不可以再随心所欲的设计一些自嗨型的积木,另一方面,又极大程度释放了设计师——是的,只要热卖,只要符合成本,你可以任意发挥——这像极了若干年后的一个叫做twitter的机制,我限制你140字,但是在这个范围里,是你的王国。于是在接下来的10年里,乐高设计得到了井喷式的发展。

你说,天呐,这么神奇吗?——其实中国历史上有一个同样神奇的案例。商鞅变法强大了秦国,而这一法度的核心是什么?是军功爵制,士兵们每获取一个敌人的人头(首),就可以官升一级。从而有了一个耳熟能详的词汇:首级。

如果说13.5原则是品牌和财务对内的体现,那么对外,对市场和消费者,乐高反思了它过去十年的产品线,它觉得,也必须要做出一些改变。

第二步,重新定义积木。积木没有被电子游戏淘汰,它有永恒的生命力。

在2004年前,乐高在做什么?电脑游戏和电影工作室、乐高教育中心、新奇特玩具(甚至有芭比那套玩意)……砍掉,统统砍掉,因为他们不符合13.5的原则。那么,乐高的产品中心该向哪里转移呢?

~~~回归原点,得宝系列重生~~~

在此前的乐高振荡期,一个被广为接受的观念是,电子游戏时代来了,积木将被淘汰。正是在这种思潮下,乐高的一个王牌产品得宝系列(0-5岁适用),被废弃停产了。可是这真的对吗?

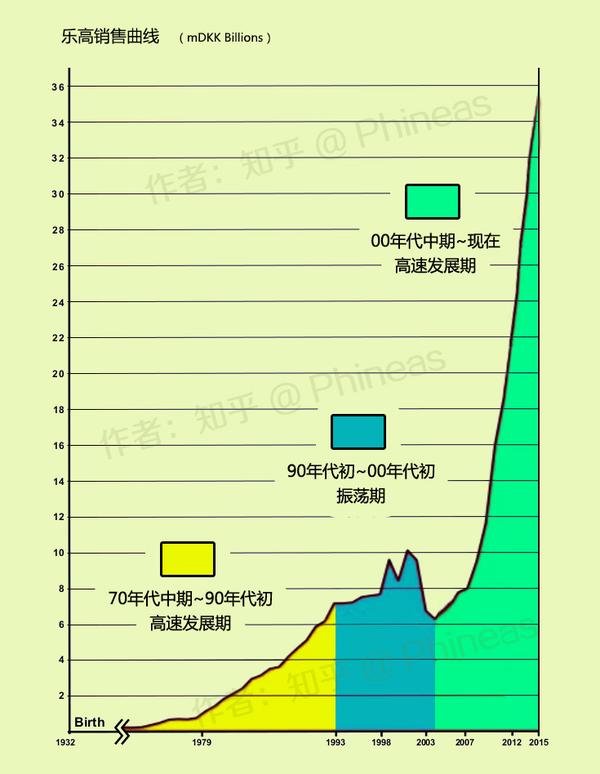

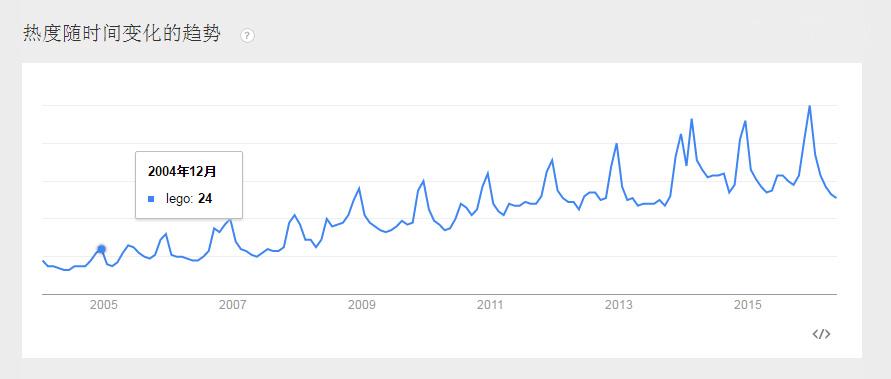

上图是全球趋势。乐高的关注度从2004年至今,有2个明显的特点,一是持续上涨,而是几乎每个高峰点都是圣诞季。ok,一个很大程度上作为礼物的积木产品,它抛弃了专为幼儿的得宝系列?太荒唐了吧。

你问,得宝真的好吗,它有竞争对手吗? 从数学角度来说,如果你有六块八颗凸起的乐高长方体积木,可以砌出一亿种组合。

从数学角度来说,如果你有六块八颗凸起的乐高长方体积木,可以砌出一亿种组合。

从人性角度来说,拼接真的会上瘾。

——这是得宝的天然优势。

乐高设计师在13.5原则引导下,面向广大孩子,推出了全新的得宝系列。2005当年,实现了三倍的销售额,受到热捧。更有死忠粉热泪盈眶:看到得宝重生,我觉得我爱的乐高回来了。

虽然到今天得宝早已退出了乐高销售三甲。但这个系列,是一个细水长流的长青产品,是乐高的初心,也是粉丝的摇篮。

在得宝的这场战役里,新任的左膀右臂收货了信心,同时他们也看到了与时俱进的魅力。满足消费者需求,不是把消费者请到公司来做焦点访谈,而是应该我们自己,去到广阔的真实世界,去仔细观察消费者的实际形态。

~~~星球大战系列再临~~~

星球大战系列,是乐高热销了几十年的产品。2005年,迎来了星战电影第五集的公映。

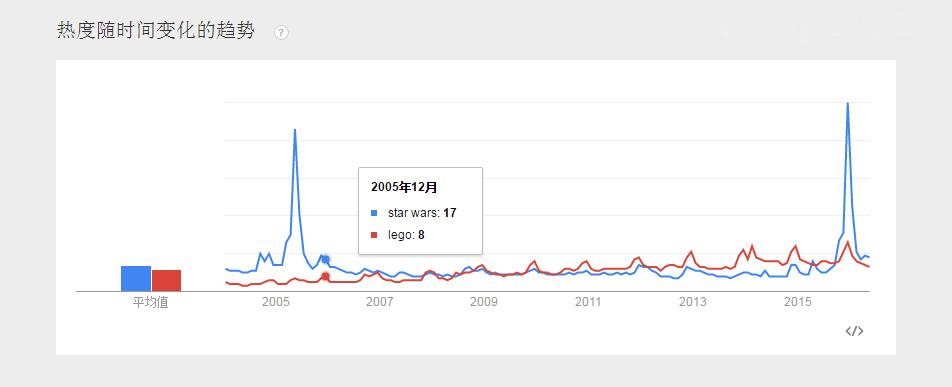

我们对比前面的乐高全球趋势,看看星战有多热。

天哪。在大部分的时间里,星战这一个电影系列,居然比乐高还热乎。了解欧美的人知道,星战那是和披头士一样,影响了一代人的伟大作品。乐高显然不能忽视这一点。在得宝上尝到甜头的团队,重新设计(包括复刻)了一系列星战相关周边。

我们来看著名的星战飞行器“千年隼”号(编号7965,2011年推出,是10179的复刻缩小版)在美国亚马逊商城的购买评论。

This is a massive and amazing set. I'm a huge fan of the original trilogy and lego so have been wanting to get a Millennium Falcon set for several years. Unfortunately I found most of them either far to expensive, or simply not worth the asking price. This one finally hit the sweet spot for me…… is nearly perfect……这是一个重大且惊艳的套组。我是星战最初三部曲以及乐高的超级粉丝,所以希望得到一个千年隼套组已经很多年了。不幸的是,我发现他们大多要么太过昂贵,或者干脆不值得的问价。这一次终于击中我要害了……几乎是完美的……

(130个人觉得此评论很赞)

Played with this at a friend's house. He got it for his birthday and took him more than 5 hours to build, and he wouldn't let us take it apart to rebuild! It is impressive! The details on the outside is just like the movie. The fold out panels open the reveal the inside where the minifigs can act out the movie scenes. The size of the Falcon is just right to fly around, not too heavy or bulky, and is actually quite sturdy compared to other Lego sets.在朋友家玩这个,他是作自己的生日礼物的,还花了5个小时去搭建它,还不让我们拆了玩!令人印象深刻!它外面的细节和电影里一模一样……

(86个人觉得此评论很赞)

你说,你知道了,这不就是大IP吗!竞争对手也可以去活捉另外的IP哦!分分钟抢你的粉丝,抢你的市场。

真的吗?

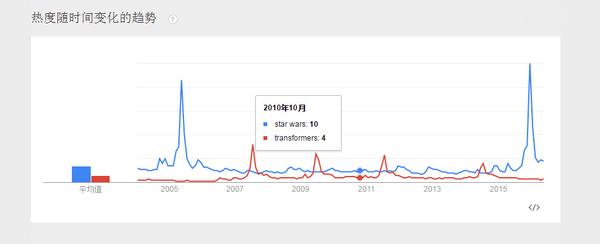

乐高有一个死对头,叫做孩之宝。现在乐高是玩具业老大,可以前孩之宝是老大。孩之宝看到星战很好卖,他也想学习,于是他看中了变形金刚。同样是有广泛受众、特别受男性喜爱。可是呢。 我们注意到:

我们注意到:

1、每个关注热点都是受到电影公映的带动。

2、星战的影响力远远大于变形金刚。

3、星战电影公映结束后,热度维持在一定水平不再衰减。

4、变形金刚电影公映结束后,热度衰减很快。

我们再来看双方公司对于IP题材的深入挖掘。

在youtube搜索“lego star wars”(乐高星球大战),大约156万条结果。排第一的是同人类作品:

在youtube搜索“Hasbro Transformers”(孩之宝变形金刚),大约16万条结果,大都是游戏、产品展示。

所以,不论是从题材本身热度、持续性、可挖掘性,星战都全面超越变形金刚。对此,我们只能说:星战不是IP,星战就是星战。这一条大腿,被乐高抱住了,特别是从2000年以来,星战前传和星战后续,一共6部的持续播出,必将给乐高带来持续助力。

~~~女孩系列咸鱼翻身~~~

除了以星战为代表的授权类产品系列。乐高也从未放弃过原创版权的努力。

如果说星战是男孩的最爱。那么乐高还想要一个女孩的王牌产品。

70年代,发布Homemaker套组,几年后下架。

1979年,发布Scala定制珠宝 猜猜这是什么?乐高全球CEO的名片(读音是姚根儿,后面还会讲他),在背面印着姚根儿的座机和email。这个人偶的脖子,腿,胳膊,和手都是都是可以拆卸可以转的,连头发都可以转可以拆下来,所以转到90°的时候,CEO的眼睛会被挡住而风中凌乱,时尚时尚最时… 显示全部 猜猜这是什么?

猜猜这是什么?乐高全球CEO的名片(读音是姚根儿,后面还会讲他),在背面印着姚根儿的座机和email。这个人偶的脖子,腿,胳膊,和手都是都是可以拆卸可以转的,连头发都可以转可以拆下来,所以转到90°的时候,CEO的眼睛会被挡住而风中凌乱,时尚时尚最时… 显示全部 猜猜这是什么?

乐高全球CEO的名片(读音是姚根儿,后面还会讲他),在背面印着姚根儿的座机和email。这个人偶的脖子,腿,胳膊,和手都是都是可以拆卸可以转的,连头发都可以转可以拆下来,所以转到90°的时候,CEO的眼睛会被挡住而风中凌乱,时尚时尚最时尚。

换了那么多名片,我承认当我拿到这“张”名片的时候忍不住说“wow”。这个小细节让我觉得很能代表这个公司,它就是卖“有趣”的。对于一直在讲智造升级的很多制造企业来说,乐高就是一个故事大师,不知道高明到哪去了。

一些亮瞎的事实是:

2014年乐高在它所有的市场都是两位数的销售增长,而其他的企业都是个位数

乐高的利润和净利润都是两位数的增长,这几年的势头都差不多

乐高的小塑料片都是自己做的,没有外包!

为什么乐高卖的这么好?

乐高卖的其实是背后的一整套玩乐体系。

每一年,乐高生产500多亿个积木,可以连到月球还多一百亿来块,可是可以说乐高卖的可不是塑料片,这个耦合的塑料片可是1958年就申请专利了,到现在还是一样的技术,没变过。从 1958 年开始,无论何时何地乐高生产的所有组件都可以完全兼容。

电子玩具刚刚兴起的时候,乐高不是没傻眼。回到 2000 年面对这些科技领域的挑战者,乐高和其他传统玩具厂商一样感到慌乱。于是,乐高开始模仿迪士尼,不仅在欧美地区建造庞大的乐高乐园,还将业务触角延伸至电子游戏、服装、学习用品等。多元化并未取得预期成效,反而使乐高的产品与形象变得模糊,导致乐高在 2003 年前后陷入亏损泥淖,营收下降 25% ,全年亏损额达到史无前例的 2.3 亿美元。亏损状态一直持续至 2004 年,公司甚至差点倒闭。

现在姚根儿出场了。

麦肯锡管理顾问出身的克努德斯道普(姚根儿)担任 CEO 后,第一件事就是回归玩具创造的核心业务,将乐高乐园与衍生产品经营进行外包,更为重要的是,在乐高产品中引入越来越多的故事元素。

除了经典的无标准拼砌系列,乐高开始推出根据 DC 漫画( DC Comics )和漫威( Marvel )中的形象和场景打造的超级英雄系列产品。可以看到的明显变化是,为了获取大量广受欢迎的动漫形象和故事场景的授权——别忘了,这些动漫形象吸引的,不仅仅是儿童——乐高在授权上所花费的资金,从 2005 年的不足 3 亿丹麦克朗激增到 2012 年的 15.06 亿丹麦克朗。

乐高是怎么包装新产品的?

乐高在制作每个系列产品时,都会用一个故事作为主题进行贯穿,并用动漫、游戏、网站、社交平台等一系列方式去推广在产品背后的故事属性。

以 2013 年上市的新产品系列气功传奇 CHIMA 为例,乐高找来了纪录片导演 John Derevlany ,请他为 CHIMA 写一部 30 集的动漫连续剧,讲述了 8 个动物部落,包括无敌狮,鳄霸王,狼武士等动物互相格斗的故事。2013 年 1 月,这部动漫连续剧开始在美国卡通娱乐网站 Cartoon Network 定期播出,每集都吸引了百万以上观众。在这之后,乐高接着让 Derevlany 继续撰写相关的 4D 电影脚本,这部电影将在乐高乐园上映。

除了动漫和电影,乐高还以这个故事为内核,让华纳兄弟旗下的游戏开发商 TT Games(这家公司在 2007 年被华纳兄弟收购之前,是乐高的游戏开发商)为这款产品制作了衍生的三款游戏,游戏中的英雄角色均采用乐高玩具形象。

其中一款游戏—— CHIMA 传奇之拉法尔的旅程——由华纳兄弟在索尼与任天堂的游戏掌机平台进行发售,在游戏中,不同部落的动物拥有不同的能力,例如狼可凭嗅觉找到隐藏物品,狐狸可以钻进狭小的空间,如果你想拥有这些特殊的能力,那需要付出不菲的价格。当然,这些动漫剧集与游戏都被整合在气功传奇的网站上了。

在这样的故事情境铺垫下,乐高又可以不断推出气功传奇相关的产品,从不同部落场景,不同英雄的拼装人偶,到故事中出现过的回旋飞车、战机,每盒都有不同的玩法。

乐高是怎么设计新产品的?

一边是贴近孩子们的内心故事世界,一边是丰满而富有现实的体验,这让乐高新产品常常能收到来自全世界孩子们,甚至是那些超级大龄粉丝们发现的“ wow ”惊呼声。

乐高在丹麦比隆的产品研发总部,就像一个儿童乐园,墙壁是天空般的蓝色,会议室是柠檬黄色,而沙发则是亮眼的玫红。展示柜上摆满了乐高积木拼砌出的各种造型,例如城堡,汽车等,一只巨大的铁皮滑梯可以让员工直接从二楼冲向一楼。每周两次,许多来自幼儿园、学校,甚至是员工的孩子,会来到这里,他们可以随便在公司里面跑来跑去,快乐地从滑梯上滑下来,而乐高的产品设计人员,则在开心陪玩的过程中实现了互动调研。

没有什么方式比让孩子们做简单的选择题更加有效:当乐高在一款会动的小卡车与一款车身更大、功能更全但不会动的大卡车之间犹豫时,孩子们一齐扑到了小卡车上。显然,孩子们已为这款新产品的市场前景做出了答案。

也只有通过孩子的思维,才更可能发现这些提供给他们自己玩耍的玩意有哪些可完善之处。

乐高 2014 年版本的“监狱”产品,比 2011 年版本除更加丰富建筑细节,还多了一辆小汽车,这是因为乐高设计总监 Ricco 带着这款产品在全世界的几个城市中与儿童互动时,上海的一个小朋友提出“为什么监狱的外面只有警车?那么犯人即使逃出监狱也肯定没法走远,他必须开汽车逃走才能成功越狱”。

当然,想象力固然重要,符合现实的体验同样必不可少。

乐高分布在全球 24 个国家和地区的 180 名设计师,常常要深入各个行业,获取真实的体验。例如设计消防车系列,设计师们曾经到消防队去当一天的见习消防员;设计跑车,设计师们会特地去赛道上进行一场跑车挑战赛;设计太空船模型,Ricco 还在美国国家航空和宇宙航行局( NASA )的阿波罗 13 号任务控制中心体验,甚至开起了曾经登月的月球车。

乐高是怎么售卖产品的?

除了商场、专卖店的布点,在线平台的开发,社交平台的营销,乐高很注重体验营销。

比如说乐高教育

用乐高的各种积木玩具开发孩子们的智力,它是独立运营的,不以售卖产品为目的,但无疑是最好的营销了。乐高教育1980年就成立于丹麦,为全世界的教师和学生提供内容丰富、具有挑战性、趣味性和可操作性的学习工具和教学解决方案。

再比如说乐高的一些宣传活动

乐高教育的独特学习理念、教学指导、小组作业、教师培训、安全环保的学具、趣味性的比赛方式,使孩子们发挥出天生的创意力和想象力,培养团队精神、解决问题能力、应变能力、表达能力、社交能力等,帮助他们从容应对 21世纪所带来的新挑战。

乐高正在以前所未有的速度加快布局在国内的品牌体验活动。伴随着乐高在嘉兴的工厂奠基开工,乐高在嘉兴图书馆举办了一场体验活动,超过 1000 名小朋友在 4 天的时间内拼装 50 万块乐高积木,用想象力拼砌未来城市。在过去的一年中,乐高的主题活动“ build the world ”在中国举办了 16 场,而在中国设立区域办公室后,今年这一活动的数量将增加至 30 场。

暑假期间,乐高带来“卡车秀”,满载着多个主题产品的乐高卡车将停在城市中儿童较为密集的地方,例如商场或公园里的一块场地,有不同的区域,包括幼儿区或女孩们的玩具系列,让小朋友们随意拼搭、比赛。

像前面一些答主说的拼砌,也是一种非常独特的营销。乐高世界杯是从1988年开始举行的。比如拼出世界著名建筑,这些叹为观止的作品都让人过目不忘。

乐高的发展或许说明了,逗比才能赢得全世界。

姚根儿挺帅的不是么?

姚根儿挺帅的不是么?

Labels:

Lego

亚航售AAC有利股价‧潜在股息或达96仙

(吉隆坡25日讯)大马航空业今年第四季的竞争将加剧,但亚洲航空(AIRASIA,5099,主板贸服组)在脱售亚洲航空资本公司(AAC)股权潜在股息诱人的利惠下,股价仍有一定上涨空间。

根据马航新首席执行员的谈话和马印航空(Malindo)增加机队,显示竞争白热化。

大马机票价格战白热化

联昌研究指出,大马机票价格战越演越烈,而航空业的竞争主要是受到航班回酬强稳,航班增加所造成。

马航的去年第四季和今年第一季每公里营业额(RASK)分别成长7.8%和15%。马航每公里营业额上涨,归功于其前首席执行员穆勒削减了一些长程和短程航班。

马航新任首席执行员彼得贝鲁也表示,该公司必须解决其平均乘客率低于70%的问题。

该公司将会把15至20%的空置座位作为廉价机票,以重夺其失去的市占率。另外马航也会在第二国际机场(KLIA2)和亚庇国际机场推出前往中国的航班。

至于马印航空,该公司也会推出前往越南、泰国以及印尼航班,这些都会蚕食亚航在该地区的乘客人数。同时,该公司在今年也增加了8家737-800s飞机。

尽管大马航空业竞争加剧,但联昌并没有对于目前情况过于担心,并有信心亚航可以达到目标价。

这是因为AAC的出售将会为亚航带来重大刺激,加上该公司之前所定做的100架A321neos飞机,其中30架属于ACC所有拥有,这大大增加该公司的吸引力。若该公司成功出售ACC,其潜在股息高达96仙。

不过,联昌预测该公司2017年每股核心盈利会减少10%,这是因为该公司之前以每股1令吉80仙(比目前股价折价20%)私下配售予两位大股东5亿5900股新股的冲稀效应所致。

针对上述条件,联昌维持亚航“买进”评级不变,目标价为4令吉15仙。

文章来源:

星洲日报‧财经‧报道:傅文耀‧2016.07.26

Labels:

AirAsia

Monday, July 18, 2016

Genting - Are you ready to place your bets?

Genting - Are you ready to place your bets?

Genting "GENT" (pronounced as https://www.youtube.com/watch?v=gF4sUlYTPh0, definitely not pronounced using the Queen’s English otherwise will sound like you need to use the Gent.) is a household name mainly known for their leisure themeparks, casinos, cruise, plantation, and property. To understand Genting, one would need to take a look at Genting Singapore (GENS), Genting Malaysia (GENM) and Genting Plantation (GENP).

You will find a lot of pictures and charts in this note. They say a picture tells a thousand words. Much easier to understand IMO.

For GENT the following 4 catalysts to drive the share price. Namely. 1) Turnaround in GENS, 2) The launch of Twenty Century Theme Park at Genting Highlands Malaysia, 3) TauRx, the potential blockbuster drug getting FDA approval. 4) GENP's leverage to CPO.

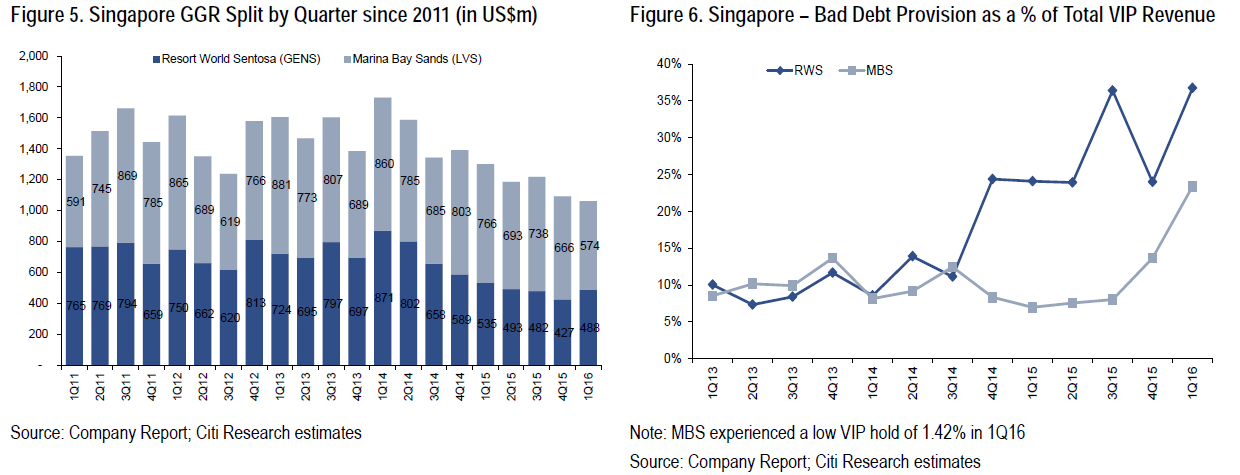

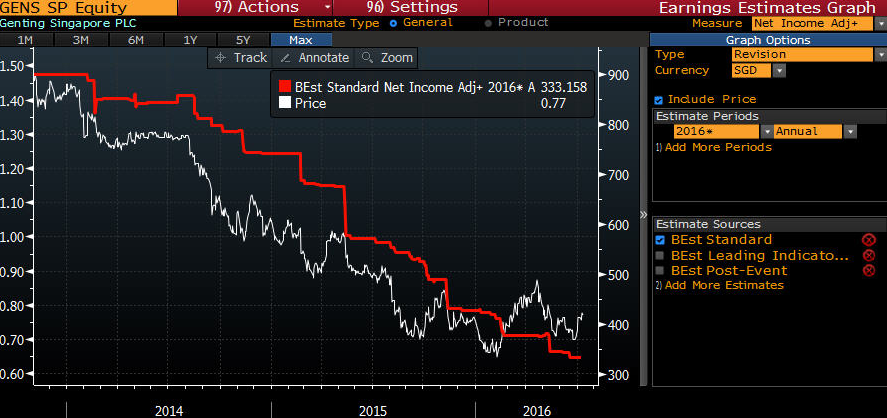

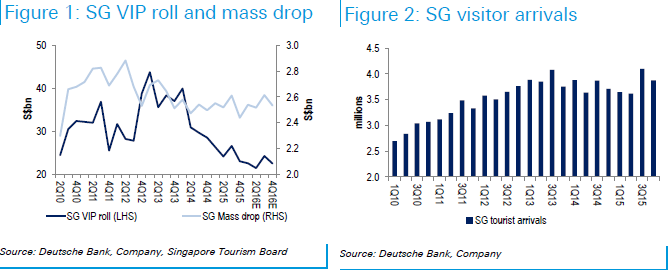

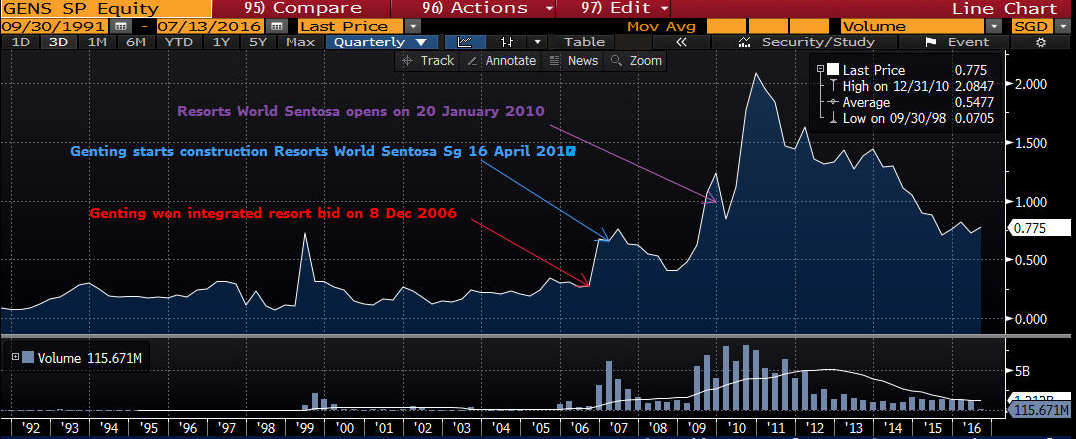

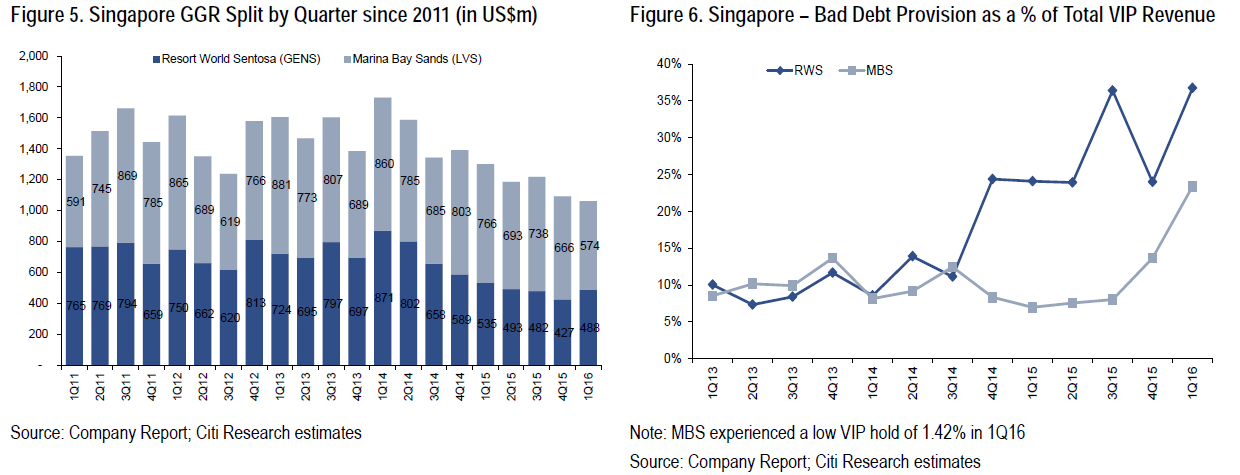

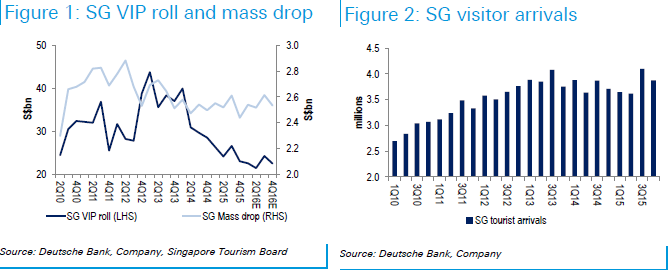

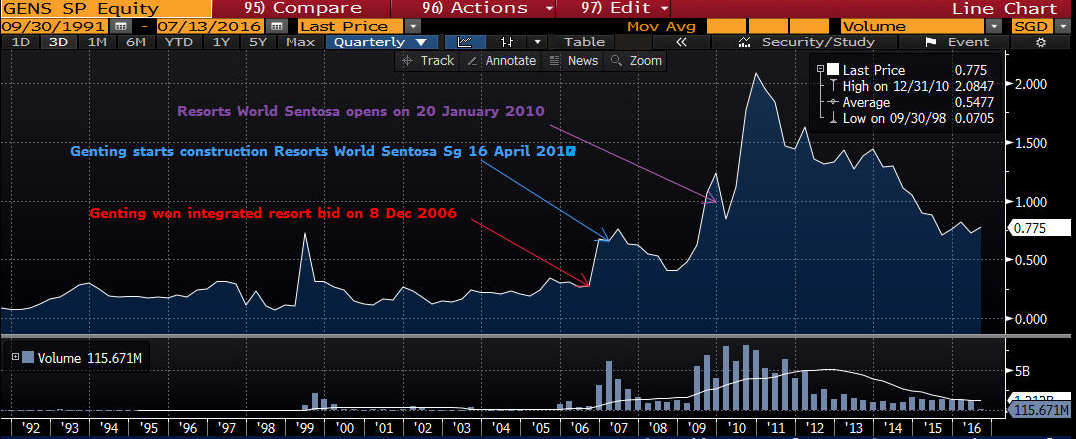

Catalyst 1. We expect GENS to turnaround. This following the recent 1Q results which saw GGR stabilizing as of 1Q16 while bad debt provision has stayed flat at 35%.

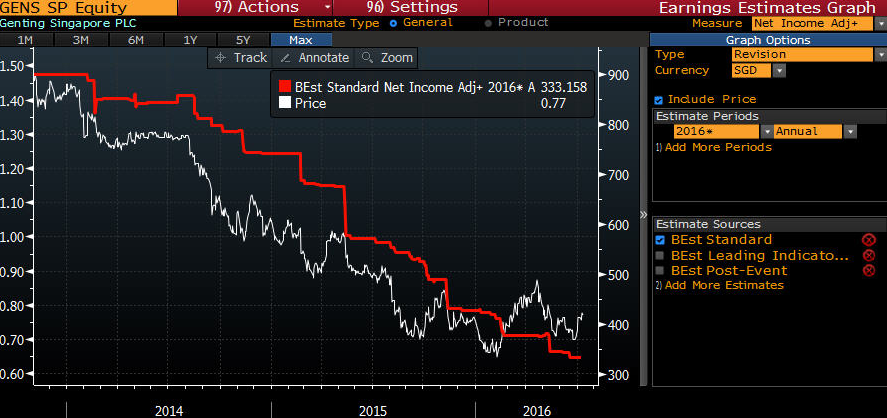

The share price of GENS has started to stabilized too. Earnings expectations already all time low!

If tourist arrival start to improve, the gaming and theme park of GENS will improve.

Catalyst 2. We move on to 52.9% owned GENM which operates the highland theme park. This was what it look like in the good old days of 90s.

Come 2017, the theme park should be ready and look like this...

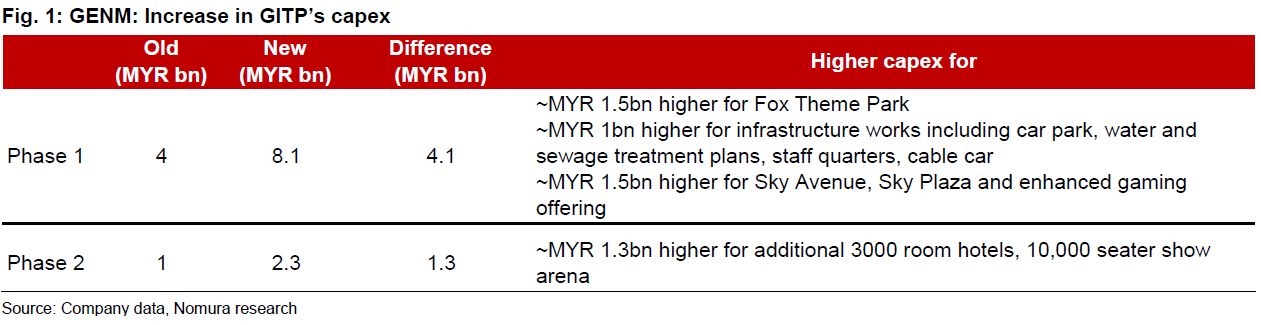

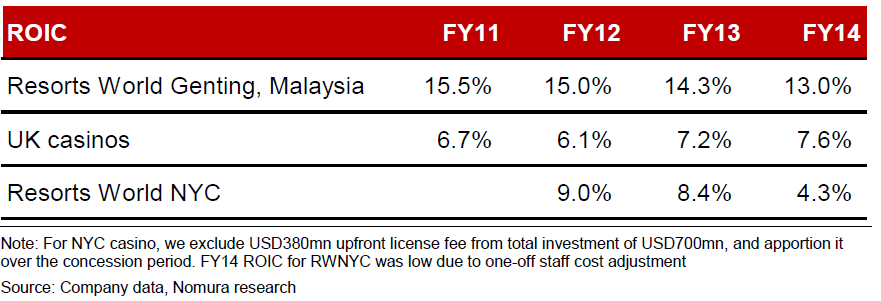

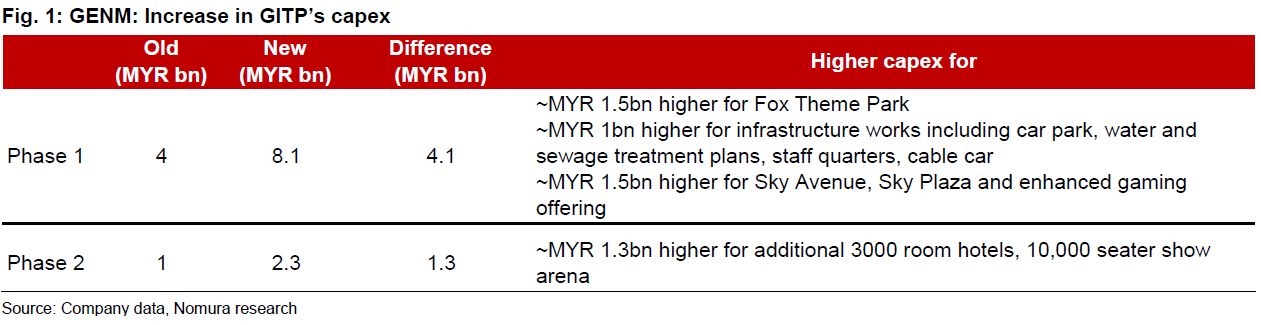

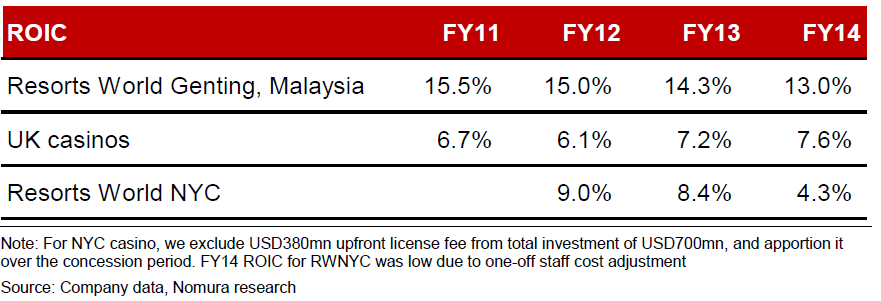

That’s right folks. Twenty Century Fox is opening a theme park in partneship with Genting Highlands. This is part of Genting Integrated Tourism Plan (GITP). For GITP, GENM is spending a total MYR8.1 bn and 2.3bn in capex for phase 1 and 2 respectively. In the past, the local theme park is big ROIC generator.

As someone who hasn’t been to the highland for ages, I can’t hide the excitement. Haha.

The theme park is expected to be ready by end 2017. Management however has hinted July 2017 to the investment community. For the latest photos on their status, please refer to http://www.themeparx.com/20th-century-fox-world-malaysia/

20th Century Fox World Genting Theme Park Rides

• Rio

• Ice Age

• Titanic

• Life of Pi

• Planet of the Apes

• Alien vs. Predator

• Night at the Museum

As the theme park is being build as we speak, the financial numbers for GENM is of course not exciting. For 2016, GENM’s revenue will be driven by its UK business. The recent Brexit should not affect much on its UK operation. DB estimated about c1% decline in core profit for every 10% depeciation in the pound. UK assets comprises 19% of GENM of total assets in the form of casino property.

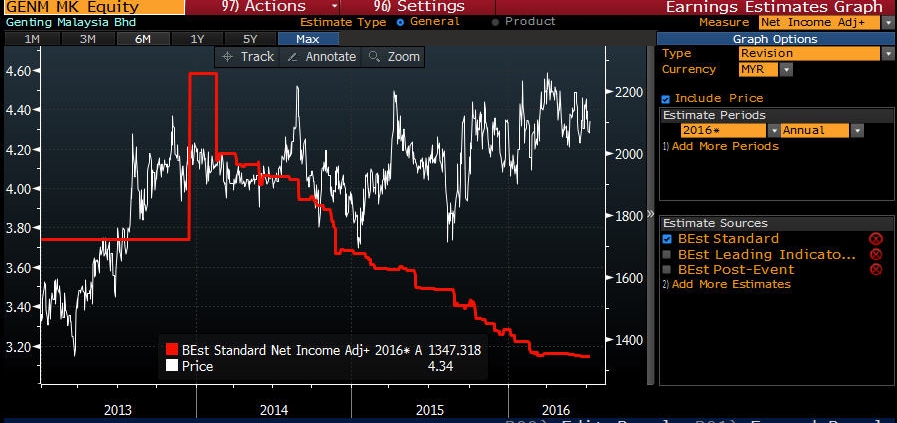

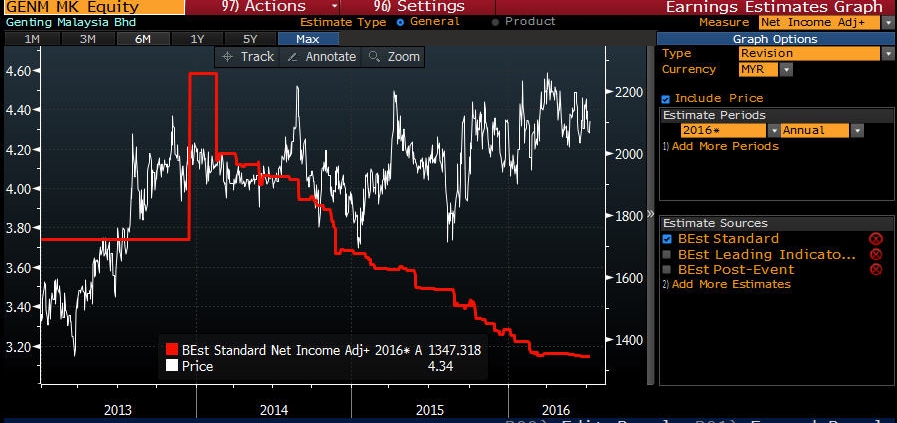

Similar to GENS, GENM’s earnings has already bottomed, how low can it go?

“History doesn't repeat itself but it often rhymes,” Mark Twain

The timeline on GENS from start construction to finish/opening of thempark and share price during the same period. I believe the same could happen for GENM.

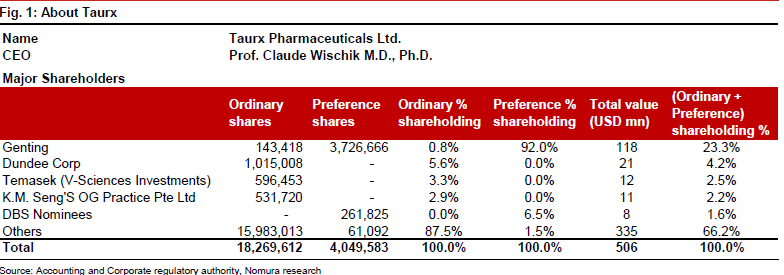

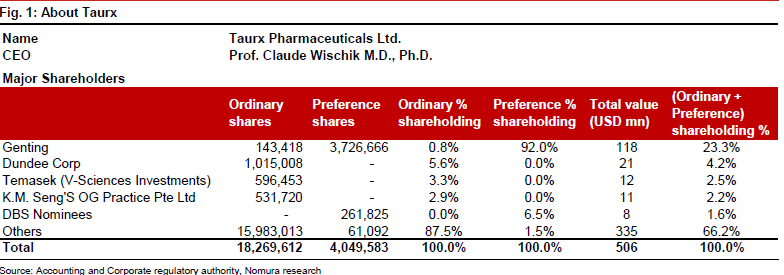

Catalyst 3. TauRx may provide a blockbuster boost for Genting’s valuation. Its initial investment of MYR450m or USD150m could be worth RM15b if TauRx goes for IPO listing. This would add RM10.4b or 40% to the sum of parts of Genting.

TauRx, founded by Claude Wischik is involved in Alzeheimer research. Its biggest backers include Genting, Singapore Temasek and little known Dundee Corp.

http://www.thestar.com.my/business/business-news/2016/01/07/taurx-boost-for-genting/

http://www.bloomberg.com/news/articles/2016-03-17/a-30-year-quest-for-an-alzheimer-s-remedy-nears-the-finish-line

When the Star and bloomberg news reported about this drug. The investors reaction was bullish and share price of Genting soared from MYR7.00 to MYR9.90 in 3 months.

To follow TauRx. https://twitter.com/hashtag/TauRx?src=hash

The excitement in TauRx is clearly reflected in the share price of Dundee Corp which has rallied some 58% YTD. http://www.investing.com/equities/dundee-corp

The key date to watch will be around 27 July 2016 where the company will present results from its third phase of human trial on its experiemental Alzheimer’s drug known as LMTX.

Meanwhile, we can see insiders buying Genting.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5135433

DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) : DEALINGS OUTSIDE CLOSED PERIOD

OMG!, insider buying ahead of clinical phase 3 trials.. a signal of confidence?

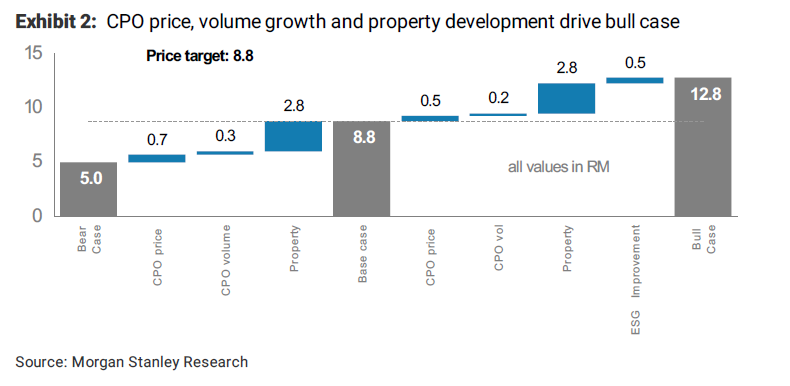

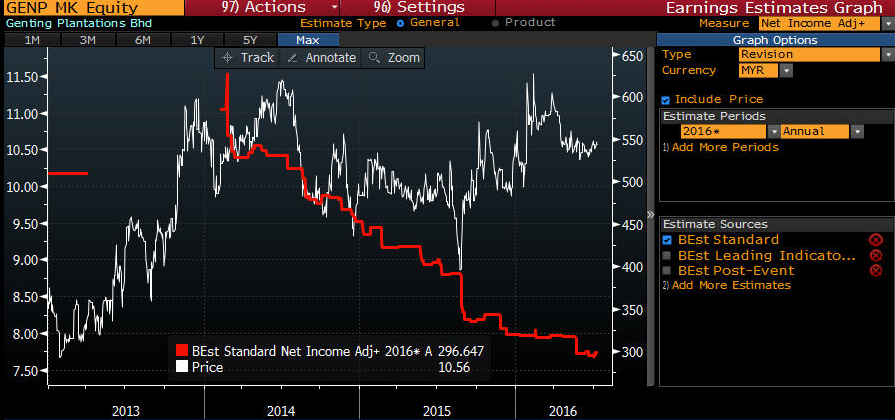

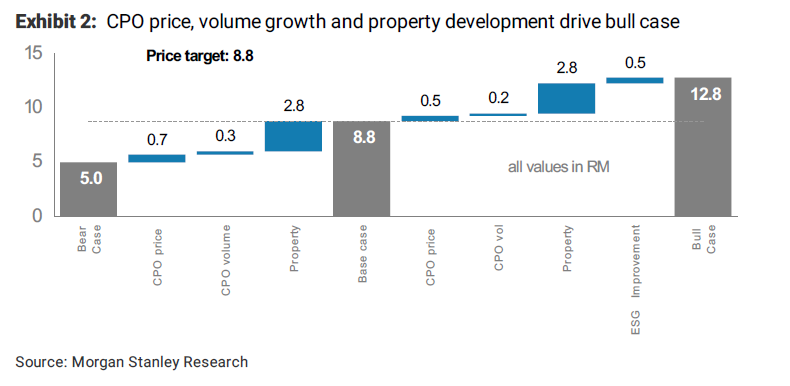

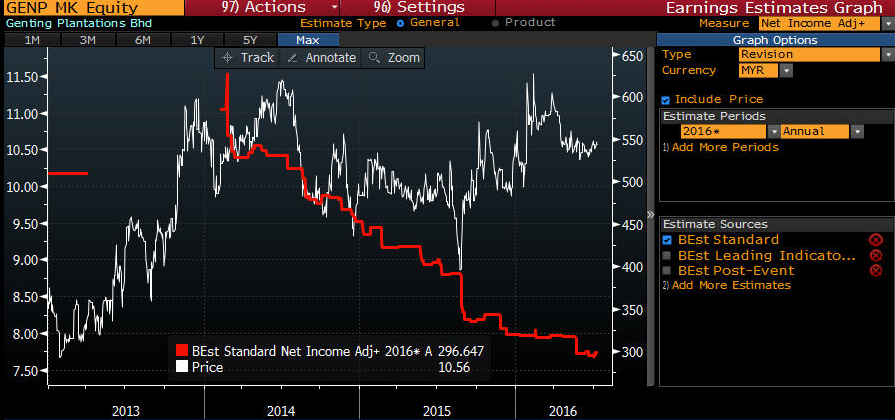

Catalyst 4. GENP is a company involved in crude palm oil (CPO) production. It has fairly young mature estates with good FFB and CPO volume growth. It also has a property development arm. It is leverage to CPO price movement.

GENP earnings and price has bottomed?

Valuations of GENT

So are you ready to place your bets?

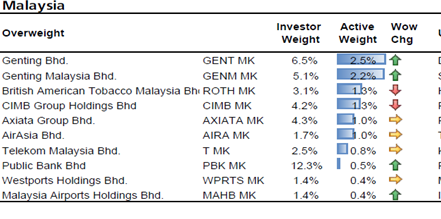

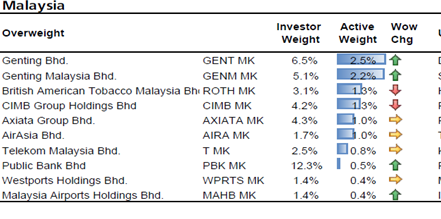

Fyi Investors’ chips are already rolling into Genting.

Genting "GENT" (pronounced as https://www.youtube.com/watch?v=gF4sUlYTPh0, definitely not pronounced using the Queen’s English otherwise will sound like you need to use the Gent.) is a household name mainly known for their leisure themeparks, casinos, cruise, plantation, and property. To understand Genting, one would need to take a look at Genting Singapore (GENS), Genting Malaysia (GENM) and Genting Plantation (GENP).

You will find a lot of pictures and charts in this note. They say a picture tells a thousand words. Much easier to understand IMO.

For GENT the following 4 catalysts to drive the share price. Namely. 1) Turnaround in GENS, 2) The launch of Twenty Century Theme Park at Genting Highlands Malaysia, 3) TauRx, the potential blockbuster drug getting FDA approval. 4) GENP's leverage to CPO.

Catalyst 1. We expect GENS to turnaround. This following the recent 1Q results which saw GGR stabilizing as of 1Q16 while bad debt provision has stayed flat at 35%.

The share price of GENS has started to stabilized too. Earnings expectations already all time low!

If tourist arrival start to improve, the gaming and theme park of GENS will improve.

Catalyst 2. We move on to 52.9% owned GENM which operates the highland theme park. This was what it look like in the good old days of 90s.

Come 2017, the theme park should be ready and look like this...

That’s right folks. Twenty Century Fox is opening a theme park in partneship with Genting Highlands. This is part of Genting Integrated Tourism Plan (GITP). For GITP, GENM is spending a total MYR8.1 bn and 2.3bn in capex for phase 1 and 2 respectively. In the past, the local theme park is big ROIC generator.

As someone who hasn’t been to the highland for ages, I can’t hide the excitement. Haha.

The theme park is expected to be ready by end 2017. Management however has hinted July 2017 to the investment community. For the latest photos on their status, please refer to http://www.themeparx.com/20th-century-fox-world-malaysia/

20th Century Fox World Genting Theme Park Rides

• Rio

• Ice Age

• Titanic

• Life of Pi

• Planet of the Apes

• Alien vs. Predator

• Night at the Museum

As the theme park is being build as we speak, the financial numbers for GENM is of course not exciting. For 2016, GENM’s revenue will be driven by its UK business. The recent Brexit should not affect much on its UK operation. DB estimated about c1% decline in core profit for every 10% depeciation in the pound. UK assets comprises 19% of GENM of total assets in the form of casino property.

Similar to GENS, GENM’s earnings has already bottomed, how low can it go?

“History doesn't repeat itself but it often rhymes,” Mark Twain

The timeline on GENS from start construction to finish/opening of thempark and share price during the same period. I believe the same could happen for GENM.

Catalyst 3. TauRx may provide a blockbuster boost for Genting’s valuation. Its initial investment of MYR450m or USD150m could be worth RM15b if TauRx goes for IPO listing. This would add RM10.4b or 40% to the sum of parts of Genting.

TauRx, founded by Claude Wischik is involved in Alzeheimer research. Its biggest backers include Genting, Singapore Temasek and little known Dundee Corp.

http://www.thestar.com.my/business/business-news/2016/01/07/taurx-boost-for-genting/

http://www.bloomberg.com/news/articles/2016-03-17/a-30-year-quest-for-an-alzheimer-s-remedy-nears-the-finish-line

When the Star and bloomberg news reported about this drug. The investors reaction was bullish and share price of Genting soared from MYR7.00 to MYR9.90 in 3 months.

To follow TauRx. https://twitter.com/hashtag/TauRx?src=hash

The excitement in TauRx is clearly reflected in the share price of Dundee Corp which has rallied some 58% YTD. http://www.investing.com/equities/dundee-corp

The key date to watch will be around 27 July 2016 where the company will present results from its third phase of human trial on its experiemental Alzheimer’s drug known as LMTX.

Meanwhile, we can see insiders buying Genting.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5135433

DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) : DEALINGS OUTSIDE CLOSED PERIOD

| GENTING BERHAD |

| Type | Announcement | |||||||||||||||

| Subject | DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) DEALINGS OUTSIDE CLOSED PERIOD | |||||||||||||||

| Description | Pursuant to Paragraph 14.09(a) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, we set out below details of the dealings in the Company's securities by a Principal Officer. | |||||||||||||||

Name of Principal Officer : Tan Kong Han

Profile Mr. Kong Han Tan has been Deputy Chief Executive Officer of Genting Plantations Berhad since December 2010. Mr. Tan served as President and Chief Operating Officer of Genting Berhad. Mr. Tan served as the Group Chief Operating Officer of Tanjong PLC from March 2003 to June 2007. Mr. Tan has more than 13 years of working experience with an Investment Bank in Malaysia. He has been a Director of TauRx Pharmaceuticals Ltd., since November 20, 2012. He was called to the English Bar (Lincoln's Inn) in 1989 and the Malaysian Bar in 1990. He holds Bachelor of Arts degree in Economics and Law from Cambridge in 1988. | ||||||||||||||||

Catalyst 4. GENP is a company involved in crude palm oil (CPO) production. It has fairly young mature estates with good FFB and CPO volume growth. It also has a property development arm. It is leverage to CPO price movement.

GENP earnings and price has bottomed?

Valuations of GENT

So are you ready to place your bets?

Fyi Investors’ chips are already rolling into Genting.

Labels:

Genting

Sunday, July 17, 2016

AirAsia and Norwegian Air Could Create A Worldwide Low Cost Alliance

Two of the world’s most successful low cost carriers could soon be joining forces.

Norwegian newspaper Dagens Naeringsliv has reported that AirAsia boss Tony Fernandes met with Norwegian Air CEO Bjorn Kjos at the Farnborough International Airshow. The two reportedly want to set up meetings to discuss the possibility of a joint venture.

Friendly competitors or allies?

Kjos praised AirAsia as he stood next to Fernandes at the World Airline Awards. Speaking of both airlines’ awards for best long haul low cost carrier and best low cost carrier, Kjos said, “These are the world’s two best airlines. [The awards] show that the customers like our product. They’re the ones who voted for us.”

Fernandes, for his part, donned a Norwegian Air pin and told Kjos “If I get the opportunity to come to Oslo, we should sit down and talk. Why not?”

A worldwide low cost carrier alliance

Should such a joint venture come to pass, the two airlines would be able to cover most of the world. AirAsia has more than 200 routes in Asia and the Pacific regions. Norwegian flies extensively in Europe and has been dramatically expanding its international route offerings. The US market has been a major target for Norwegian, though it has met with resistance from American labor unions and regulators.

AirAsia’s low cost long haul wing, AirAsia X, does fly to Europe, but most of its routes are in Asia and Oceania. Sharing passengers with Norwegian would allow it to reach further into Europe and even into North America. Norwegian, likewise, has a limited number of routes to Asia (to Thailand, Hong Kong and India). So, on paper at least, this seems like a perfect match.

Or could they become rivals

AirAsia is looking to expand its route options in Europe through AirAsia X. Fernandes has already teased more flights to the UK. Potentially, he could also opt to open routes into Scandinavia and use Norwegian’s European services as feeders. Norwegian could want to expand in the other direction, using AirAsia as a feeder airline. If the two carriers cannot come to an agreement about which airline flies which route, they could just as easily become competitors instead of partners.

Following the trend

Such joint venture partnerships have become more common as airlines look to minimize the risks and costs of expansion. United Airlines recently partnered with Air New Zealand, for example, and American Airlines has joined forces with South American super-carrier LATAM on intercontinental routes.

In the current climate, a joint venture between Norwegian and AirAsia does not seem at all far fetched.

Making low cost carriers global

An alliance between Norwegian and AirAsia could signal a new era in the evolution of the low cost carrier phenomenon, which is still mainly focused on regional flights. Carriers like Norwegian and WOW have brought the same low fare model to transcontinental flying, but the trend is still in the very early stages of development. It will be some time before travelers will be able fly anywhere overseas on low cost carriers like they now can on full service airlines.

It is an attractive idea, however. With worldwide networks, low cost carriers could make international travel possible for many people who could not previously afford it (the same way that they have made flying more affordable on the domestic level).

For American fliers, a joint venture between AirAsia and Norwegian could eventually mean low cost flights to both Asia and Europe. As fuel costs start to rise again and airlines start murmuring about raising fares, that would be a very welcome development.

The only reason this is a story is because of the people involved. Both Kjos and Fernandes are shrewd businessmen who have showed a knack for developing the next trend before everyone else. If a long haul low cost revolution is to take place, both their airlines will certainly be a part of it.

http://www.travelpulse.com/news/airlines/airasia-and-norwegian-air-could-create-a-worldwide-low-cost-alliance.html

Norwegian newspaper Dagens Naeringsliv has reported that AirAsia boss Tony Fernandes met with Norwegian Air CEO Bjorn Kjos at the Farnborough International Airshow. The two reportedly want to set up meetings to discuss the possibility of a joint venture.

Friendly competitors or allies?

Kjos praised AirAsia as he stood next to Fernandes at the World Airline Awards. Speaking of both airlines’ awards for best long haul low cost carrier and best low cost carrier, Kjos said, “These are the world’s two best airlines. [The awards] show that the customers like our product. They’re the ones who voted for us.”

Fernandes, for his part, donned a Norwegian Air pin and told Kjos “If I get the opportunity to come to Oslo, we should sit down and talk. Why not?”

A worldwide low cost carrier alliance

Should such a joint venture come to pass, the two airlines would be able to cover most of the world. AirAsia has more than 200 routes in Asia and the Pacific regions. Norwegian flies extensively in Europe and has been dramatically expanding its international route offerings. The US market has been a major target for Norwegian, though it has met with resistance from American labor unions and regulators.

AirAsia’s low cost long haul wing, AirAsia X, does fly to Europe, but most of its routes are in Asia and Oceania. Sharing passengers with Norwegian would allow it to reach further into Europe and even into North America. Norwegian, likewise, has a limited number of routes to Asia (to Thailand, Hong Kong and India). So, on paper at least, this seems like a perfect match.

Or could they become rivals

AirAsia is looking to expand its route options in Europe through AirAsia X. Fernandes has already teased more flights to the UK. Potentially, he could also opt to open routes into Scandinavia and use Norwegian’s European services as feeders. Norwegian could want to expand in the other direction, using AirAsia as a feeder airline. If the two carriers cannot come to an agreement about which airline flies which route, they could just as easily become competitors instead of partners.

Following the trend

Such joint venture partnerships have become more common as airlines look to minimize the risks and costs of expansion. United Airlines recently partnered with Air New Zealand, for example, and American Airlines has joined forces with South American super-carrier LATAM on intercontinental routes.

In the current climate, a joint venture between Norwegian and AirAsia does not seem at all far fetched.

Making low cost carriers global

An alliance between Norwegian and AirAsia could signal a new era in the evolution of the low cost carrier phenomenon, which is still mainly focused on regional flights. Carriers like Norwegian and WOW have brought the same low fare model to transcontinental flying, but the trend is still in the very early stages of development. It will be some time before travelers will be able fly anywhere overseas on low cost carriers like they now can on full service airlines.

It is an attractive idea, however. With worldwide networks, low cost carriers could make international travel possible for many people who could not previously afford it (the same way that they have made flying more affordable on the domestic level).

For American fliers, a joint venture between AirAsia and Norwegian could eventually mean low cost flights to both Asia and Europe. As fuel costs start to rise again and airlines start murmuring about raising fares, that would be a very welcome development.

The only reason this is a story is because of the people involved. Both Kjos and Fernandes are shrewd businessmen who have showed a knack for developing the next trend before everyone else. If a long haul low cost revolution is to take place, both their airlines will certainly be a part of it.

http://www.travelpulse.com/news/airlines/airasia-and-norwegian-air-could-create-a-worldwide-low-cost-alliance.html

Labels:

AirAsia

Thursday, July 14, 2016

AirAsia-Norwegian Air cooperation in the works

Tony Fernandes and Norwegian Air’s boss discuss possibility of sending passengers into each other’s network routes.

Oslo: More tourists from Scandinavian countries and Europe might be flying into Kuala Lumpur and Asia if a move by AirAsia to tie-up with Norwegian Air materialises.

AirAsia and Norwegian Air are exploring a possible joint venture, according to Norwegian newspaper Dagens Naeringsliv (DN).

AirAsia founder Tony Fernandes met Norwegian Air founder and chief executive Bjorn Kjos for the first time at the Farnborough International Airshow, it said.

The newspaper said they discussed the possibility of sending their passengers into each other’s route networks in Europe and Asia.

Newsinenglish.no quoted DN as saying the cooperation could start in about a year and that it would create a new era in route offerings for Norwegian passengers in Asia.

The two airlines, it said, had a lot in common, growing at a rapid pace on the back of relatively cheap airline tickets and creating wide route networks in their respective markets.

AirAsia has more than 200 routes in Asia using mostly Airbus aircraft while Norwegian Air has an extensive route system within Scandinavia and Europe, and is keen on expanding its intercontinental routes as well.

DN reported that Fernandes pointed to a Norwegian Air button he was wearing on his lapel, asked Kjos for his phone number and said he wanted to fly to Oslo for a serious talk.

It quoted Fernandes as telling Kjos at the airshow: “We’ve never had the opportunity to meet each other before now. If I get the opportunity to come to Oslo, we should sit down and talk. Why not?”

The two airlines could soon be competing on intercontinental routes between Europe and Asia as Fernandes intends to re-launch a route between Kuala Lumpur and London.

He had also mentioned flying into one of the Scandinavian capitals as well, feeding passengers into Norwegian Air’s route system for onward travel. Kjos, the report said, didn’t reject the idea.

“We wish him welcome and like competition,” Kjos told DN, calling Fernandes “a great guy” who leads “a very good airline”.

At Farnborough, Norwegian Air won the Skytrax Award as Europe’s best airline for the fourth time, and as the best long-distance low fare airline for the second time. The Skytrax prizes are based on votes from passengers worldwide.

AirAsia, meanwhile, won four prizes including the one for the best low-fare airline in the world.

“These are the world’s two best airlines,” Kjos claimed as he stood with Fernandes at Farnborough, according to DN. The prizes “show that the customers like our product. They’re the ones who voted for us.”

http://www.freemalaysiatoday.com/category/highlight/2016/07/14/airasia-norwegian-air-cooperation-in-the-works/

Oslo: More tourists from Scandinavian countries and Europe might be flying into Kuala Lumpur and Asia if a move by AirAsia to tie-up with Norwegian Air materialises.

AirAsia and Norwegian Air are exploring a possible joint venture, according to Norwegian newspaper Dagens Naeringsliv (DN).

AirAsia founder Tony Fernandes met Norwegian Air founder and chief executive Bjorn Kjos for the first time at the Farnborough International Airshow, it said.

The newspaper said they discussed the possibility of sending their passengers into each other’s route networks in Europe and Asia.

Newsinenglish.no quoted DN as saying the cooperation could start in about a year and that it would create a new era in route offerings for Norwegian passengers in Asia.

The two airlines, it said, had a lot in common, growing at a rapid pace on the back of relatively cheap airline tickets and creating wide route networks in their respective markets.

AirAsia has more than 200 routes in Asia using mostly Airbus aircraft while Norwegian Air has an extensive route system within Scandinavia and Europe, and is keen on expanding its intercontinental routes as well.

DN reported that Fernandes pointed to a Norwegian Air button he was wearing on his lapel, asked Kjos for his phone number and said he wanted to fly to Oslo for a serious talk.

It quoted Fernandes as telling Kjos at the airshow: “We’ve never had the opportunity to meet each other before now. If I get the opportunity to come to Oslo, we should sit down and talk. Why not?”

The two airlines could soon be competing on intercontinental routes between Europe and Asia as Fernandes intends to re-launch a route between Kuala Lumpur and London.

He had also mentioned flying into one of the Scandinavian capitals as well, feeding passengers into Norwegian Air’s route system for onward travel. Kjos, the report said, didn’t reject the idea.

“We wish him welcome and like competition,” Kjos told DN, calling Fernandes “a great guy” who leads “a very good airline”.

At Farnborough, Norwegian Air won the Skytrax Award as Europe’s best airline for the fourth time, and as the best long-distance low fare airline for the second time. The Skytrax prizes are based on votes from passengers worldwide.

AirAsia, meanwhile, won four prizes including the one for the best low-fare airline in the world.

“These are the world’s two best airlines,” Kjos claimed as he stood with Fernandes at Farnborough, according to DN. The prizes “show that the customers like our product. They’re the ones who voted for us.”

http://www.freemalaysiatoday.com/category/highlight/2016/07/14/airasia-norwegian-air-cooperation-in-the-works/

Labels:

AirAsia

A321neo orders good for AirAsia

AirAsia Bhd

June 13 (RM2.75)Maintain add with an unchanged target price of RM4.15: Investors whom we spoke to on AirAsia Bhd’s order of A321neos have generally been cautious about the potential orders, fearing that AirAsia is once again over expanding. Investors did not like the additional 100 orders which come at a list price of US$125.7 million (RM499 million) each, as they come on top of the undelivered 304 A320neo orders. However, we believe that the orders are good for the AirAsia group, and there is no need to fear.

From an operational perspective, the A321neos are good for AirAsia. A321neos usually seat 220 passengers, but from 2018, a new version with 240 seats will be offered. The A320s currently seat 180, but this can be raised to 186 under a new configuration. So, the new A321neos offer 33% more capacity than AirAsia’s current fleet, and can help AirAsia optimise the service of existing high-density routes.

This will be important for AirAsia on routes such as Kuala Lumpur to Kota Kinabalu, where it had wet leased several of AirAsia X’s A330s this year to cater to the strong demand at specific flight timings. A higher-capacity aircraft can also help AirAsia reduce its unit flying costs, which will improve flight profitability for thick routes.

Airport congestion is also a major issue that is being faced by Asean airports. For instance, Cebu Pacific Air currently has 30 A321neos on order, against a fully delivered fleet of 38 A320s. This is important since the Manila airport is very congested, and also affecting AirAsia Philippines.

Thai AirAsia is facing similar congestion issues at Bangkok Don Muang, and Indonesia AirAsia in Jakarta. So we think a good number of the A321neos may be placed outside Malaysia.

Also, history has shown that AirAsia has significant flexibility to negotiate deferrals with Airbus when needed, so the orders placed today are meant to secure the future delivery slots. Should demand slow in future, we are confident that AirAsia will be able to defer the deliveries to avoid overcapacity.

The A321neo orders may be parked under the leasing arm Asia Aviation Capital (AAC). We expect this to boost the valuation of AAC to above the US$1 billion which is already on the table from a potential Chinese buyer, as it locks in future delivery slots at what we expect to be attractive prices.

A higher valuation for AAC has the potential to boost upcoming special dividends upon the partial sale of AAC.

If and when a formal announcement on the A321neo orders are made, we would look at several details including: i) over how many years the 100 A321neo orders will be delivered; ii) when the A321neo deliveries will start; and iii) whether the 100 new A321neo orders will replace some of the A320neos that are currently on order.

If the orders are spread out over many years and deliveres do not start until several years later, we expect current investors’ concerns to be alleviated. The major risk to AirAsia is if there is a terrorist attack on Malaysian soil, which could impact inbound travel demand into Malaysia, much like the Erawan shrine bombing in August 2015 which affected tourist arrivals into Thailand. — CIMB Research, July 12

http://www.theedgemarkets.com/my/article/a321neo-orders-good-airasia

June 13 (RM2.75)Maintain add with an unchanged target price of RM4.15: Investors whom we spoke to on AirAsia Bhd’s order of A321neos have generally been cautious about the potential orders, fearing that AirAsia is once again over expanding. Investors did not like the additional 100 orders which come at a list price of US$125.7 million (RM499 million) each, as they come on top of the undelivered 304 A320neo orders. However, we believe that the orders are good for the AirAsia group, and there is no need to fear.

From an operational perspective, the A321neos are good for AirAsia. A321neos usually seat 220 passengers, but from 2018, a new version with 240 seats will be offered. The A320s currently seat 180, but this can be raised to 186 under a new configuration. So, the new A321neos offer 33% more capacity than AirAsia’s current fleet, and can help AirAsia optimise the service of existing high-density routes.

This will be important for AirAsia on routes such as Kuala Lumpur to Kota Kinabalu, where it had wet leased several of AirAsia X’s A330s this year to cater to the strong demand at specific flight timings. A higher-capacity aircraft can also help AirAsia reduce its unit flying costs, which will improve flight profitability for thick routes.

Airport congestion is also a major issue that is being faced by Asean airports. For instance, Cebu Pacific Air currently has 30 A321neos on order, against a fully delivered fleet of 38 A320s. This is important since the Manila airport is very congested, and also affecting AirAsia Philippines.

Thai AirAsia is facing similar congestion issues at Bangkok Don Muang, and Indonesia AirAsia in Jakarta. So we think a good number of the A321neos may be placed outside Malaysia.

Also, history has shown that AirAsia has significant flexibility to negotiate deferrals with Airbus when needed, so the orders placed today are meant to secure the future delivery slots. Should demand slow in future, we are confident that AirAsia will be able to defer the deliveries to avoid overcapacity.

The A321neo orders may be parked under the leasing arm Asia Aviation Capital (AAC). We expect this to boost the valuation of AAC to above the US$1 billion which is already on the table from a potential Chinese buyer, as it locks in future delivery slots at what we expect to be attractive prices.

A higher valuation for AAC has the potential to boost upcoming special dividends upon the partial sale of AAC.

If and when a formal announcement on the A321neo orders are made, we would look at several details including: i) over how many years the 100 A321neo orders will be delivered; ii) when the A321neo deliveries will start; and iii) whether the 100 new A321neo orders will replace some of the A320neos that are currently on order.

If the orders are spread out over many years and deliveres do not start until several years later, we expect current investors’ concerns to be alleviated. The major risk to AirAsia is if there is a terrorist attack on Malaysian soil, which could impact inbound travel demand into Malaysia, much like the Erawan shrine bombing in August 2015 which affected tourist arrivals into Thailand. — CIMB Research, July 12

http://www.theedgemarkets.com/my/article/a321neo-orders-good-airasia

Labels:

AirAsia

Tuesday, July 12, 2016

This Is Why the World’s Most Successful Investors Are Buying Gold Now

Don't make the mistake of ignoring what an all-star roster of the world's richest investors is doing right now. They are buying billions of dollars' worth of gold.

(This is one of many reasons that it makes a lot of sense to have gold in your portfolio. We explain the why and the how in a free 22-page special report you can download here.)

For example, hedge fund legend Stanley Druckenmiller has earned an average of 30% a year for 30 years, without a single negative year. And currently, 18% of Druckenmiller's portfolio is made up of the SPDR Gold Trust (GLD) , an exchange-traded fund that tracks the price of gold bullion.

George Soros, the man who "broke the bank of England" in the early 1990s, earned $1 billion by shorting the British pound. Along with Jim Rogers, Soros also earned investors a 3,365% return in just 11 years with the Quantum Fund.

Now, Soros owns a $264 million stake in Barrick Gold (ABX) , the largest gold mining company in the world. It is his fund's second-largest holding. But that's not the only gold Soros owns. He also bought more than 1 million option contracts on the SPDR Gold Trust.

Another well-known investor with a stake in gold is David Einhorn of Greenlight Capital. Einhorn's investors have seen average annual returns of 16.5% since 1996. Now, he has a $165 million stake in VanEck Vectors Gold Miners ETF (GDX) .

The list goes on with other big names like Paul Singer, Carl Icahn and John Paulson all owning large stakes in gold.

Why are so many big-name investors flocking to gold? As Druckenmiller said about his own large stake in the SPDR Gold Trust, it's because of the "absurd notion of negative interest rates."

Negative interest rate policy (NIRP) has flipped the world of international finance on its head. The concept of negative interest rates does not make theoretical sense. Instead of the borrower paying the lender with interest, the lender pays the borrower to take his money. Even former Federal Reserve Chairman Ben Bernanke didn't think this would happen. In 2009 he said, "No one will lend at a negative interest rate; potential creditors will simply choose to hold cash, which pays zero nominal interest."

Now, Soros owns a $264 million stake in Barrick Gold (ABX) , the largest gold mining company in the world. It is his fund's second-largest holding. But that's not the only gold Soros owns. He also bought more than 1 million option contracts on the SPDR Gold Trust.

Labels:

黄金

Sunday, July 10, 2016

松下50周年- PANAMY(3719)上市50周年,50年从RM1,350 变成RM1,032,712,

我们都知道PUBLIC BANK的神话,因为它造就了无数的百万富翁。而今天要跟大家分享另外一家消费股神话,那就是松下电器PANAMY。这家公司的产品出现在很多人的家里,例如风扇,冷气,热水器,电饭锅等。而PANAMY的股价都是高于RM10, 是消费大象股。

上图是在PANAMY的ANNUAL REPORT 获得的计算,假设当初的Initial Capital是RM1,350, 在资金增长+股息收入的成长下,50年的回酬将如上。不过以上的价格计算时RM22.00,所以笔者以最新的股价RM29.82以及加入2015年12月收到的15仙的股息计算,50年的投资将会让你的RM1,350的投资变成RM1,032,712。

经过多次的的红股以及1975年的附加股,投资手上将会有19,034股PANAMY.

以RM29.82计算,投资持股的价值如下:

19384*29.82 = RM 650,0333

50年的股息收入如下:

2016年收到15仙的股息 = 19384*0.15=2907.6

Total Dividend = 379,472+2907 = 382,379

Total Wealth as at 4 July 2016 = 650,0333 + 382,379 = RM1,032,712

PANAMY的例子告诉我们长期持有的威力,但是可以持有这么久的人应该没有几个。毕竟现在的年轻一代大部分都要看到快钱,要他们持有超过1年都不容易。而且长期持有也必须要选对好的公司,不然抱着一家不派股息又亏钱的股息,公司的股价是很难会有作为的。

股票投资有很多方式,趋势投资,技术分析,价值投资或者股息投资。没有最好的,只有最适合你的。

共勉之。

不过它是一家净现金公司,而且派息非常大方,最近5年的平均派息%高达92.1%。也就是说公司每年平均赚RM100, 其中的RM92.1都会拿来派发股息。所以这家公司是股息投资者的最爱,因为过去几年的周息率介于4 - 7%之间。假设投资者在1966年IPO买进RM1,000股,过后在1975年subscribe RM350的附加股。当时的RM1,350资本在50年后就会变成了RM1,032,712( 7月4日股价 = RM29.82)。以下是计算方式。

经过多次的的红股以及1975年的附加股,投资手上将会有19,034股PANAMY.

以RM29.82计算,投资持股的价值如下:

19384*29.82 = RM 650,0333

50年的股息收入如下:

2016年收到15仙的股息 = 19384*0.15=2907.6

Total Dividend = 379,472+2907 = 382,379

Total Wealth as at 4 July 2016 = 650,0333 + 382,379 = RM1,032,712

PANAMY的例子告诉我们长期持有的威力,但是可以持有这么久的人应该没有几个。毕竟现在的年轻一代大部分都要看到快钱,要他们持有超过1年都不容易。而且长期持有也必须要选对好的公司,不然抱着一家不派股息又亏钱的股息,公司的股价是很难会有作为的。

股票投资有很多方式,趋势投资,技术分析,价值投资或者股息投资。没有最好的,只有最适合你的。

共勉之。

觀點 - 施永青 黃金會恢復歷史上的功能嗎?

有論者認為:這只是一時的恐懼所造成,黃金不可能恢復它的貨幣功能;因為全世界的政府都不想失去發鈔的權力;只要政府在操控經濟環境時略佔上風,政府都會盡全力打擊民眾對黃金的偏好,設法讓人們相信,黃金遲早會變爛銅。

現實是:全球各處的文明,都曾在一段相當長的歷史時段上,以黃金作為易物媒介,以及作為主要的財富儲存工具。

在原始時代,人類的生產力有限,只能採摘與捕獵上天提供給他們的食物,所獲僅夠糊口。到生產力上升,所獲有餘的時候,就可以用自己所餘去換自己所需。譬如,自己所養的雞生了很多蛋,吃不完,可以與鄰家換點稻米。但可能鄰家也有養雞,不需要你的蛋,導致這項以物換物的交易沒法成交。因此,最好先把自己的雞蛋換成一種大部分人都願意接受的東西(如黃金),那就用來換甚麼東西都可以。

黃金閃閃發光,大多數人都會喜歡,可以接受用作交易媒介。黃金相對稀有,並非隨處可摘,價格相對穩定。黃金不易有化學變化,長期儲存也不會變質,極適合用作財富儲存工具。

黃金的貨幣功能,源自黃金本身的物理性質,不容易人為地被剝奪。相反,由政府發行的貨幣,其實只是一張印刷品,其交換能力與儲存價值,全靠政府立法保障;一旦政府失去權力或財力不足,其保障就會成為一句空話。

近年,全世界大部分政府在財政上都有赤字,都在一定的程度上濫發鈔票,以至貨幣的增長速度遠遠快過整體的財富增長速度。結果是貨幣的購買力不斷蒸發,同一分量的貨幣可以代表的財富不斷減少。這等同政府正不斷地把人民的財產充公。

私有產權是人權的主要部分。不保障私有產權的地方(如社會主義國家),通常連其他方面的人權也一併不太尊重。只可惜一般人權組織只關心與產權無關的人權,甚少意識到在貨幣上的量化寬鬆其實也是一種侵權行為,而且受害人眾多。更有一批為虎作倀的學者,長期為政府的無錨發鈔做法辯護,刻意貶低黃金的天然貨幣功能。

格林斯潘早年曾是艾茵‧蘭德信徒。1966年曾在《The Objectivist》雜誌發表一篇名為“Gold and Economic Freedom”的文章,主張維護黃金的原始功能,並以金本位的方式,去限制政府胡亂發鈔。想不到他後來竟會去當聯儲局主席,並不斷以減息的方法去擴大貨幣供應;次按危機與全球金融海嘯可謂是他有份搞出來的。不過,他的這篇文章仍值得讀者上網一看。

英國脫歐後,人們預期各國政府都會繼續量化寬鬆,為了避免自己的財產不斷地被政府充公,人們於是減持現金,增持實物資產,包括黃金與地產。我估計會作出這樣選擇的人將愈來愈多。

現實是:全球各處的文明,都曾在一段相當長的歷史時段上,以黃金作為易物媒介,以及作為主要的財富儲存工具。

在原始時代,人類的生產力有限,只能採摘與捕獵上天提供給他們的食物,所獲僅夠糊口。到生產力上升,所獲有餘的時候,就可以用自己所餘去換自己所需。譬如,自己所養的雞生了很多蛋,吃不完,可以與鄰家換點稻米。但可能鄰家也有養雞,不需要你的蛋,導致這項以物換物的交易沒法成交。因此,最好先把自己的雞蛋換成一種大部分人都願意接受的東西(如黃金),那就用來換甚麼東西都可以。

黃金閃閃發光,大多數人都會喜歡,可以接受用作交易媒介。黃金相對稀有,並非隨處可摘,價格相對穩定。黃金不易有化學變化,長期儲存也不會變質,極適合用作財富儲存工具。

黃金的貨幣功能,源自黃金本身的物理性質,不容易人為地被剝奪。相反,由政府發行的貨幣,其實只是一張印刷品,其交換能力與儲存價值,全靠政府立法保障;一旦政府失去權力或財力不足,其保障就會成為一句空話。

近年,全世界大部分政府在財政上都有赤字,都在一定的程度上濫發鈔票,以至貨幣的增長速度遠遠快過整體的財富增長速度。結果是貨幣的購買力不斷蒸發,同一分量的貨幣可以代表的財富不斷減少。這等同政府正不斷地把人民的財產充公。

私有產權是人權的主要部分。不保障私有產權的地方(如社會主義國家),通常連其他方面的人權也一併不太尊重。只可惜一般人權組織只關心與產權無關的人權,甚少意識到在貨幣上的量化寬鬆其實也是一種侵權行為,而且受害人眾多。更有一批為虎作倀的學者,長期為政府的無錨發鈔做法辯護,刻意貶低黃金的天然貨幣功能。

格林斯潘早年曾是艾茵‧蘭德信徒。1966年曾在《The Objectivist》雜誌發表一篇名為“Gold and Economic Freedom”的文章,主張維護黃金的原始功能,並以金本位的方式,去限制政府胡亂發鈔。想不到他後來竟會去當聯儲局主席,並不斷以減息的方法去擴大貨幣供應;次按危機與全球金融海嘯可謂是他有份搞出來的。不過,他的這篇文章仍值得讀者上網一看。

英國脫歐後,人們預期各國政府都會繼續量化寬鬆,為了避免自己的財產不斷地被政府充公,人們於是減持現金,增持實物資產,包括黃金與地產。我估計會作出這樣選擇的人將愈來愈多。

Labels:

黄金

2016马股上半年涨幅最多的30家公司

FROM: 1296.【马股风云榜】- 2016马股上半年涨幅最多的30家公司,10家公司上涨超过100%!!

2016年就这样度过了一半,而大马KLCI指数也在【橱窗粉饰】的效应下上涨了11.57点,闭市1,653.78点。不过2016上半年KLCI指数下跌了38.72点,相当于2.29%。不过今年还有6个月的时间可以冲刺,或许马股可以逃离KLCI指数连续3年下跌的厄运。

2016年就这样度过了一半,而大马KLCI指数也在【橱窗粉饰】的效应下上涨了11.57点,闭市1,653.78点。不过2016上半年KLCI指数下跌了38.72点,相当于2.29%。不过今年还有6个月的时间可以冲刺,或许马股可以逃离KLCI指数连续3年下跌的厄运。

今天准备了4大马股榜单跟大家分享,分别是:

1. 【上涨%最多】的30家公司

2. 【RM1以上】%上涨最多的20家公司

3. 【股价涨幅】最多的20家公司

4. 【美金出口股】跌幅最惨重的其中15家公司!

今天分享的数据准确度有98%以上,若有些许失误,请多多包涵。

以上的RCECAP是因4:1 consolidation,所以不应该上榜,以上失误请大家多对见谅。- 今年一共有10家公司的涨幅超过100%,当中最风光的莫过于航空股AAX以及AIRAXIA,在10大涨幅股当中,只有AIRASIA的股价是超过RM1的。

- 不过从上图的30家【涨幅%】最高的公司来看,大部分的公司都是来自航空,钢铁,消费,科技以及【热炒仙股】。

- 而当中股价超过RM2的只有5家,分别是AIRASIA, PMETAL, TRIPLC,SLP以及AJI.

- 以上的榜单是股价超过RM1,【涨幅%】最高的20家公司。

- 这20家公司大部分来自消费服贸,工业以及建筑领域。

- 当中的大象股就有AJI, F&N以及SCIENTX。借此我们可以看到,只要有【价值】的大象股,股价再贵也是可以上涨的。

- 而上图20家公司是股价涨幅最高的公司,消费股可说是今年的大赢家,一共有9家入榜,6家工业股,其他就是种植,金融以及服贸股。

- 而这20家公司当中,2015年有18家的盈利是进步的,2016Q1只有3家盈利退步,分别是LAYHONG, PIE以及UTDPLT。

- 所以【盈利永远是决定股价】的首要因素,亏钱的公司是很难有这样的表现的。

- 最后1个榜单就是去年非常火热的出口股,以上15家公司去年平均上涨152.3%,但是今年全部平均下跌了29.49%。【所以说股市欠你的,它一定会还给你。而你欠股市的,它迟早会收回。】

- 当中大部分来手套,科技以及家私领域。而在2016Q1的业绩当中,超过半数也就是8家的公司盈利YOY是下跌的。所以大家可以看到跌幅比较严重的10家有8家都是盈利下跌,而跌幅比较少的10家公司在2016Q1盈利都是有进步的。

- 但是在最新的季度当中,COMFORT, VS以及POHUAT的盈利YOY都退步了。

以上纯属数据分享,希望可以让大家对2016上半年的走势有更加深入的了解。

以上纯属分享,买卖自负。

Labels:

Harry

Subscribe to:

Posts (Atom)